Gross Margin Vs Ebit are an enjoyable and interesting tool for children and adults, providing a mix of education and learning and entertainment. From tinting web pages and puzzles to mathematics obstacles and word video games, these worksheets satisfy a large range of rate of interests and ages. They help enhance important thinking, analytical, and creativity, making them suitable for homeschooling, class, or household activities.

Quickly easily accessible online, printable worksheets are a time-saving resource that can transform any day right into a discovering experience. Whether you require rainy-day tasks or additional learning devices, these worksheets give unlimited opportunities for fun and education and learning. Download and install and appreciate today!

Gross Margin Vs Ebit

Gross Margin Vs Ebit

Use this fun real world inspired worksheet to practice identifying and comparing 2D shapes found in everyday activities This 2D & 3D Shapes Worksheet Bundle is suitable for Kindergarten, 1st Grade and 2nd Grade students who are learning about 2D and 3D shapes and their properties ...

3d shapes worksheets TPT

EBIT Vs EBITDA Vs Net Income How They Differ And How New Accounting

Gross Margin Vs EbitPrintable comparing 2D and 3D shapes worksheets with activities to analyze plane and solid figures and tell the similarities and differences between the two. These worksheets help students learn the basic shapes they include exercises on tracing drawing naming and identifying 2D shapes

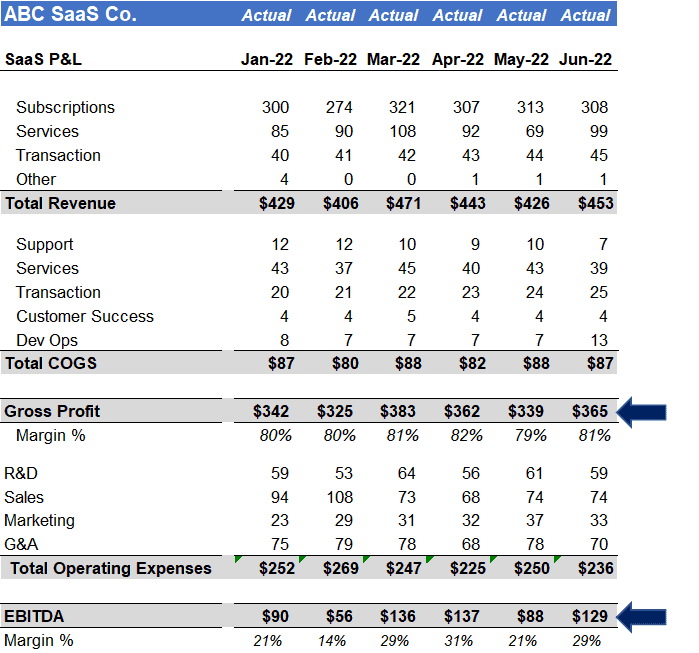

These 2D and 3D shapes worksheets provide a fun way to help your students practice identifying, drawing, and naming shapes. Your students will practice ... Gross Profit Gross Profit

2D and 3D Shapes Worksheets Crayon Lane Teach

SCDATA GCPS System

It includes 31 engaging worksheets which allow students to practice composing 2D and 3D shapes identifying 2D and 3D shapes naming 2D and 3D EBITDA Meaning Formula Uses And Limitations Stock Analysis

These worksheets compare 2D and 3D shapes Students classify shapes as being either 2 dimensional flat or 3 dimensional Gross Margin Gross Margin

