Objectives Of Job Order Costing are a fun and interesting device for kids and grownups, providing a mix of education and learning and entertainment. From coloring web pages and challenges to mathematics obstacles and word video games, these worksheets accommodate a vast array of rate of interests and ages. They assist enhance essential thinking, analytical, and creativity, making them optimal for homeschooling, classrooms, or family tasks.

Easily available online, worksheets are a time-saving resource that can transform any type of day right into a knowing adventure. Whether you require rainy-day activities or supplemental discovering tools, these worksheets offer endless opportunities for enjoyable and education. Download and take pleasure in today!

Objectives Of Job Order Costing

Objectives Of Job Order Costing

If you must use the Simplified Method to figure the taxable amount in Box 2a of the 1099 R form use this guide to assist you with your entries If you use the Simplified Method, you can do so within your account by clicking the link beside box 2 on your 1099-R entry screen. The Simplified Method ...

Desktop The Simplified General Rule Worksheet Support

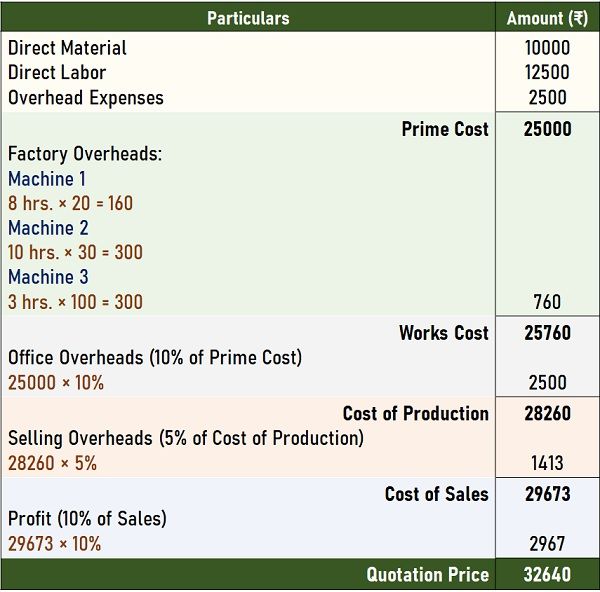

What Is Job Costing Definition Features And Example The Investors Book

Objectives Of Job Order Costingwe have used the Simplified Method to figure the taxable amount of your CSRS or FERS annuity. For your convenience, this amount is reported on your 1099R. This is the simplified method worksheet It is used to figure the taxable part of your pension or annuity using the simplified method

In TurboTax there's a worksheet associated with the 1099-R form, called “Simplified Method Worksheet”. Line 1 shows the “total pension received this year” ($ ... Job Order Costing Understanding The Costs Behind The Jobs Job Order Costing Cma Cpa Practice Test 46 Chapter 5 JOB ORDER

Should I use the Simplified Method Worksheet to figure my 1099 R s

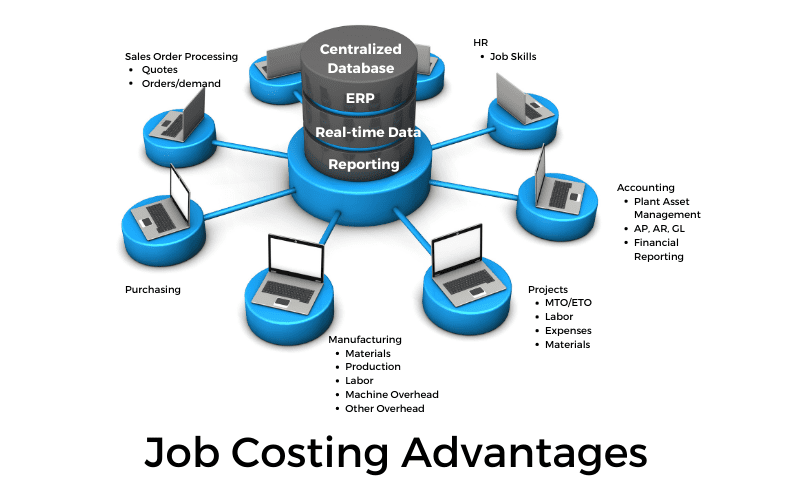

5 Advantages Of Having A Job Order Costing System

Use the Simplified Method and you can use the worksheet provided to figure your taxable annuity amount for the year Ch02 Noo CHAPTER 2 JOB ORDER COSTING SUMMARY OF QUESTIONS BY

