Percent Of Change Formula Example are a fun and interesting device for kids and grownups, offering a mix of education and enjoyment. From tinting pages and puzzles to math difficulties and word games, these worksheets accommodate a wide range of interests and ages. They aid boost vital thinking, problem-solving, and creative thinking, making them perfect for homeschooling, classrooms, or household tasks.

Easily accessible online, worksheets are a time-saving resource that can turn any day into a discovering experience. Whether you require rainy-day activities or additional discovering tools, these worksheets provide endless possibilities for enjoyable and education. Download and appreciate today!

Percent Of Change Formula Example

Percent Of Change Formula Example

This pack of needs and wants activities has everything you need to teach your students about needs vs wants as part of your social studies curriculum Fee and fun preschool activities on social studies, needs and wants.

16 Kindergarten social studies needs and wants ideas Pinterest

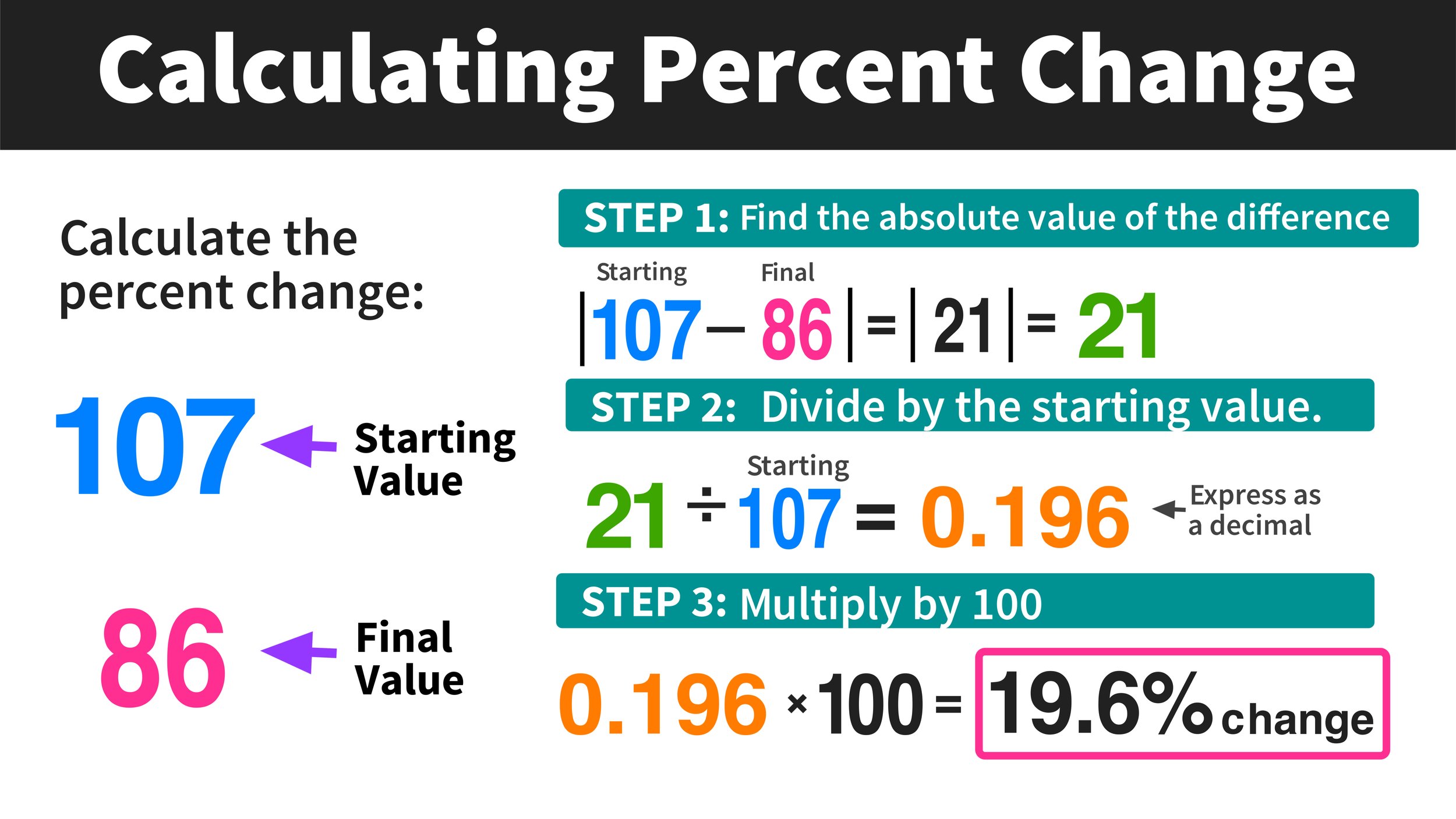

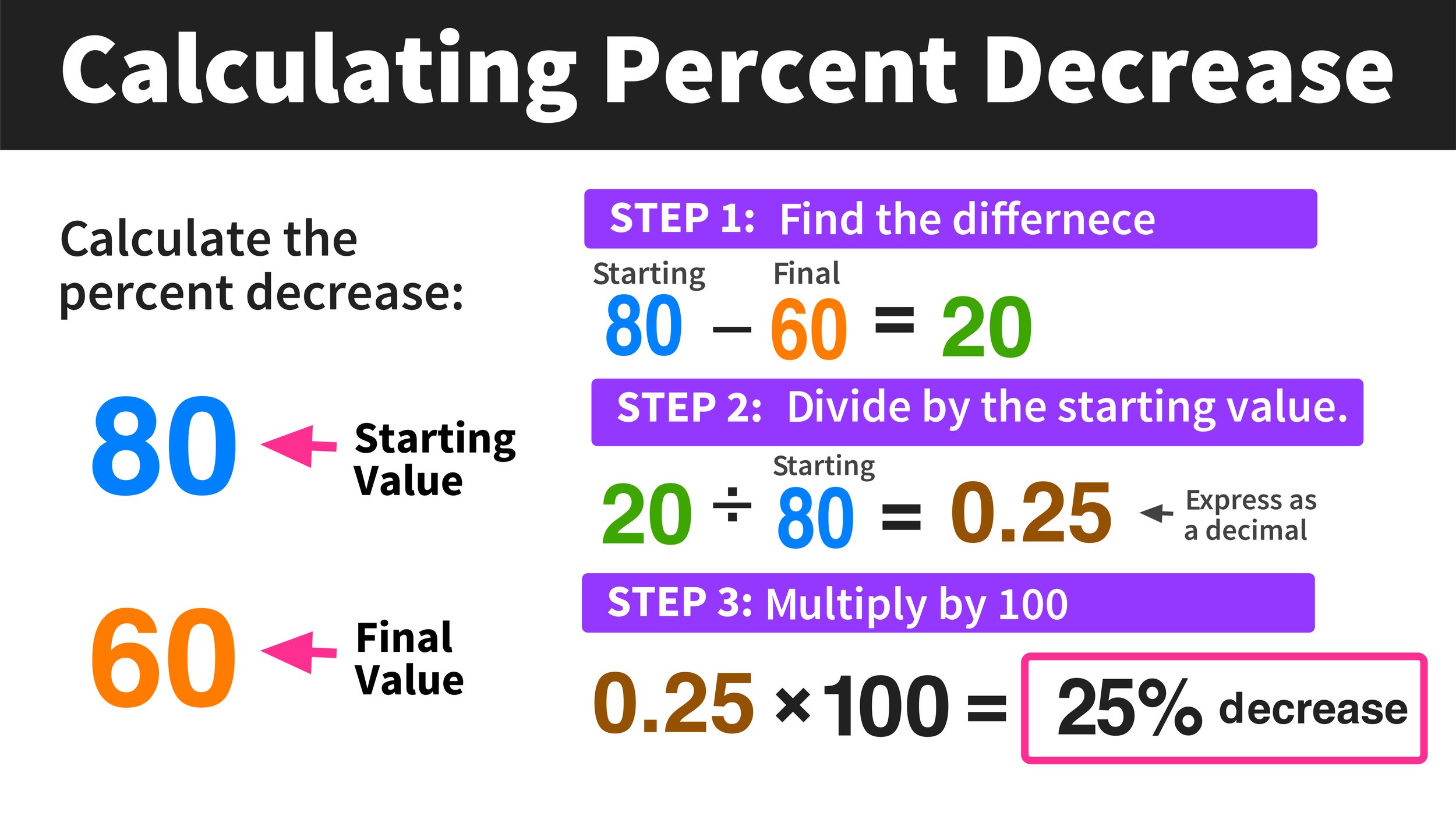

How To Calculate Or Find Percent Of Change Explained Percent Increase

Percent Of Change Formula ExampleDo you little or big learners have a little trouble distinguishing between needs and wants? That's why I created this Wants vs Needs Learning Pack! Grab our printable compilation of needs and wants worksheets featuring charts and exercises to identify needs and wants and differentiate between the two

