What Are Home Equity Interest Rates Today are a fun and interesting tool for youngsters and grownups, offering a blend of education and learning and entertainment. From tinting web pages and problems to math difficulties and word games, these worksheets satisfy a variety of rate of interests and ages. They assist enhance essential reasoning, analytical, and creative thinking, making them optimal for homeschooling, class, or household activities.

Conveniently easily accessible online, printable worksheets are a time-saving source that can turn any kind of day into a discovering experience. Whether you require rainy-day tasks or additional discovering devices, these worksheets offer limitless opportunities for fun and education. Download and appreciate today!

What Are Home Equity Interest Rates Today

What Are Home Equity Interest Rates Today

Snell s Law Worksheet 1 Part A 1 When light passes from air into water at an angle of 60 from the normal what is the angle of refraction 40 6 2 When Light entering a block of glass at an angle of incidence of 18.5˚ leaves the boundary between the air and the glass at an angle of 12.0˚.

Of Refraction Snell s Law Questions After Textbook Worksheet

Skovgaard Niemann LiveInternet

What Are Home Equity Interest Rates TodaySnell's Law Worksheet. Important stuff: n - index of refraction of a material n = - c = speed of light in vacuum = 3.00 x 108 m/s v = speed of light in the ... Ni sin nr sin index of refraction in first medium sine of the angle of incidence index of refraction in second medium sine of the angle of refraction

The Law of Refraction Worksheet. Name: 1. A ray of light travels from air to water at an angle of incidence of 34°. What is the ... [img_title-17] [img_title-16]

Snell s Law and Critical Angles Westgate Mennonite Collegiate

Will Mortgage Rates Drop In 2026

Snell s Law Problem Set 1 Name Block Date Do all problems on a separate sheet of lined paper Indicate your [img_title-11]

A ray of light traveling from air into crown glass strikes the surface at an angle of 30 What will the angle of refraction be [img_title-12] [img_title-13]

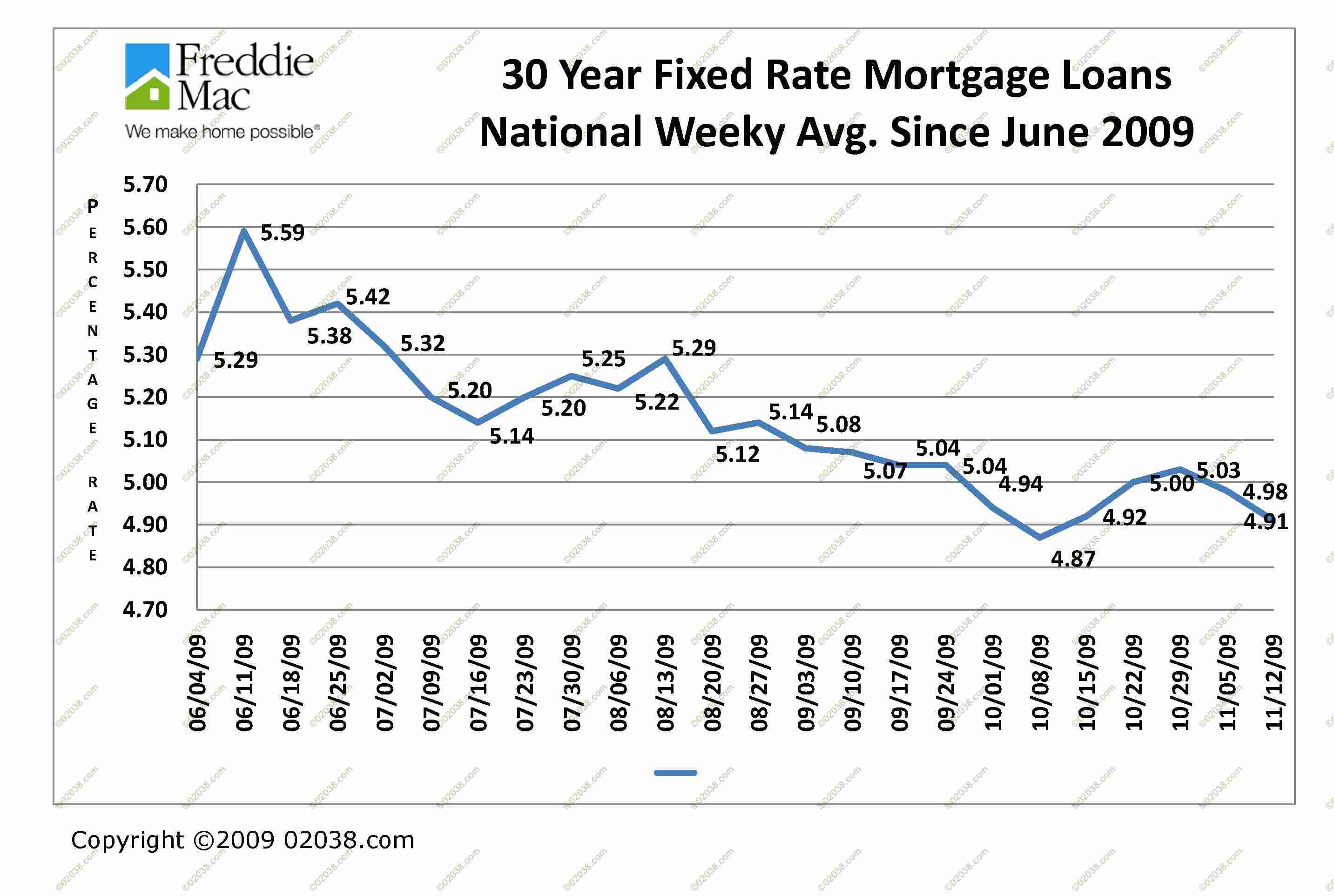

U S Mortgage Rates Rise To 6 81 Highest Level This Year Freddie Mac

Home Equity Interest Rates Know Their Meaning Types Etc

Mortgage Rates Today September 29 2025 30 Year Rates Steady 15

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]