Different Types Of Self Employment Income are a fun and appealing tool for kids and adults, supplying a mix of education and learning and entertainment. From tinting pages and puzzles to math obstacles and word games, these worksheets deal with a large range of passions and ages. They aid improve essential thinking, analytic, and creative thinking, making them optimal for homeschooling, classrooms, or family members tasks.

Conveniently accessible online, worksheets are a time-saving source that can transform any day right into an understanding journey. Whether you require rainy-day activities or additional discovering tools, these worksheets provide endless opportunities for fun and education and learning. Download and take pleasure in today!

Different Types Of Self Employment Income

Different Types Of Self Employment Income

You can simply download our InstallShield installation file by clicking on Calculator msi 4 691 456 bytes If you would rather not use the Windows installation file we provide alternative versions of the calculator setup package as a simple Winzip self extracting file or a plain zip file · You can use Social Security's benefit calculators to: Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70) Calculate what payments you would receive based on your earning history; Find out your full retirement age; Learn about earning limits if you plan to work while receiving Social Security benefits

Social Security Calculator Estimate Your Benefits AARP

Personal Income Tax Returns Ppt Download

Different Types Of Self Employment Income · Estimate your monthly Social Security retirement benefit using your age, income and when you want to retire. Use this Social Security benefits calculator to estimate your retirement. If you have a personal my Social Security account you can get an estimate of your future retirement benefits and see the effects of different retirement age scenarios If you don t have a personal my Social Security account create one at www ssa gov myaccount

With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office. We have a variety of calculators to help you plan or assist you with your needs. Customizing You To Your Market Statement Template Lettering Letter Self Employed Income Declaration Form Employment Form

Use Social Security Retirement Calculators To Estimate Your

Self Employment Income Statement Template Beautiful Profit And Loss

Oct 2024 Update I ve updated the SS Benefit Spreadsheet to reflect the Sept and Oct CPI and wage data Here s the new link This version is currently a DRAFT for 2025 meaning I have done NO troubleshooting yet Self employed Income Support Scheme Gary Sambrook

Social Security offers plenty of online calculators to help you estimate benefits and if you care to know your life expectancy too They range from simple to complex The best and most Self employed Income Desert Financial And Tax Services Pensioner Income Sources PolicyEngine UK Documentation