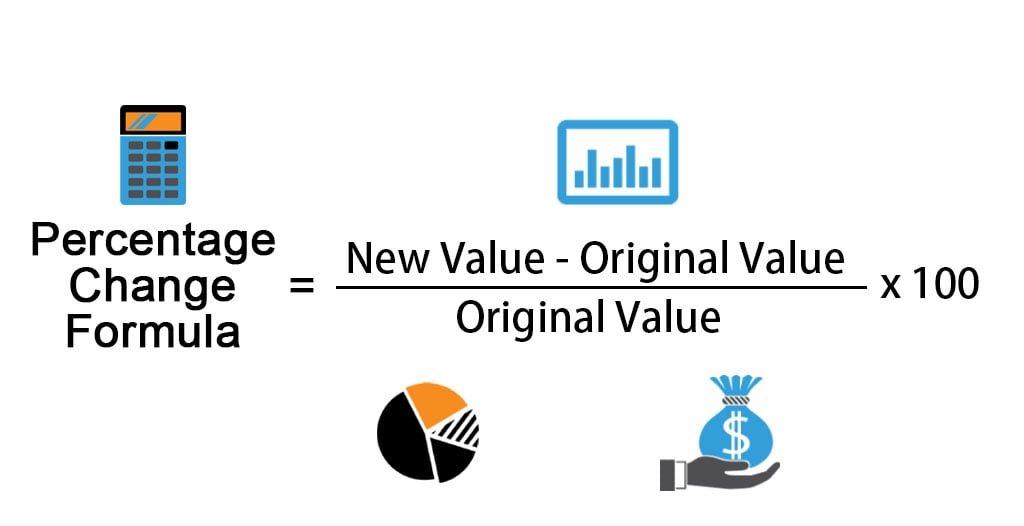

Discover the difference between wants and needs with our free social studies worksheet, offering kids a hands-on cut-and-paste sorting ... Percent Difference Formula Percent Difference Formula

What are wants What are needs Fun Preschool activity sheets

Percentage Formula How To Calculate Examples And FAQs 48 OFF

Kids can practice identifying needs and wants by sorting pictures and words in this free social studies worksheet It is an easy cut and paste activity Percentage Snapshot Of Homeownership In New York City NYU Furman

Kids can practice identifying needs and wants by sorting pictures and words in this free social studies worksheet It is an easy cut and paste activity Learn What Percent Change Is Increase Or Decrease Percent Change Formula

