What Is Process Costing In Management Accounting are a fun and interesting device for youngsters and adults, providing a mix of education and entertainment. From tinting web pages and challenges to math difficulties and word video games, these worksheets deal with a variety of rate of interests and ages. They help boost essential thinking, analytic, and creative thinking, making them perfect for homeschooling, class, or family members activities.

Conveniently available online, worksheets are a time-saving source that can turn any kind of day into a discovering experience. Whether you need rainy-day tasks or additional discovering devices, these worksheets give endless opportunities for enjoyable and education and learning. Download and install and take pleasure in today!

What Is Process Costing In Management Accounting

What Is Process Costing In Management Accounting

See IRS Pub 501 Dependents Standard Deduction and Filing Information or your tax return instructions to find out if you have to file a return We developed this worksheet for you to see if your benefits may be taxable for 2024 Fill in lines A through E · Learn how to calculate the taxable portion of your Social Security benefits. Understand income thresholds, provisional income and strategies to minimize tax liability.

Calculating How Much Of Your Social Security Payment Is Taxable

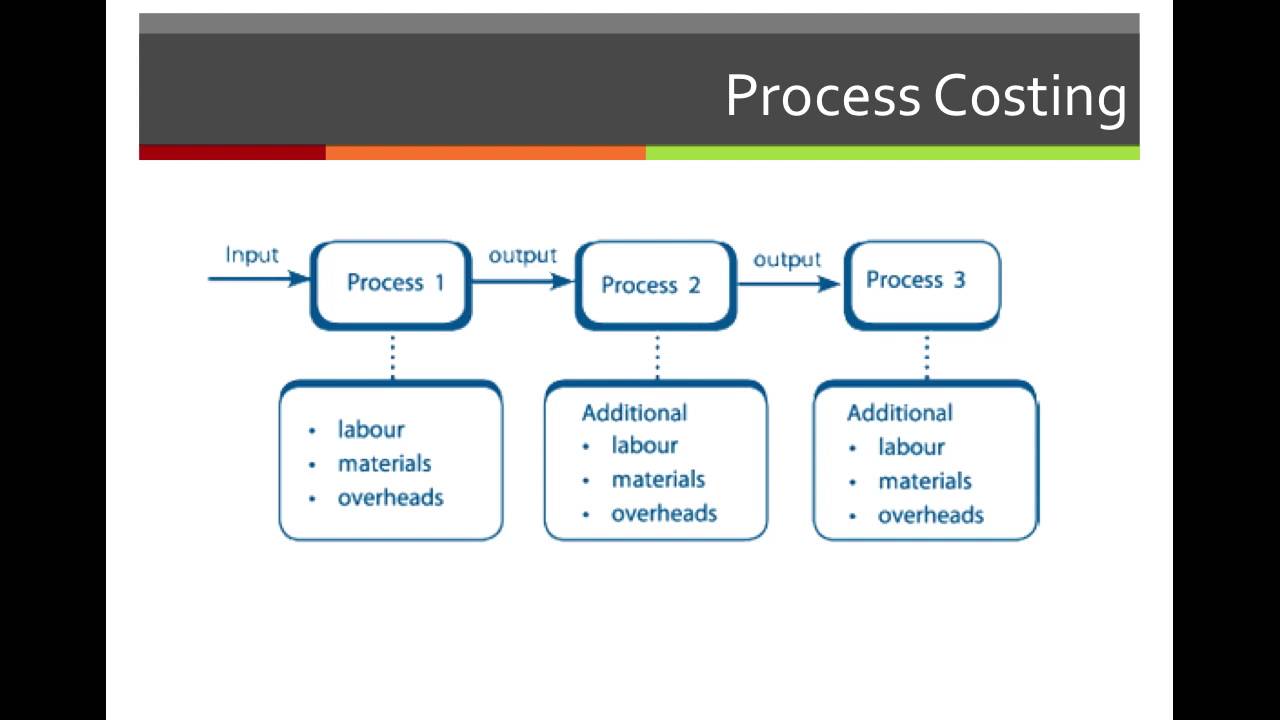

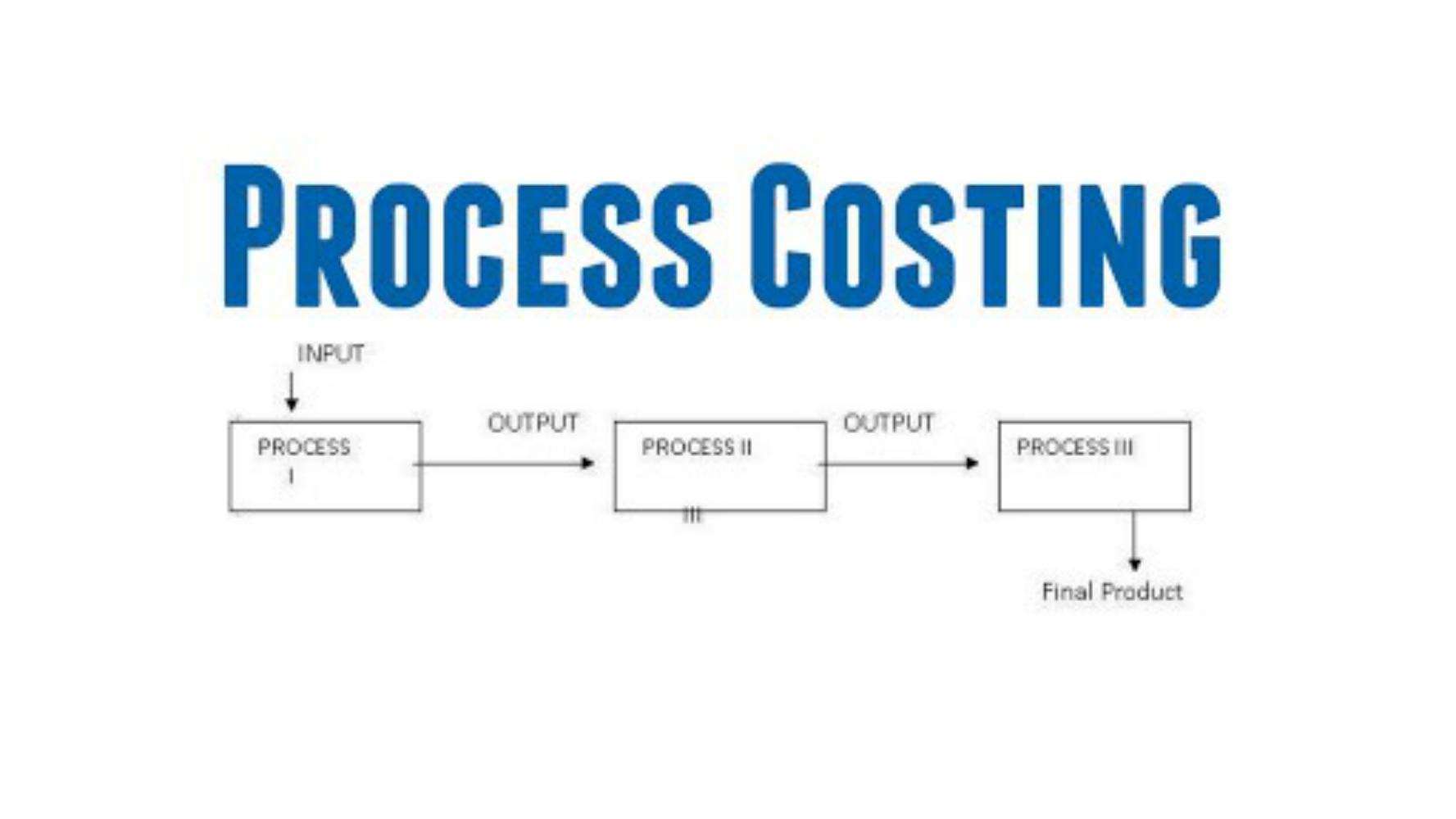

Process Costing Definition Features

What Is Process Costing In Management AccountingUse this calculator to estimate how much of your Social Security benefit is subject to income taxes. v Don t use this worksheet if you repaid benefits in 2022 and your total repayments box 4 of Forms SSA 1099 and RRB 1099 were more than your gross benefits for 2022 box 3 of Forms SSA 1099 and RRB 1099 None of your benefits are taxable for 2022

· The Old Age, Survivors, and Disability Insurance (OASDI) tax, more commonly referred to as the Social Security tax, is calculated as a percentage of a worker's income. The tax is deducted from. Premium Vector Weighted Average Method Calculation Of Inventory What Is Activity Based Costing

Calculating Taxes On Social Security Benefits Kiplinger

What Is Process Costing Definition And Example BooksTime

You may have to pay federal income taxes on your Social Security benefits This usually happens if you have enough other income such as other retirement income e g pen sion 401k and IRA distributions wages self employ ment interest dividends and other taxable income that must be reported on your tax return in addition to Social Process Costing A Guide With Illustrations EFinanceManagement