This Is The Ultimate Cash Flow Guide To Understand The Differences

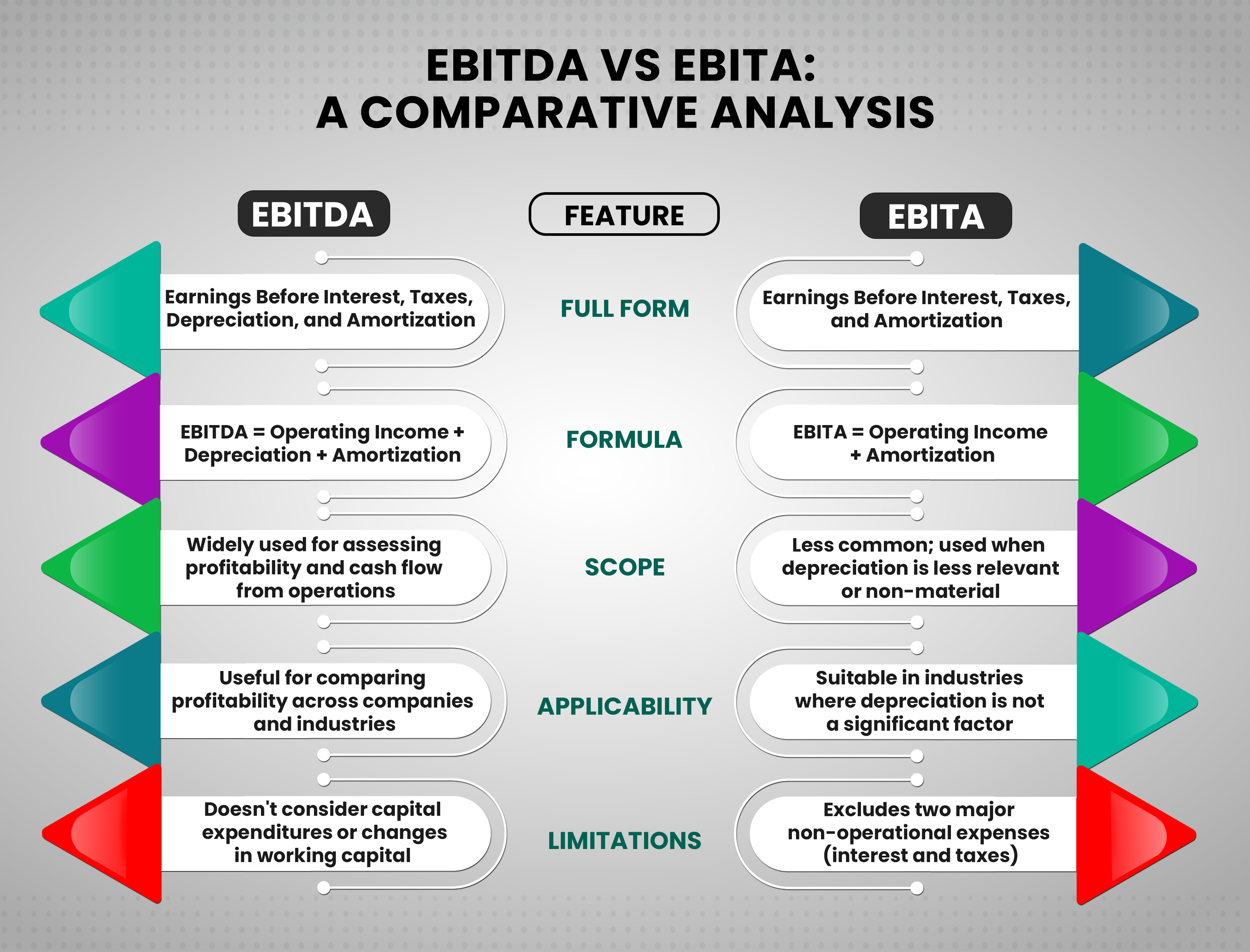

Ebita

ROI PowerPoint Slide Template SlideBazaar

Gross Margin

THIS Is What s Fueling Inflation Company Profits For 2023

