What Percentage Of Self Employment Tax Can Be Deducted As An Adjustment To Gross Income are an enjoyable and appealing device for children and adults, providing a blend of education and learning and amusement. From coloring pages and puzzles to math obstacles and word video games, these worksheets satisfy a wide range of rate of interests and ages. They assist boost important thinking, analytic, and creativity, making them ideal for homeschooling, class, or family tasks.

Quickly available online, worksheets are a time-saving source that can turn any day into a discovering journey. Whether you need rainy-day activities or supplementary discovering devices, these worksheets offer countless opportunities for enjoyable and education. Download and appreciate today!

What Percentage Of Self Employment Tax Can Be Deducted As An Adjustment To Gross Income

What Percentage Of Self Employment Tax Can Be Deducted As An Adjustment To Gross Income

Print or download the free 2 times table worksheets These have been specially created for primary school students to practice and remember times tables These This is a worksheet for testing the students knowledge of the times tables. A student should be able to work out the 60 problems correctly in 1 minute.

Printable Times Tables 2 Times Table Sheets Math Salamanders

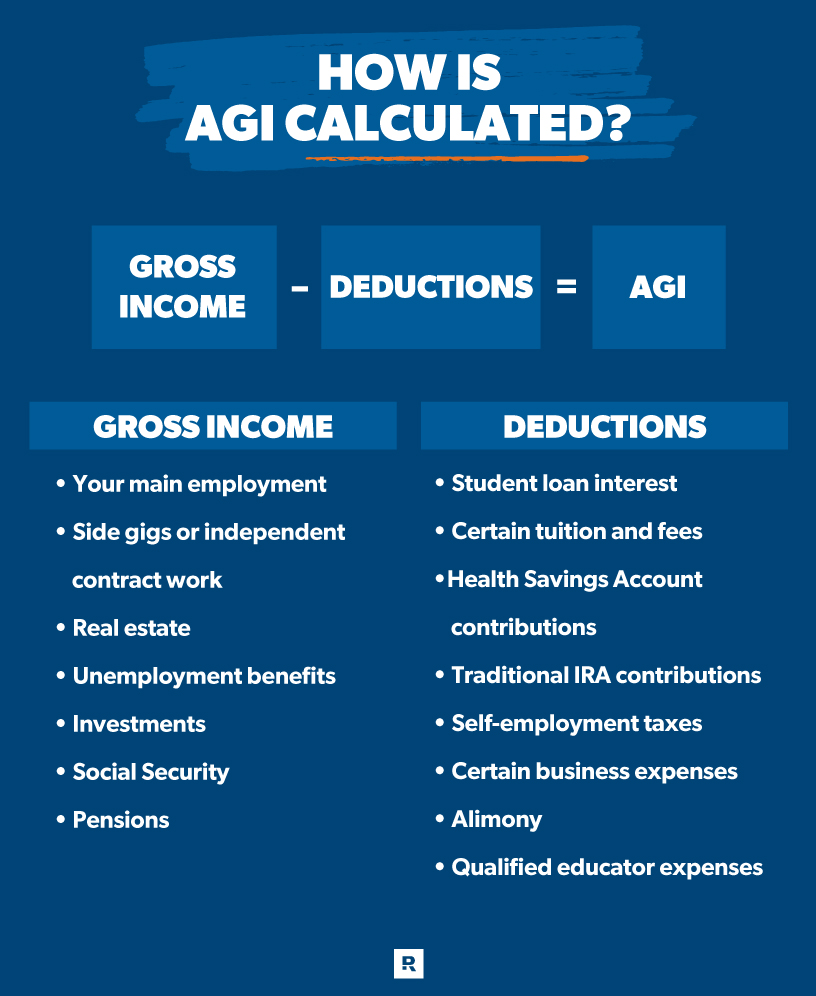

Adjusted Gross Income AGI What It Is And How To Calculate

What Percentage Of Self Employment Tax Can Be Deducted As An Adjustment To Gross IncomeA quick activity sheet for practicing the 2 times tables. Great for students just learning their doubles, or a warm up or revision activity. Grade 2 multiplication worksheets including multiplication facts multiples of 5 multiples of 10 multiplication tables and missing factor questions