Be sure you have read the Exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable Enter the total amount from box 5 of all your Forms SSA 1099 and Forms RRB 1099 Also enter this amount on Form 1040 line 5a 1 Target Costing Meaning Process Benefits And More What Is Process Costing SuperfastCPA CPA Review

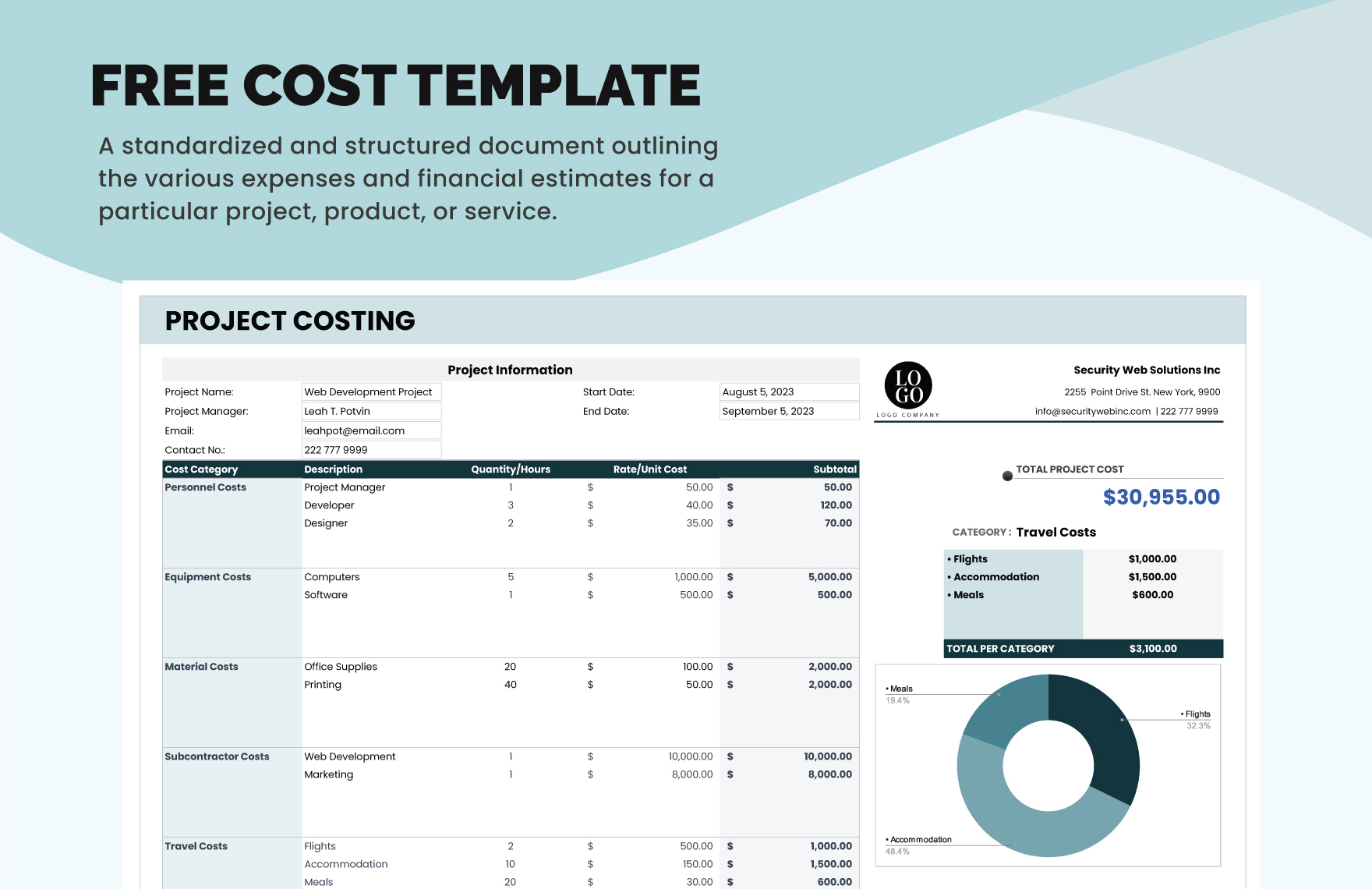

Free Recipe Costing Templates For Google Sheets And Microsoft Excel

Costing Archives Double Entry Bookkeeping

