What Is Selective Functional Movement Assessment are an enjoyable and engaging tool for kids and adults, using a blend of education and learning and home entertainment. From tinting web pages and challenges to mathematics difficulties and word video games, these worksheets cater to a variety of passions and ages. They aid enhance critical thinking, problem-solving, and creativity, making them perfect for homeschooling, classrooms, or family activities.

Easily accessible online, worksheets are a time-saving source that can turn any day right into a knowing adventure. Whether you need rainy-day activities or supplemental understanding tools, these worksheets give limitless opportunities for fun and education. Download and enjoy today!

What Is Selective Functional Movement Assessment

What Is Selective Functional Movement Assessment

This worksheet was created to give you a manual method of tracking your business income and expenses monthly to assist with annual tax preparation Enter This free business expense template from Microsoft Create. This keeps all my business expenses in one place so they can easily be tracked and analyzed.

Get Your Free Excel Spreadsheet for Business Expenses

Selective Functional Movement Assessment SFMA Offerings

What Is Selective Functional Movement AssessmentGet this simple, automated spreadsheet template to record and keep track of your small business income and expenses. Free small business ... Take a look at the best small business expense spreadsheets for both Excel and Google Sheets users Best of all these are free to download

Download Signeasy's small business expense report template to track your expenses and be on top of your financial planning for 2022. Selective Functional Movement Assessment SFMA Comprehensive

Track business expenses with Excel Learn at Microsoft Create

Functional Movement Systems Specht Physical Therapy

Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF Selective Functional Movement Assessment

Use these business budget templates for startups small businesses or large businesses You can easily edit these free business budget templates in Excel Selective Functional Movement Assessment What Is Selective Functional Movement Assessment SFMA

Selective Functional Movement Assessment SFMA Spokane Valley WA

FMS Functional Movement Systems FlexibilityRx Performance Based

Selective Functional Movement Assessment Functional Physio SA

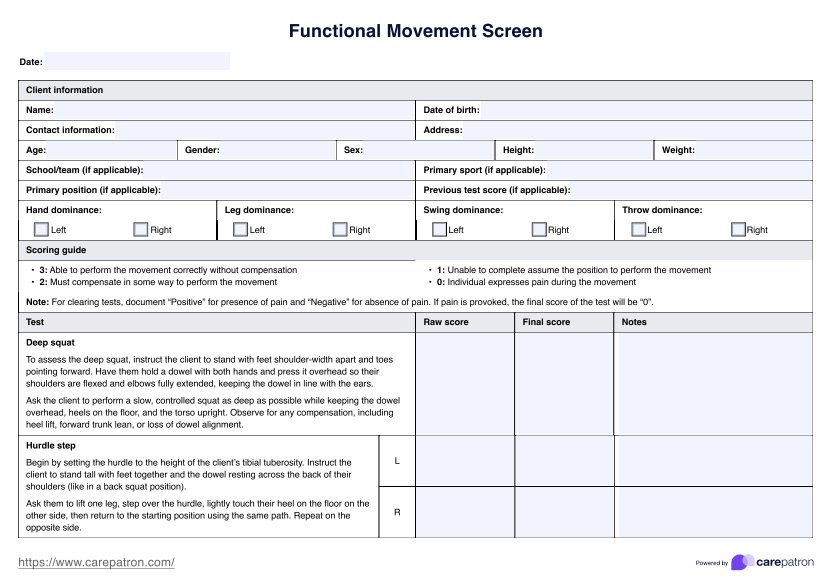

Functional Movement Screen

BMP Chart Example Free PDF Download

Chiropractic Assessments In Kelowna BC Langedyk Chiropractic

Selective Functional Movement Assessment Somers Sport And Spine

Selective Functional Movement Assessment

Selective Functional Movement Assessment S F M A

What Is Selective Hearing How Does It Impact Communication