What Tax Form For Self Employed are an enjoyable and appealing device for kids and adults, offering a blend of education and enjoyment. From tinting web pages and puzzles to mathematics difficulties and word games, these worksheets cater to a large range of rate of interests and ages. They assist improve crucial thinking, problem-solving, and creative thinking, making them excellent for homeschooling, classrooms, or family members tasks.

Quickly obtainable online, printable worksheets are a time-saving source that can transform any day into an understanding experience. Whether you require rainy-day tasks or extra discovering tools, these worksheets offer unlimited possibilities for fun and education. Download and take pleasure in today!

What Tax Form For Self Employed

What Tax Form For Self Employed

Practice labeling the bones of the skull with this printable activity 4) Label the right lateral view of the skull below with its correct feature. Coronal suture. Frontal bone. Zygomatic arch. Lambdoid suture. Mastoid process.

Human skull labeling TPT

Tax Return Self Employed Grant Employment Form

What Tax Form For Self EmployedThis is a free printable worksheet in PDF format and holds a printable version of the quiz Labeling the Bones of the Skull. In this worksheet we are going to review some of the major bones that protect and surround your brain The parts of the skull have been labeled Your

Ask the students to sort the skulls into groups, initially by those that are carnivores, herbivores and omnivores. Then sort them into more closely related ... Form For Self Employed Taxes Employment Form 1099 Forms Printable Printable Forms Free Online

Suture Cranial Bones Connected Study

Schedule Se Tax Form 2024 Carry Crystal

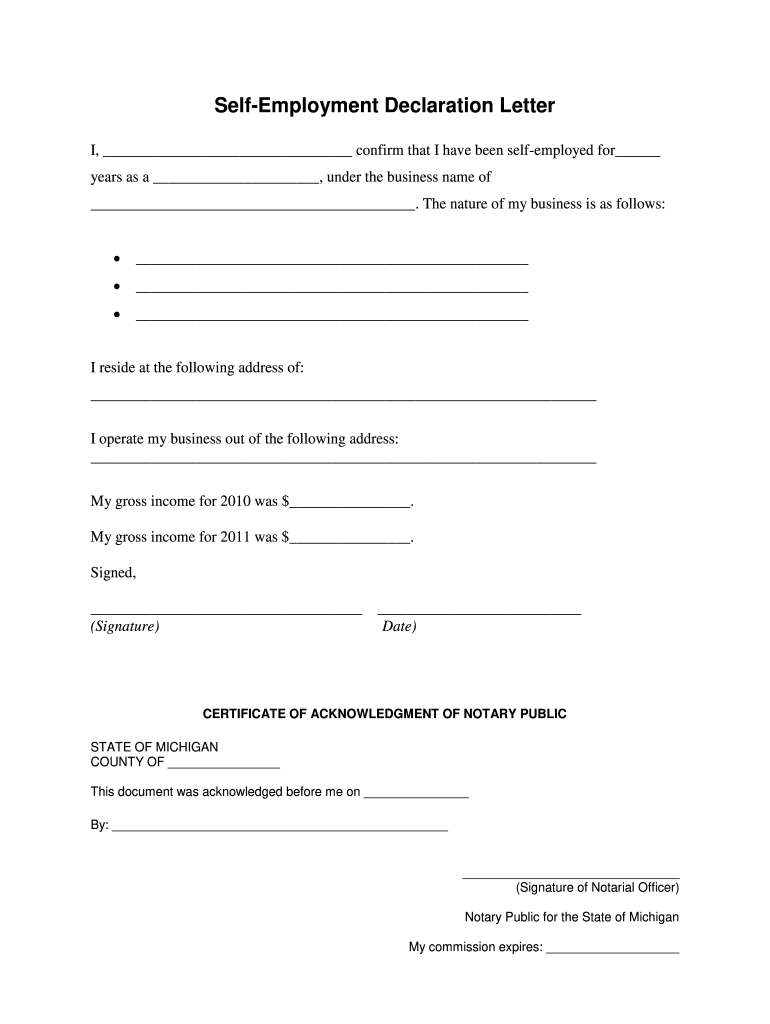

Interactive downloadable and printable PDF to help students studying human skull anatomy Anatomically accurate poster illustrations and worksheet Self Employed Income Declaration Form Employment Form

Download your free PDF labeling worksheet of the anterior skull below Contents Skull anatomy diagrams Labeled Skull Diagram Blank Skull Diagram Learn Self Employed Earnings Declaration Form Employment Form 2022 Self Employed Tax Form Employment Form

Self employed Tax Made Easy TaxScouts

Realtor Tax Deduction List

Self Employed Form Illinois Employment Form

Cheapest Tax Service For Self Employed News Week Me

Tax Planning NumberSquad

Self Employment Tax Guide For Online Sellers Tax Hack Accounting Group

Self Employed Canada Tax Form Employment Form

Self Employed Income Declaration Form Employment Form

Tax Form For Self Employed Individuals

A List Of Itemized Deductions