Meeting Tracker Template In Google Sheets Excel Download Template

Invoice Tracking Template In Excel Google Sheets Download Template

Cost Management Quotes

Batch Costing Meaning Examples Formula Advantages

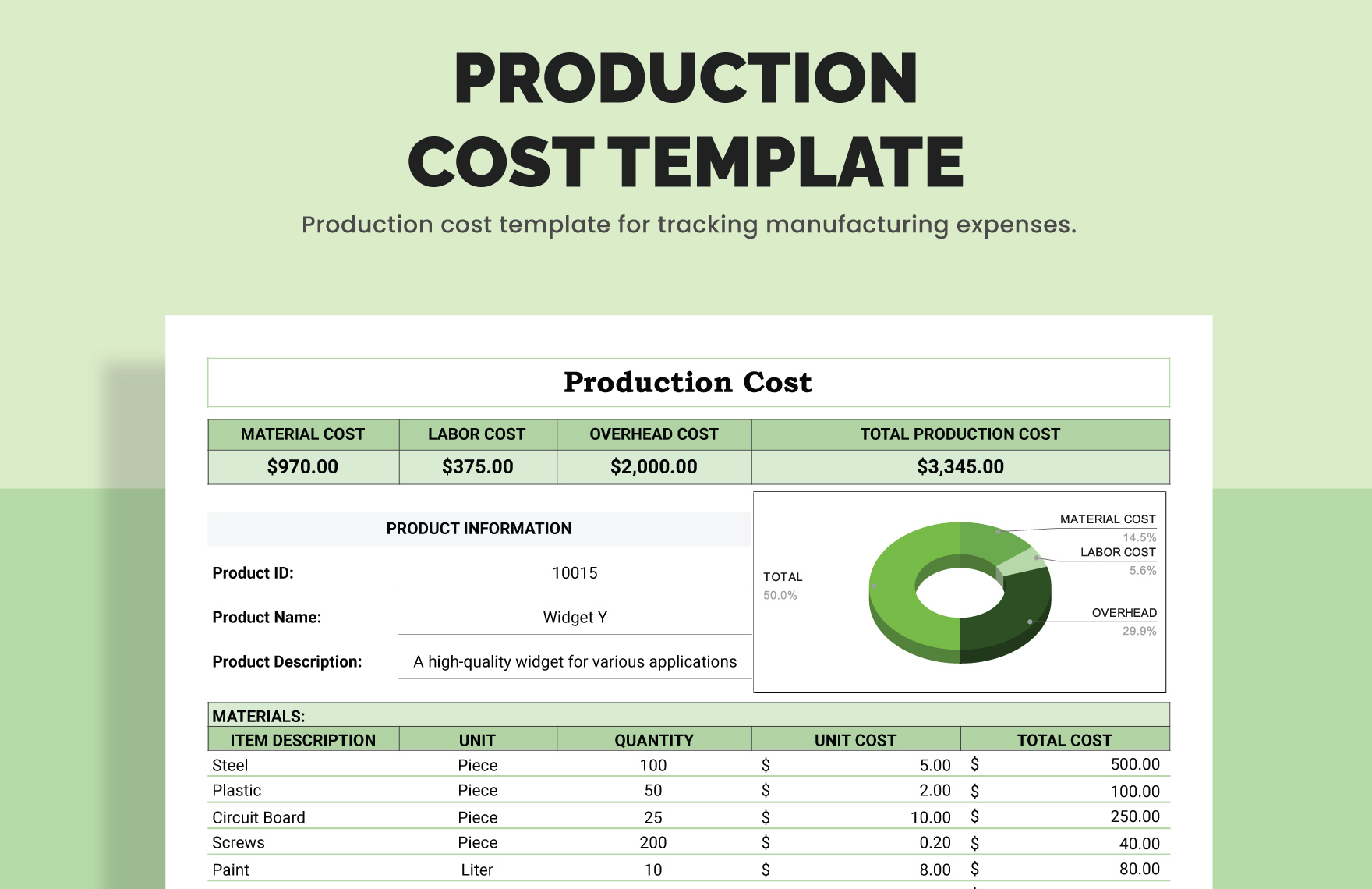

Production Cost Report Template Excel Prntbl concejomunicipaldechinu

Process Costing A Guide With Illustrations EFinanceManagement

Types Of Costing Artofit

Manufacturing Cost Budget Schedule Excel Template And Google Sheets