Principles Of Taxation Ppt Download

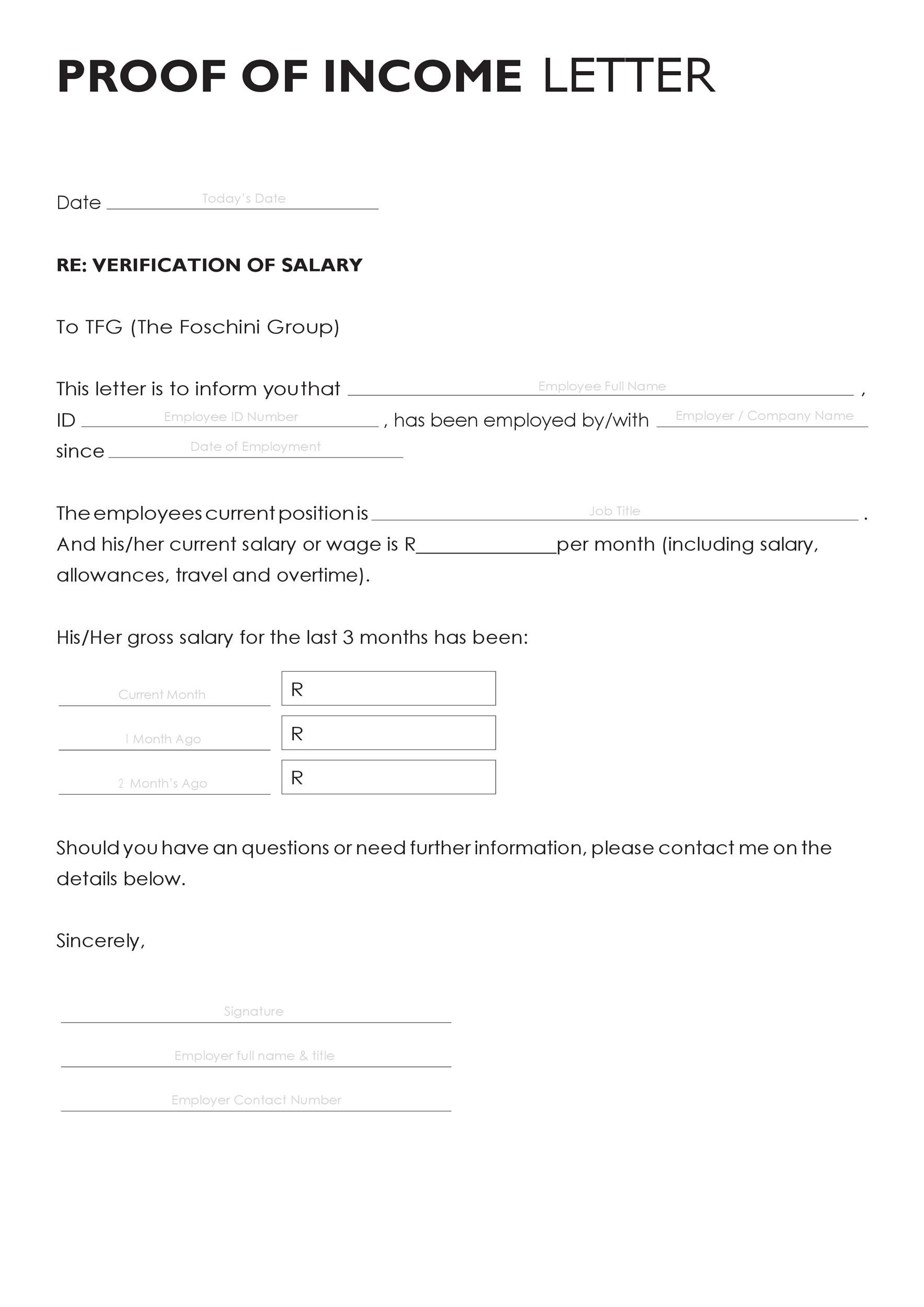

Self Employment Income Form 2 Free Templates In PDF Word Excel Download

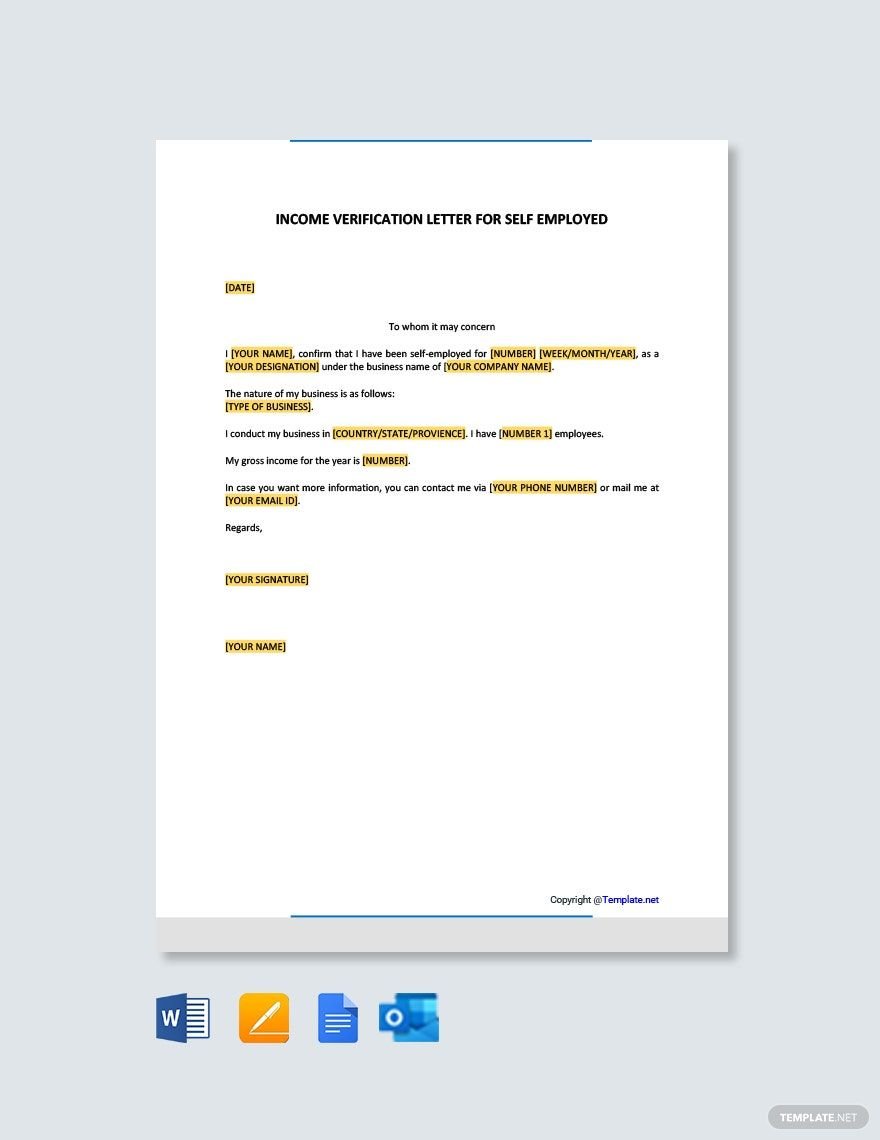

Self Employed Templates In Google Docs FREE Download Template

Self Employment Income Statement Template Beautiful Business Profit And

Estimated Payments Miller CPA

The Self Employment Income Drop Ora cfo

The Self Employment Income Drop Ora cfo

Self employed Income Support Scheme Gary Sambrook

Self Employed Canada Tax Form Employment Form

Income Verification Letter Example Design Talk