What Is Budget Plan Reconciliation Utility Warehouse Gov are an enjoyable and appealing device for children and grownups, providing a mix of education and home entertainment. From tinting web pages and problems to mathematics difficulties and word video games, these worksheets cater to a vast array of rate of interests and ages. They help enhance important thinking, problem-solving, and creative thinking, making them perfect for homeschooling, class, or household activities.

Easily obtainable online, worksheets are a time-saving resource that can turn any type of day into a discovering experience. Whether you need rainy-day tasks or additional learning devices, these worksheets provide endless opportunities for enjoyable and education and learning. Download and take pleasure in today!

What Is Budget Plan Reconciliation Utility Warehouse Gov

What Is Budget Plan Reconciliation Utility Warehouse Gov

This easy to use training content is designed to get you and your team up to speed with the 12 Week Year both quickly and effectively We provide access to everything you need to train your team and to build momentum week after week To make The 12 Week Year work for you, you will need to measure both lead and lag indicators. Lag Lag indicators are the end results, while lead indicators are the activities that produce the lag results.

The 12 Week Year Planner And Templates FREE Download

Budget Law Monitor

What Is Budget Plan Reconciliation Utility Warehouse GovThere are three key steps to applying the 12 Week Year Challenge: vision, planning, and daily execution. Vision – The first workbook that you received from the 12 Week Year ChallengeTM helped you to set you life purpose, define your vision, and set one or more 12 week goals. On the 12 week year system you are accountable for reaching your objectives In this post you ll find 15 downloadable templates that you need in order to use the 12 WY system as your goal setting tool

[desc_9] Spending Policy Template Prntbl concejomunicipaldechinu gov co How To Make A General Ledger In Excel Sheetaki