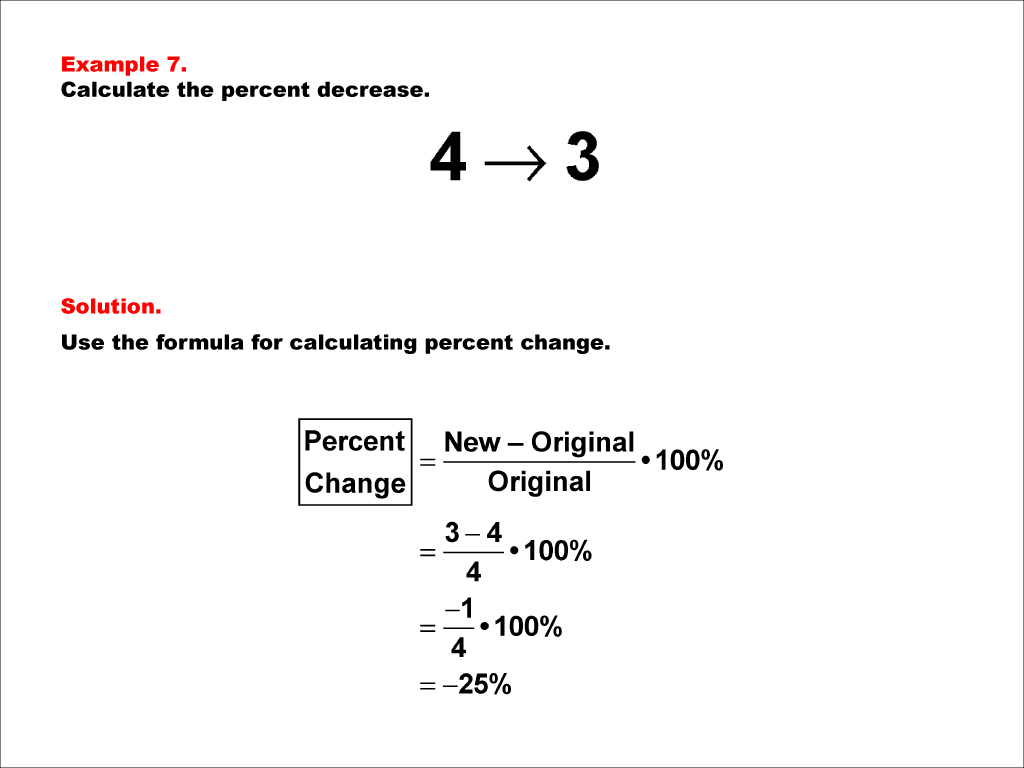

Student Tutorial Percent Decrease Media4Math

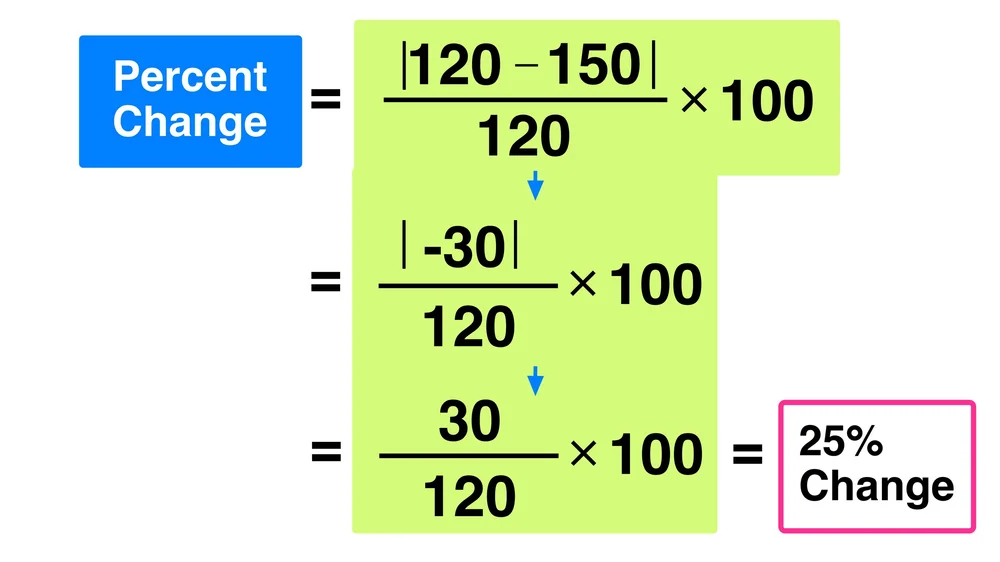

Percentage Change Explanation Examples

Percent Change Calculator Mashup Math