Here is our selection of 2 Times Table worksheets which will help your child learn and practice their multiplication facts for the 2 times table. Solved The Massoud Consulting Group Reported Net Income Of Chegg Answered Jacob Is A Member Of WCC an LLC Taxed Bartleby

Multiplication Worksheets Times Table Timed Drill Worksheets

QBI Deduction Calculator For Qualified Business Income

Use this 2 Times Tables worksheet with your elementary math class to teach them to memorize their multiples of 2 then use them to answer math problems 2024 2025 Tax Year Self Assessment

Students multiply 2 times numbers between 1 and 12 The first worksheet is a table of all multiplication facts 1 12 with two as a factor Is The Standard Deduction Applicable To Business Expenses A 1099 Guide To The Mortgage Interest Deduction

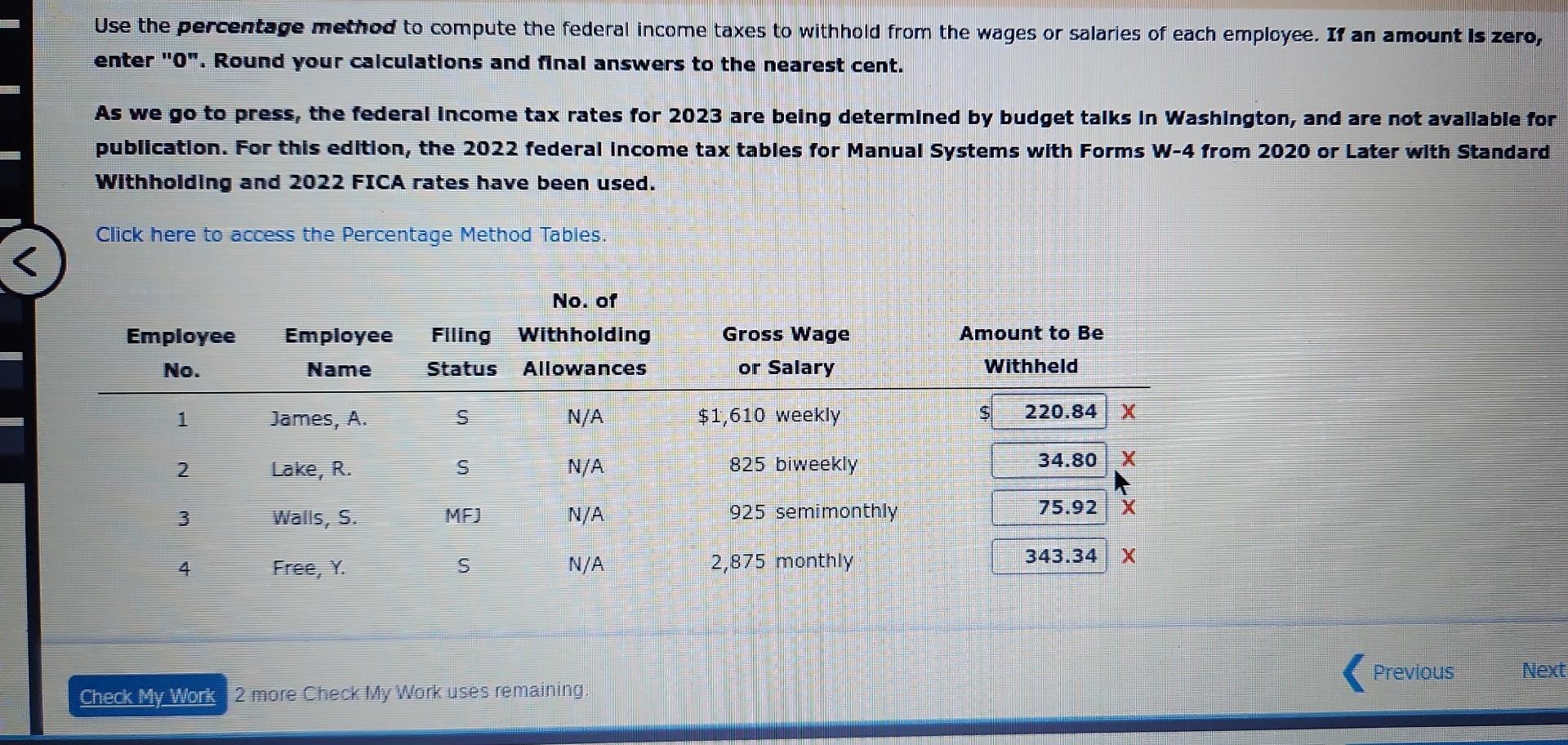