The 12 Week Year PARTICIPANT WORKBOOK

SmartMatter Micro Billing

[desc-8] St James Catholic Church Noelker And Hull Associates Inc

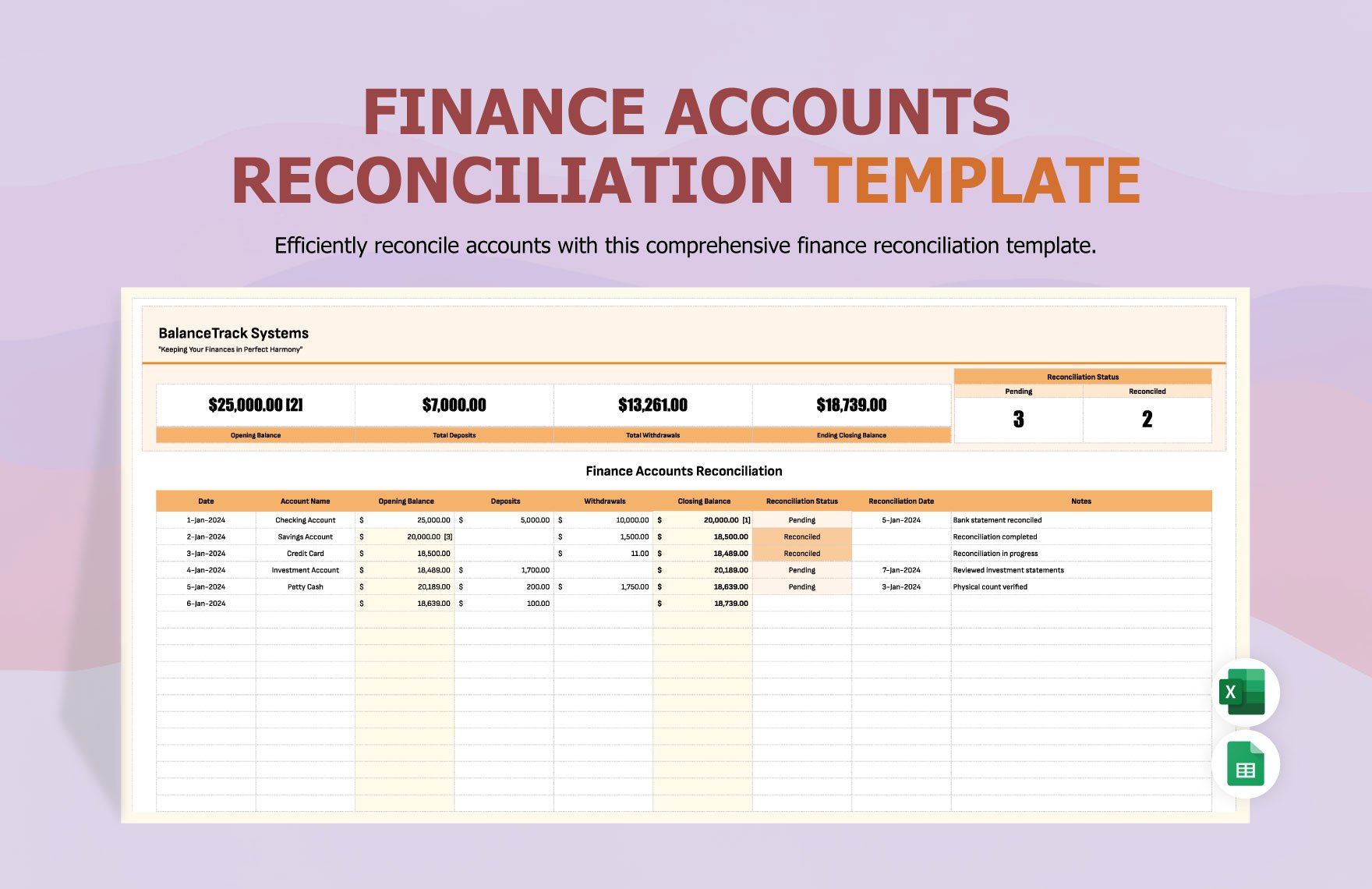

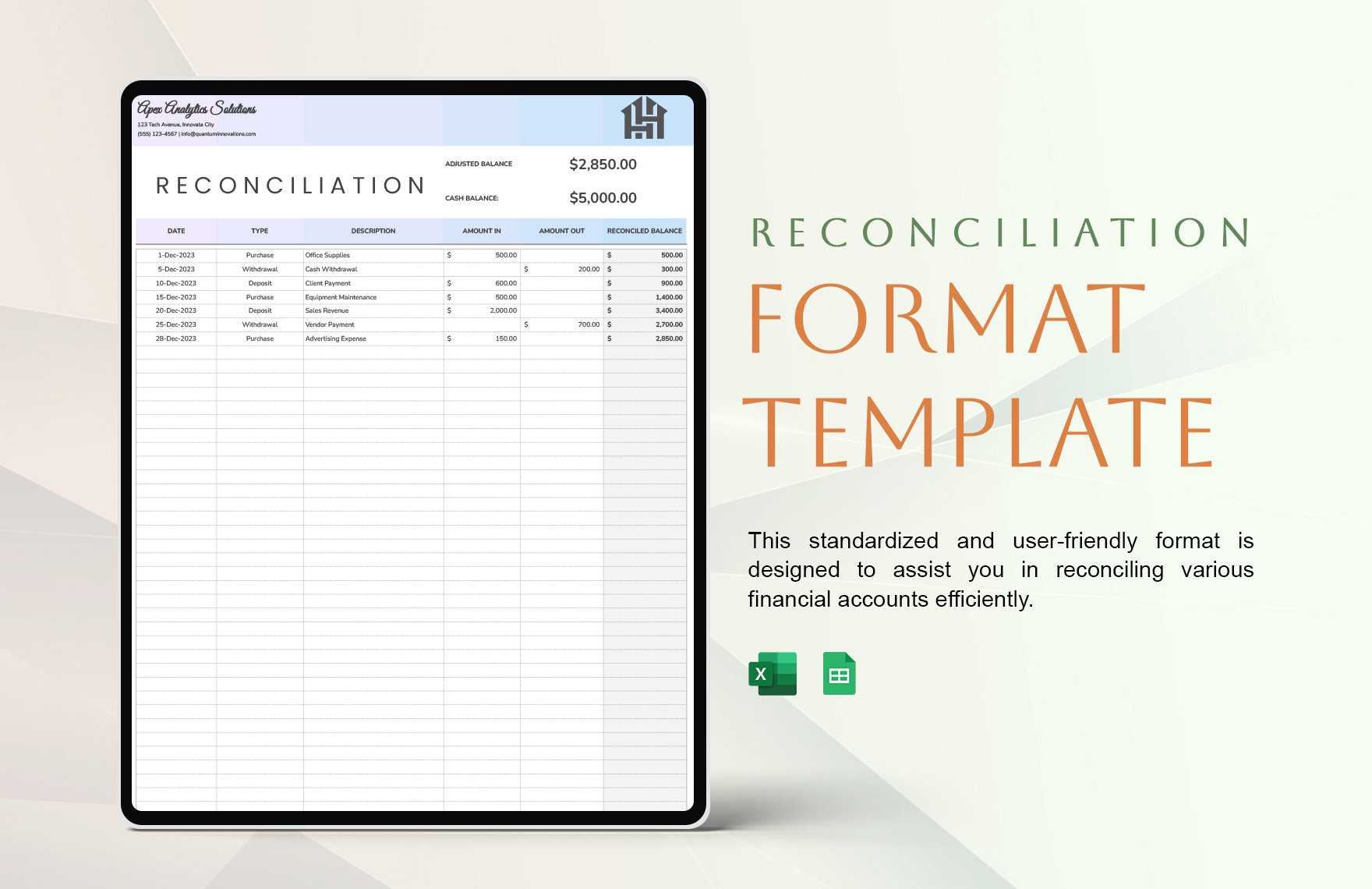

To make The 12 Week Year work for you you will need to measure both lead and lag indicators Lag Lag indicators are the end results while lead indicators are the activities that produce the lag results Budget Execution PowerPoint And Google Slides Template PPT Slides Budget Reconciliation Template In Excel Google Sheets Download

:max_bytes(150000):strip_icc()/what-makes-for-a-successful-budget-1289233_final-225d5c28eefd4a0a8ecbebce0f599b1d.jpg)

Manage Budget

Budgeting

Editable Reconciliation Templates In Excel To Download

Editable Reconciliation Templates In Excel To Download

Excel2Tally Learnwell

Meet Janice The Paper Budget Book OpenGov

St James Catholic Church Noelker And Hull Associates Inc

St James Catholic Church Noelker And Hull Associates Inc

Empty Monthly Budget Template Free

Versus Capital Capital