Mla 8 Citation Format are an enjoyable and engaging tool for youngsters and grownups, providing a mix of education and entertainment. From coloring pages and problems to mathematics challenges and word games, these worksheets deal with a wide variety of interests and ages. They help improve important reasoning, problem-solving, and imagination, making them ideal for homeschooling, classrooms, or family activities.

Conveniently accessible online, worksheets are a time-saving source that can turn any day right into a discovering experience. Whether you require rainy-day tasks or additional discovering devices, these worksheets give limitless possibilities for enjoyable and education. Download and install and delight in today!

Mla 8 Citation Format

Mla 8 Citation Format

Encourage name recognition spelling and letter formation with this name tracing practice worksheet Trace the days of the week from Sunday through Saturday A Z all on one page in bubble font Trace the alphabet with a picture guide A simple word list page that will display anything you type into it This name tracing & writing practice booklet has it all; tracing, coloring, letter sounds, letter writing, reading, and more. The best part is that it’s customizable which means you’ll be able to generate a custom booklet for any child’s name.

Create Name Tracing Worksheets PDF Generator Free

MLA Citation Guides Research Subject Guides At Stony Brook University

Mla 8 Citation FormatFree Printable name tracing worksheets for Preschool and Kindergarten students to help them practice writing their own names. Make your own worksheets with our name tracing worksheet generator. Making names more memorable is easy with a printable name tracing worksheet generator Writing names by hand engages the brain and solidifies names in your memory which makes names easier to recognize and identify in future conversations

[desc_9] Mla Paper Title Editing The Essay Ppt Download

Name Tracing amp Writing Practice Booklet

MLA Citation Transition Year Program LibGuides At Dalhousie University

[desc-8] Mla Formal

Below is my full collection of printable and free name tracing worksheets covering the entire alphabet from A to Z These names are derived from this year s list of most popular names and are designed for early childhood education and handwriting practice Referencing Arts Guide LibGuides At Edith Cowan University Free MLA 8 Citation Generator With Formatting Rules And Examples

MLA Citation Help G R Little Library At Elizabeth City State

MLA Citation English LibGuides At Dalhousie University

MLA Format Everything You Need To Know Here Essay Writing Skills

Mla Outline Example Infoupdate

Ela Format

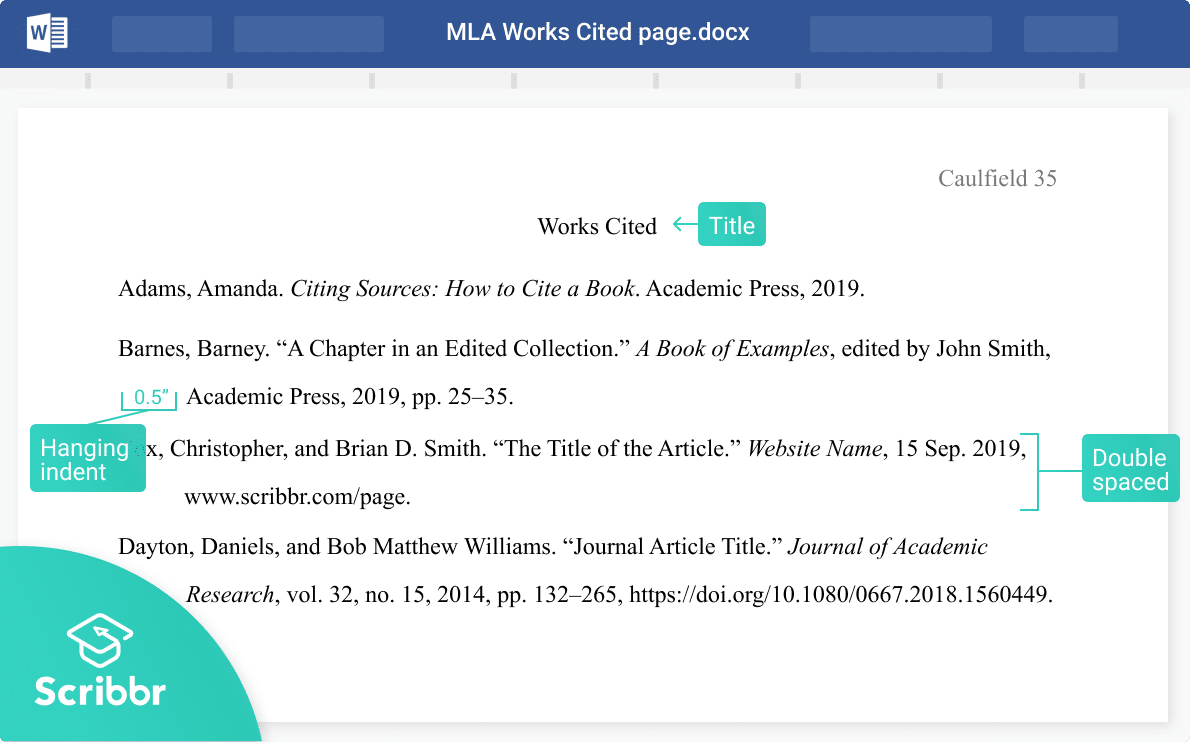

MLA Format Complete Guidelines Free Template

Citations The Watsons Go To Birmingham 1963 Civil Rights Movement

Mla Formal

Harvard Citation Style Generator L s Ditt Citeringsproblem

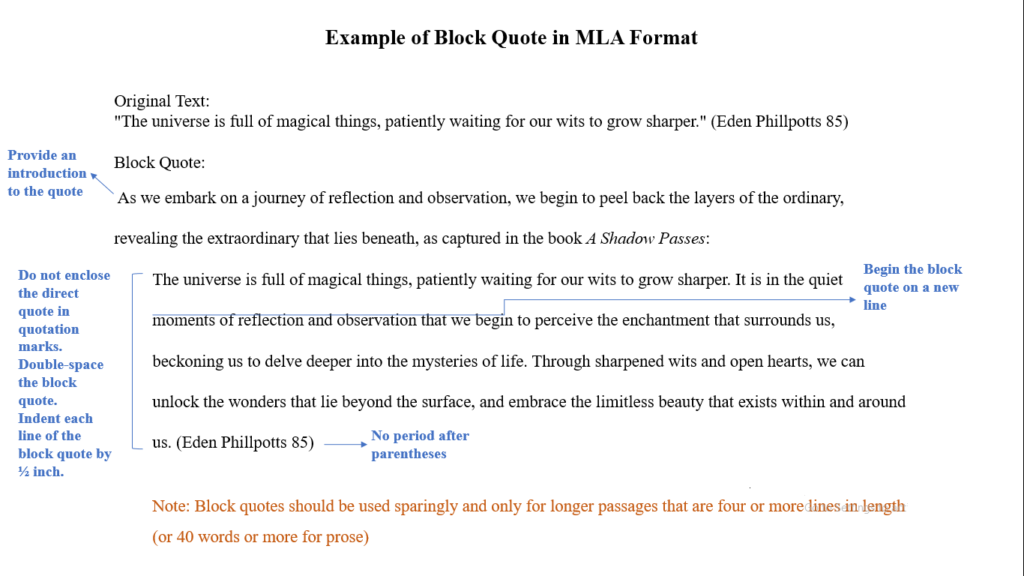

Quoting In Mla MLA Style Citation Controversial Topics Guides At