What Type Of Income Is Self Employment are an enjoyable and interesting tool for children and adults, offering a mix of education and entertainment. From coloring pages and challenges to math challenges and word video games, these worksheets deal with a wide range of rate of interests and ages. They assist improve essential thinking, analytical, and creativity, making them excellent for homeschooling, class, or family tasks.

Quickly accessible online, printable worksheets are a time-saving source that can transform any day right into a knowing journey. Whether you need rainy-day activities or extra knowing tools, these worksheets provide unlimited possibilities for enjoyable and education and learning. Download and install and delight in today!

What Type Of Income Is Self Employment

What Type Of Income Is Self Employment

If you must use the Simplified Method to figure the taxable amount in Box 2a of the 1099 R form use this guide to assist you with your entries If you use the Simplified Method, you can do so within your account by clicking the link beside box 2 on your 1099-R entry screen. The Simplified Method ...

Desktop The Simplified General Rule Worksheet Support

7 Different Types Of Income Active And Passive Income Ideas Making

What Type Of Income Is Self Employmentwe have used the Simplified Method to figure the taxable amount of your CSRS or FERS annuity. For your convenience, this amount is reported on your 1099R. This is the simplified method worksheet It is used to figure the taxable part of your pension or annuity using the simplified method

In TurboTax there's a worksheet associated with the 1099-R form, called “Simplified Method Worksheet”. Line 1 shows the “total pension received this year” ($ ... Proof Of Income Form From Employer Free Printable Documents Income Verification Letter Example Design Talk

Should I use the Simplified Method Worksheet to figure my 1099 R s

Everything You Need To Know About Self Employment Income Small

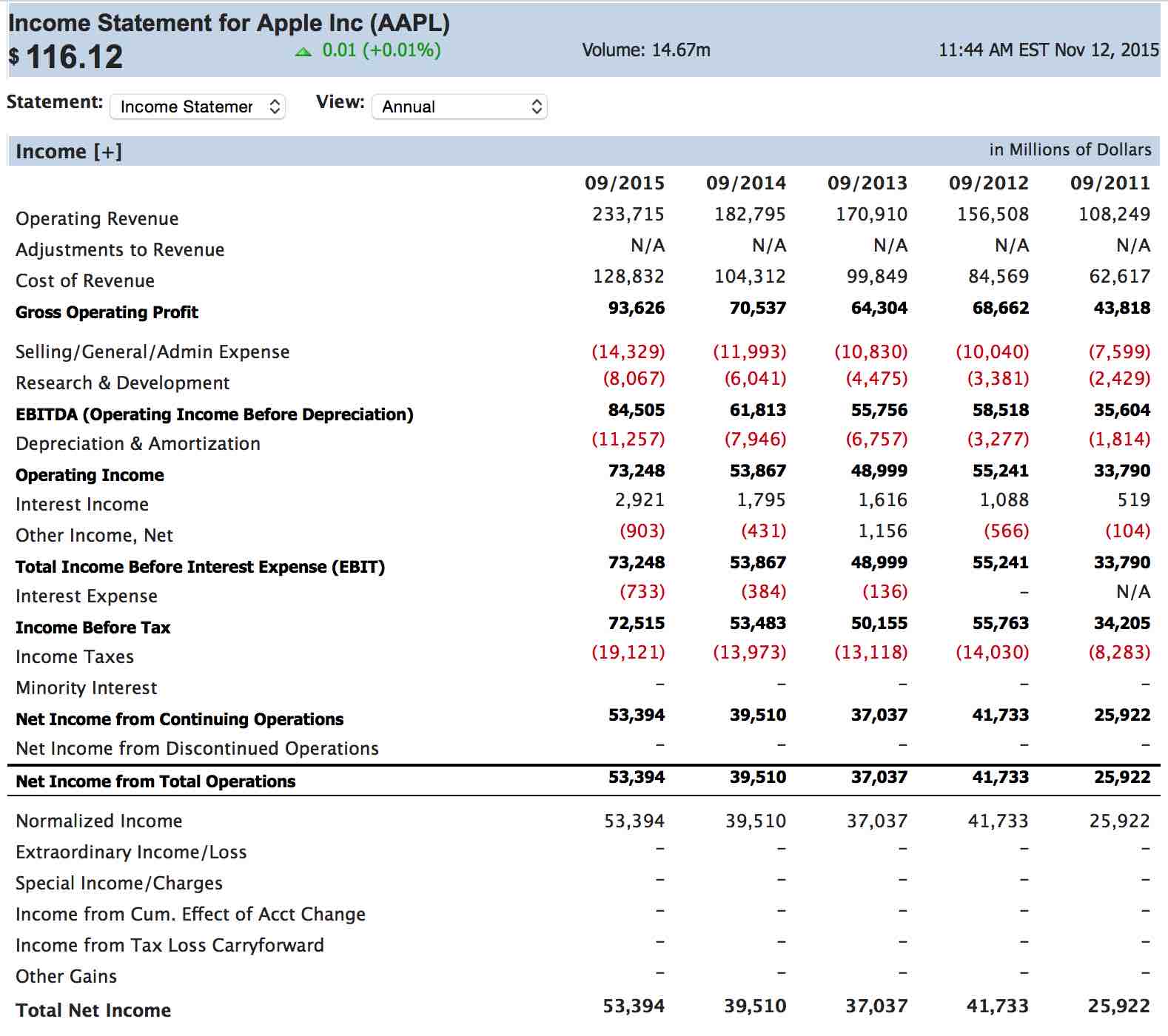

Use the Simplified Method and you can use the worksheet provided to figure your taxable annuity amount for the year Income Statement Stock Analysis