Use The Percentage Method To Compute The Federal Chegg

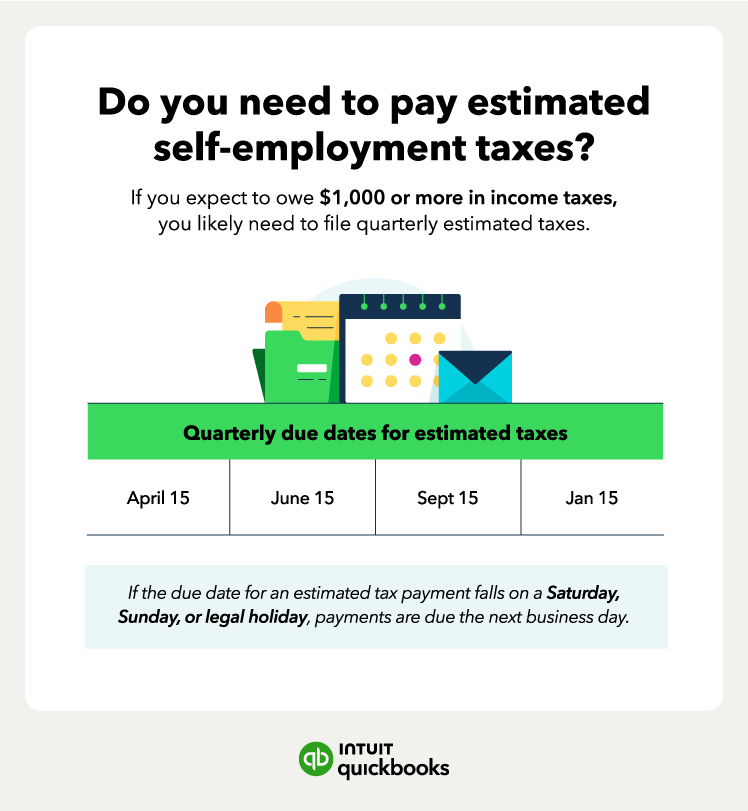

How To File Self employment Taxes QuickBooks

New Tax Regime Vs Old Tax Regime Which One To Pick Personal

Exenciones Fiscales 2025 Claves Para Contadores The Us Marketer

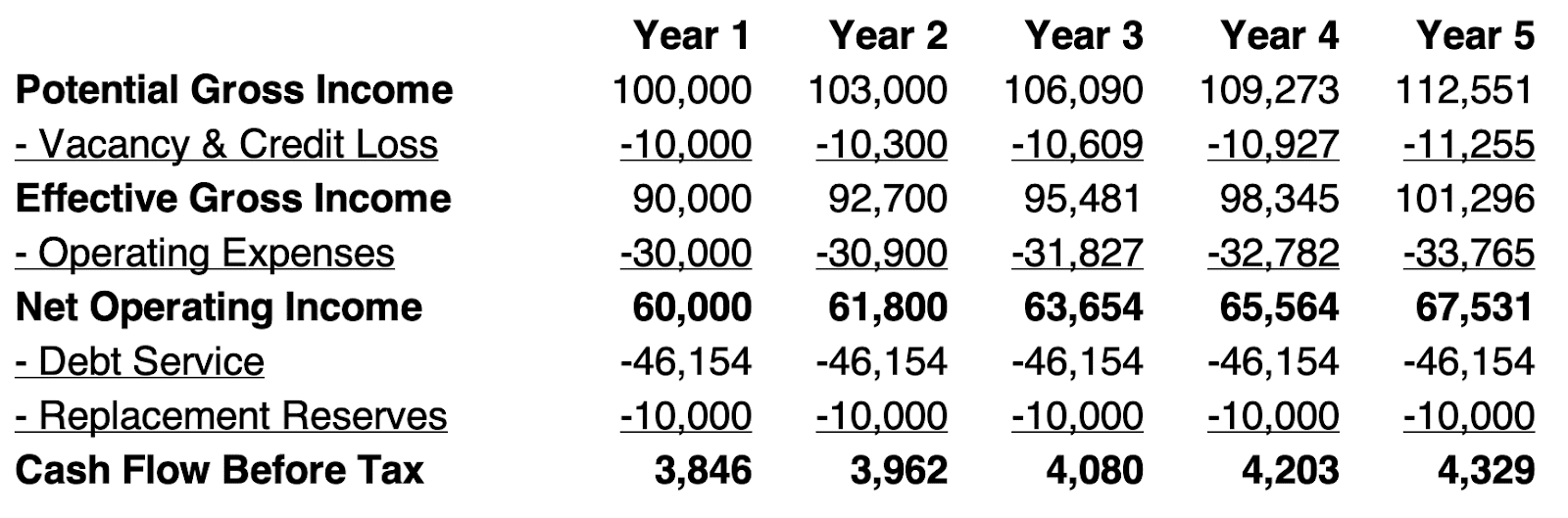

Effective Gross Income A Calculation Guide Som2ny Network

Self Employed Health Insurance Deduction Guide 3 Tips To Max It Out