If your Form 1099 R shows a larger amount use the amount on this line instead of the amount from Form 1099 R If you are a retired public safety officer Job Order Costing YouTube THE POWER OF JOB ORDER COSTING FOR SMALL BUSINESS

Benefits Of Job Costing System SydneyminSaunders

The Three Types Of Manufacturing Costs In A Job Order Costing System

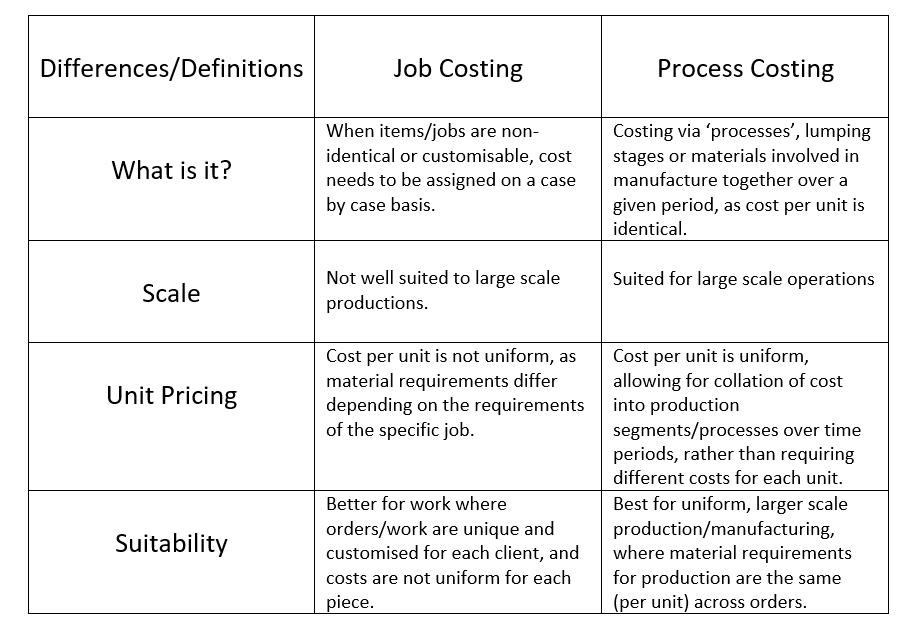

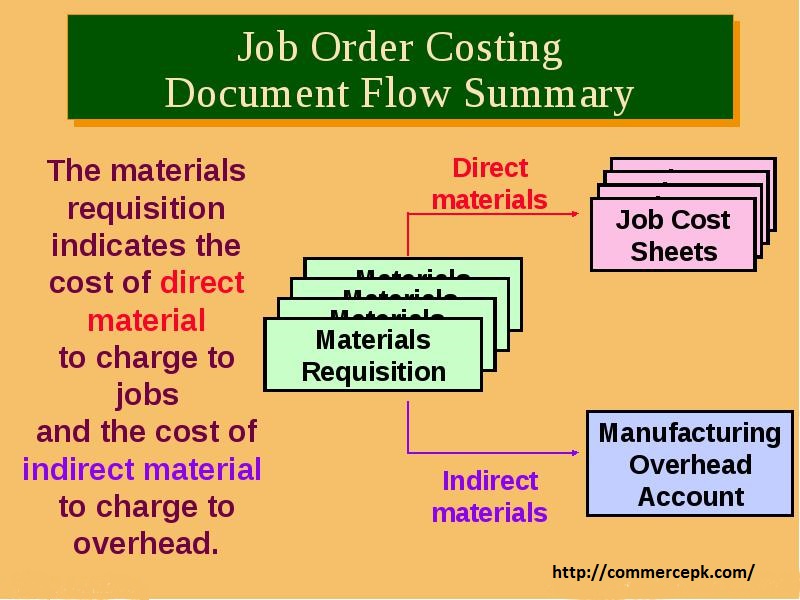

