What Kind Of Self Employment Is Doordash are a fun and appealing tool for children and adults, using a mix of education and learning and enjoyment. From tinting web pages and challenges to mathematics difficulties and word games, these worksheets accommodate a variety of passions and ages. They help boost essential thinking, problem-solving, and imagination, making them suitable for homeschooling, class, or family members activities.

Easily easily accessible online, printable worksheets are a time-saving source that can turn any day right into a learning adventure. Whether you need rainy-day tasks or supplementary discovering devices, these worksheets give countless opportunities for fun and education and learning. Download and enjoy today!

What Kind Of Self Employment Is Doordash

What Kind Of Self Employment Is Doordash

Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF D Employer ID number (EIN) (see instr.) E. Business address (including suite or room no.) City, town or post office, state, and ZIP code.

BUSINESS INCOME EXPENSE WORKSHEET Fox Tax

Employment Is Holding Us Back In Praise Of Self Employment YouTube

What Kind Of Self Employment Is DoordashUse our small business tax deductions checklist to simplify tax time, check out common FAQs relating to deductions, and get tips. Small Business Self Employed 1099 Income Schedule C Worksheet Send last year s Schedule C or tax return if you operated the business previously and we

What Expenses Can Small Business Owners Claim As Deductions?1. Accounting Fees2. Advertising & Marketing3. Amortization4. Bad Debts5. Bank Fees. Making Self Employment Work For People With Disabilities eBook Self Facts About Self Employment Income Form Employment Form

2024 Schedule C Form 1040 IRS

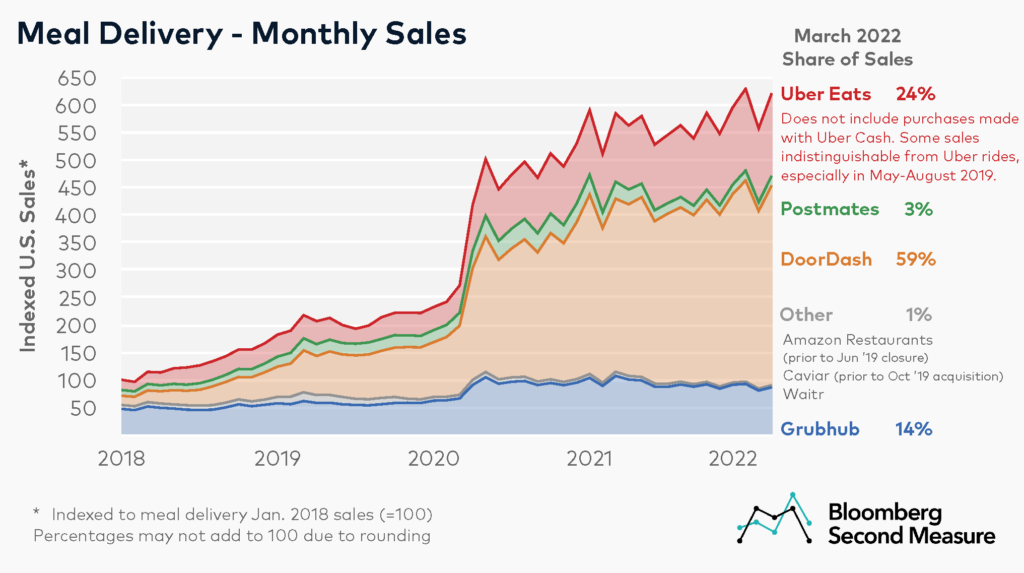

Gig Workers Drivers Self Employment In 2023 Doordash Uber

Use this guide to learn about deductions that may apply to your business including tax deductions associated with labor office costs marketing and Doordash Is Considered Self Employment Here s How To Do Taxes Stride

We ve pulled together a comprehensive checklist of all the small business tax deductions so you can make the biggest impact on your federal income tax return How To File DoorDash Taxes DoorDash Drivers Write offs How Does DoorDash Make Money Company Revenue Insights

DoorDash Management Leadership For Tomorrow

What Do You Do

MO Salah Wallpaper For PC Nehru Memorial

DoorDash Drive Payment Invoicing

Self Employment Declaration Letter Template In Pdf Word

U S Delivery Sales DoorDash Share Still Growing Food On Demand

A Kick off To National Disability Employment Awareness Month

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

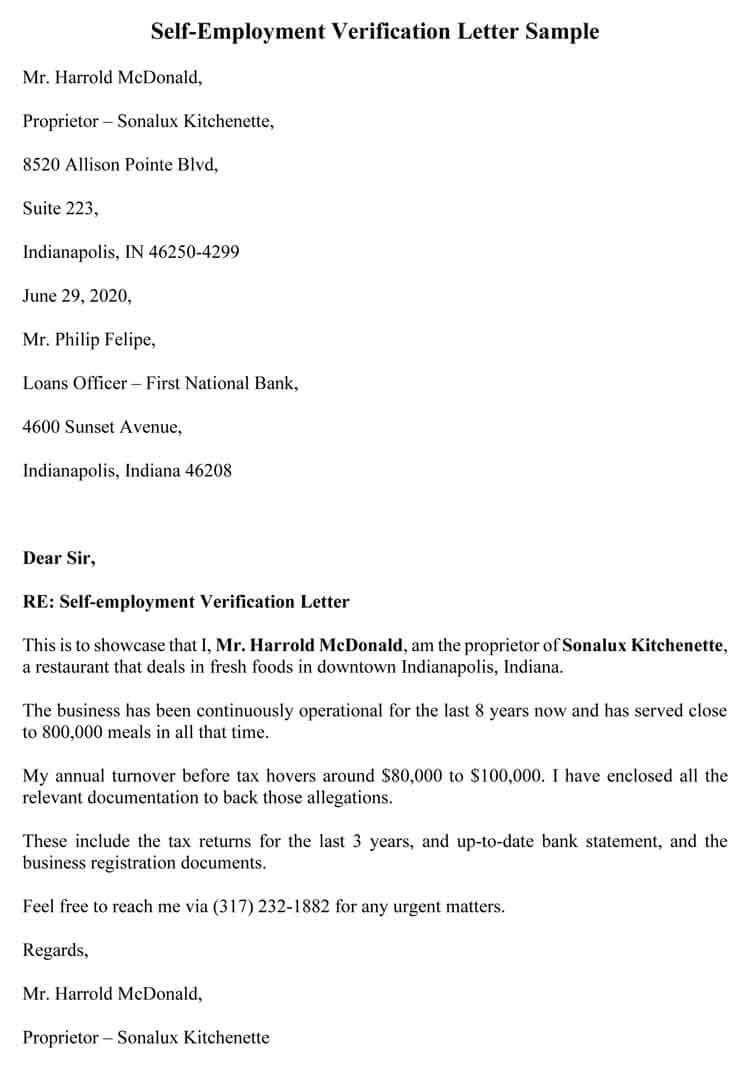

Self Employment Income Verification Letter Sample Examples

Self Employment Income Verification Letter Sample Examples