Ebitda Excel Template Prntbl concejomunicipaldechinu gov co

What Is Ebit

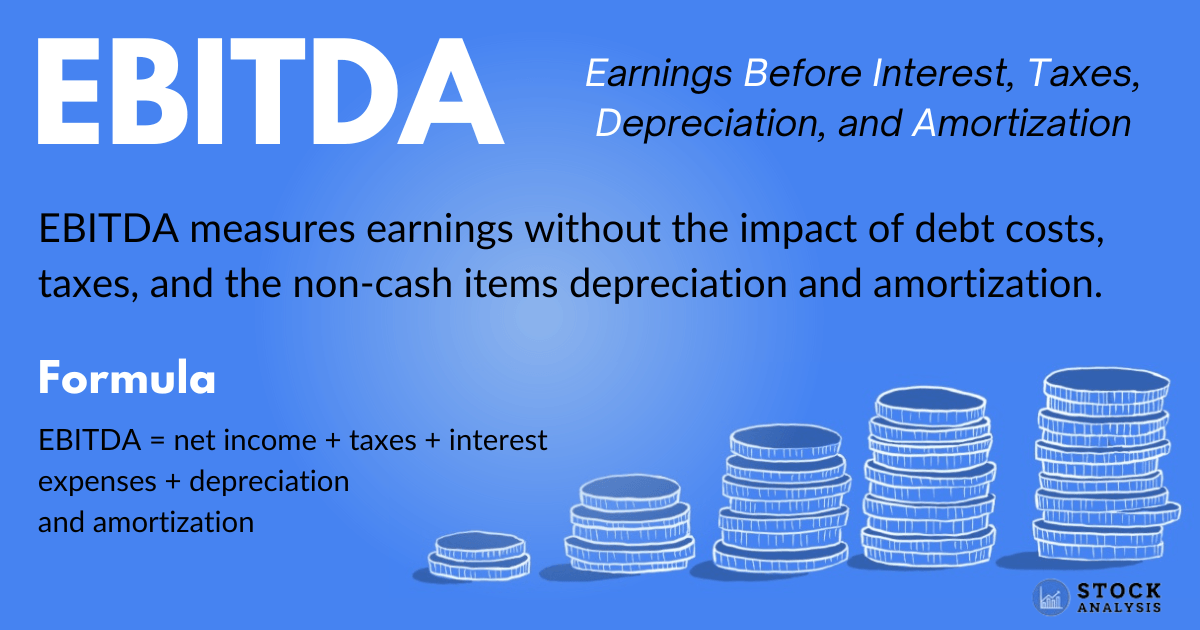

EBITDA Meaning Formula Uses And Limitations Stock Analysis

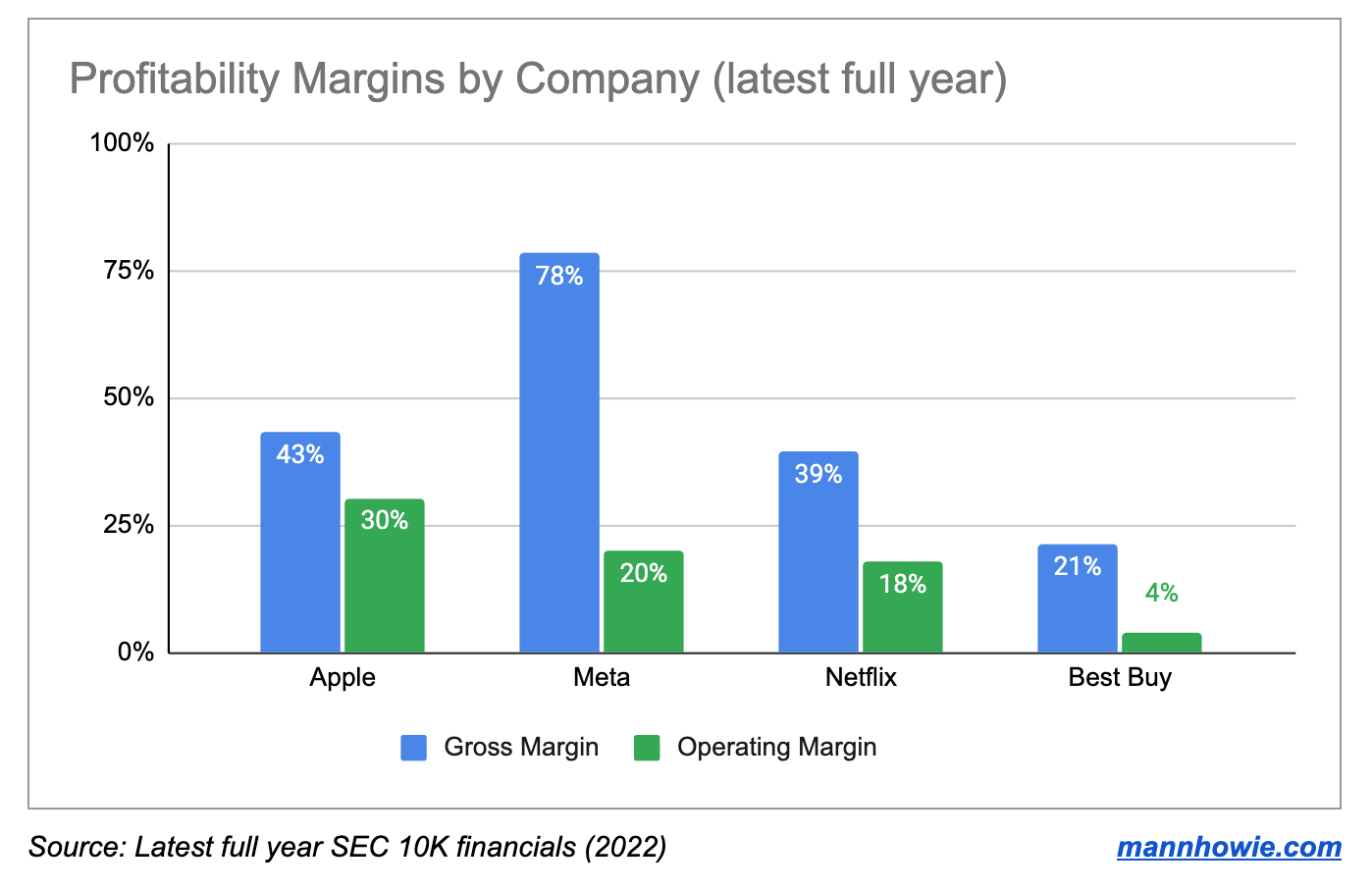

Gross Margin Chart

Ebitda Financial Statement Example