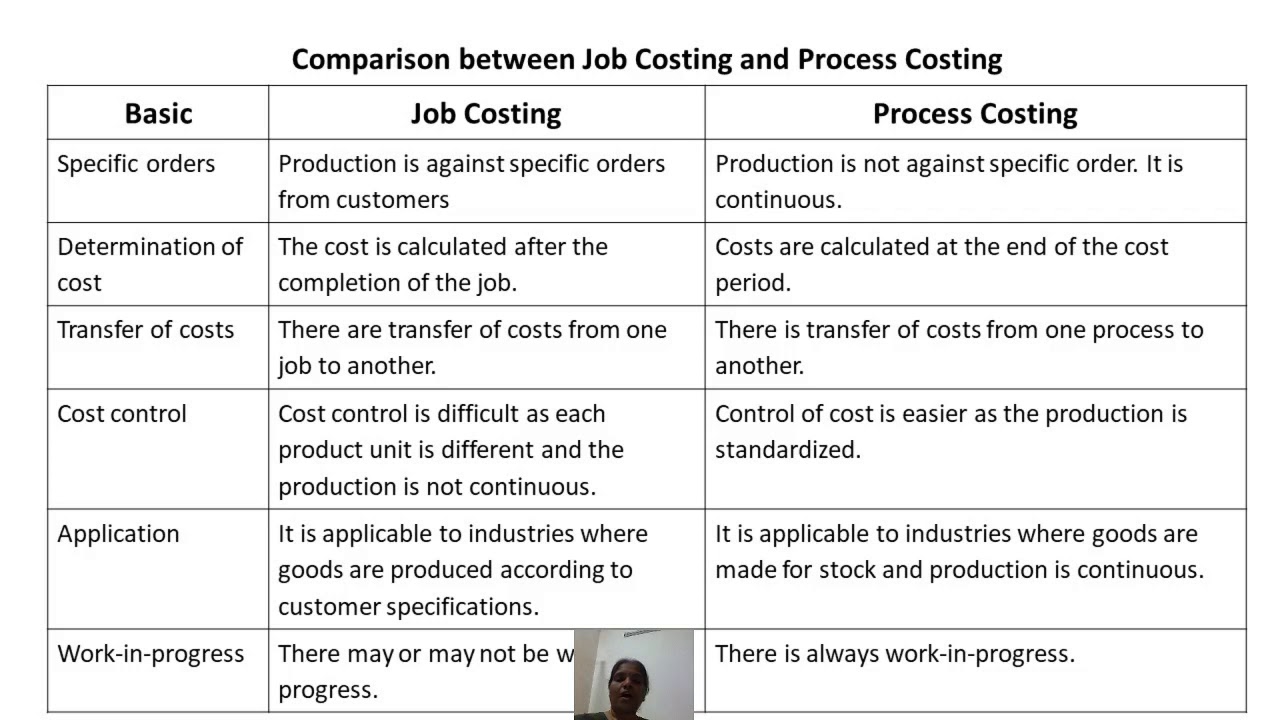

CHAPTER 3 PROCESS COSTING COMPARISON BETWEEN JOB COSTING AND PROCESS

Job Order Costing In 6 Easy Steps MRPeasy

Chapter 4 Ppt Tema 4 Chapter Four Systems Design Job Order Costing

11ch04 Compatibility Mode Job Order Costing Chapter 4 Learning

Session 3 Job order Costing 3 Session 3 Job order Costing 3

Ch02 Noo CHAPTER 2 JOB ORDER COSTING SUMMARY OF QUESTIONS BY

AxelrtJacobs

Benefits Of Job Costing System AllenminBerry