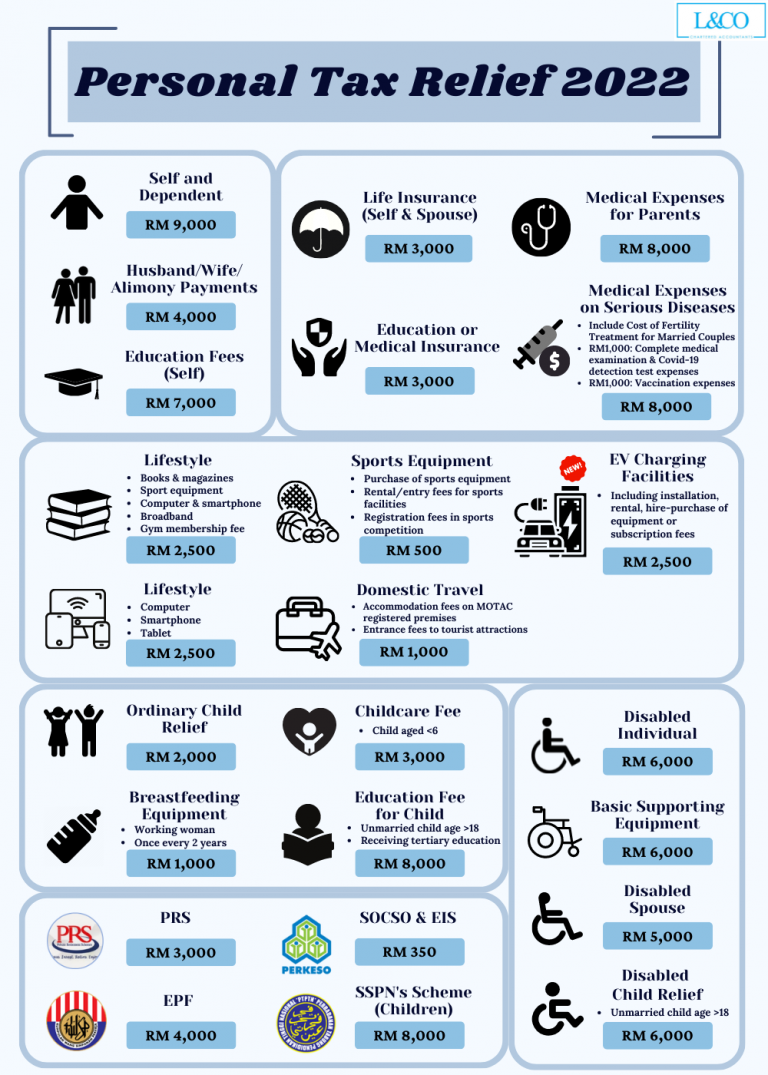

Personal Tax Relief 2022 L Co Accountants

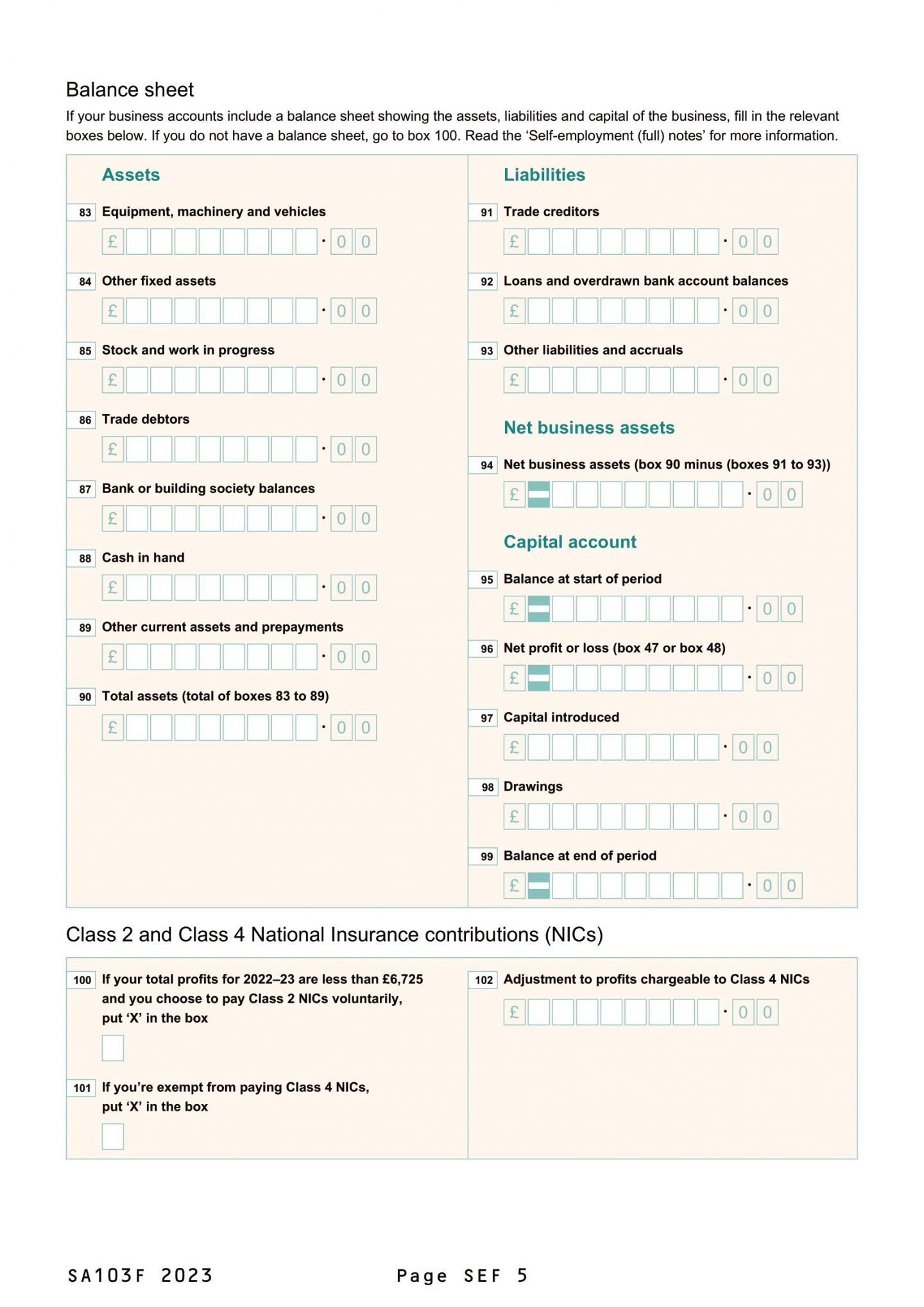

2024 2025 Tax Year Self Assessment

Self Employed Tax Return In The UK A Step by Step Guide BusinessMole

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-Tax-Final-d473b4b02caf4673ab7edf9a3c3d964b.jpg)

Earnings Before Interest Tax Depreciation Amortization