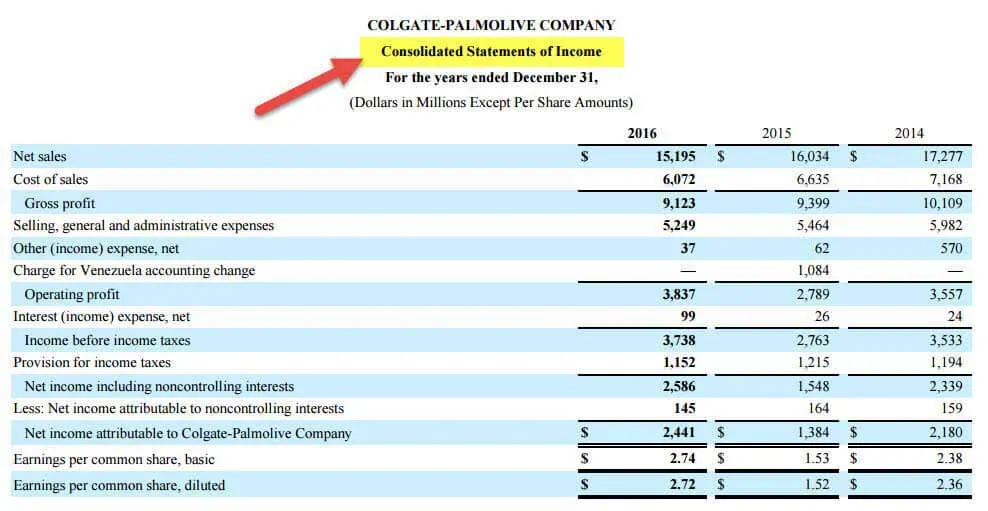

If your Form 1099 R shows a larger amount use the amount on this line instead of the amount from Form 1099 R If you are a retired public safety officer Other Comprehensive Income Statement Example Explanation Pin On Finance

Self Employment Income Form 2 Free Templates In PDF Word Excel Download

Basic Income Statement Template New Basic Profit And Loss Template

8 Different Types Of Income And How You Can Create Each One Dividend

What Defines Self employment Income Zippia

Income Statement Definition And Example

Income Verification Letter Sample Template In Pdf Word

Different Types Of Income Rental Income Passive Income Income

Income Statement Stock Analysis

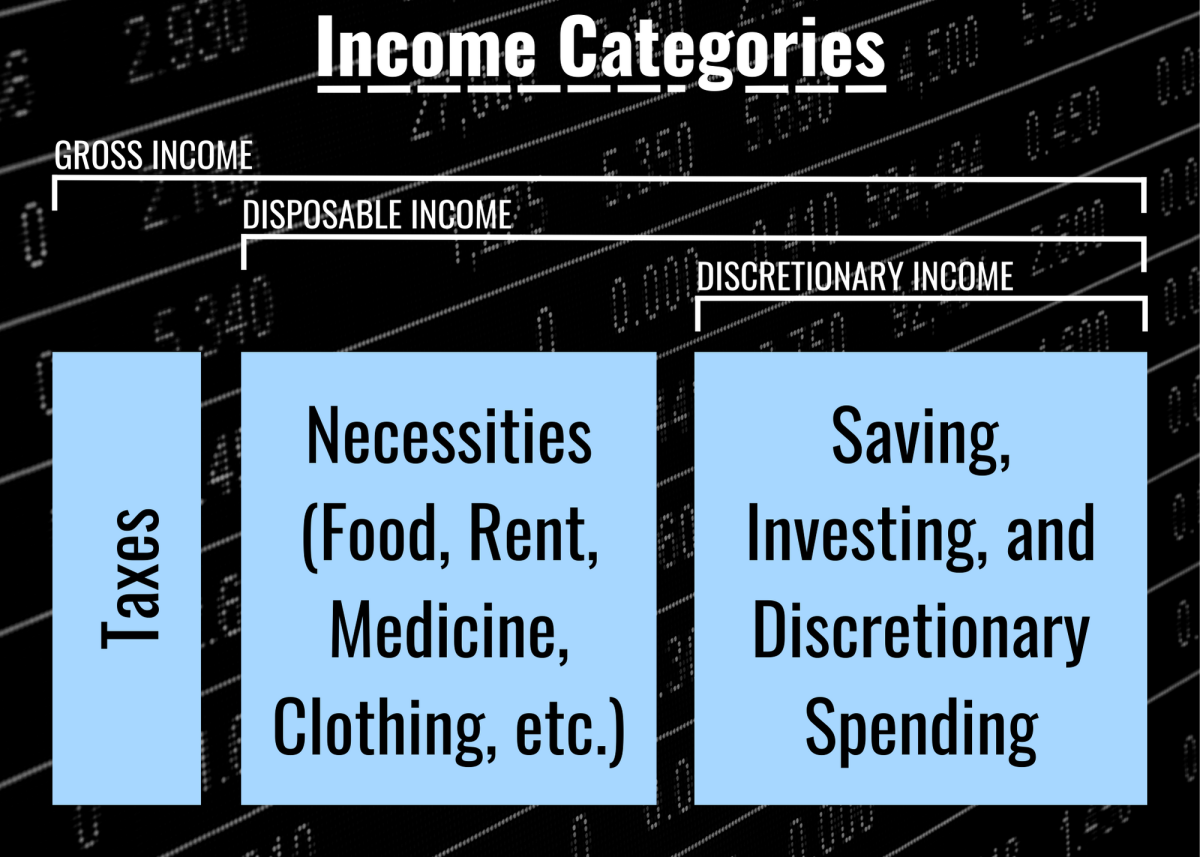

What Is Discretionary Income Definition Calculation Importance

Comprehensive Income Statement