Percent Change Definition Examples Expii

Formula Percentual

3 Steps

Formula Percentual

Percentage Snapshot Of Homeownership In New York City NYU Furman

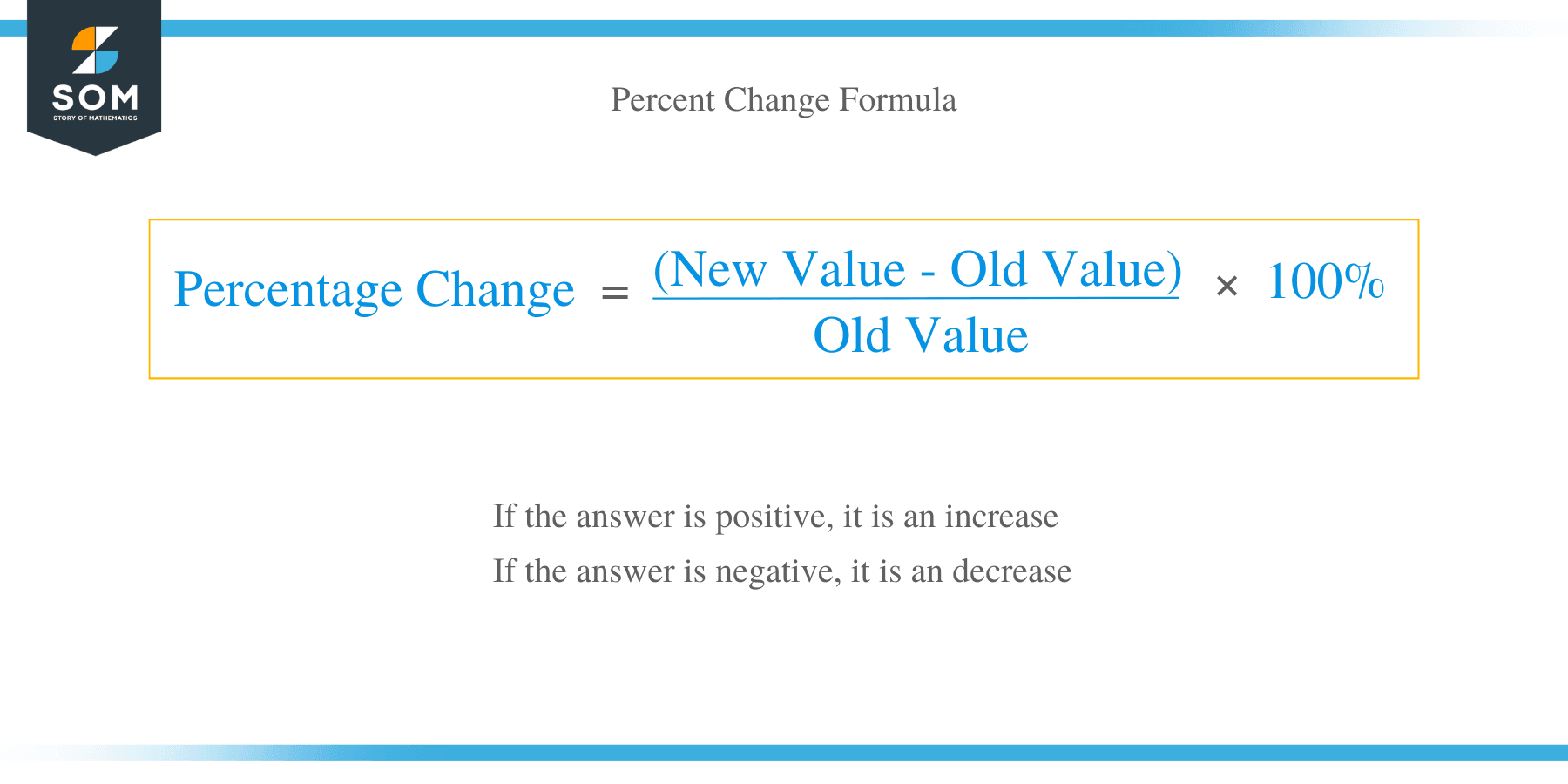

Percent Change Formula

Percent Change Formula