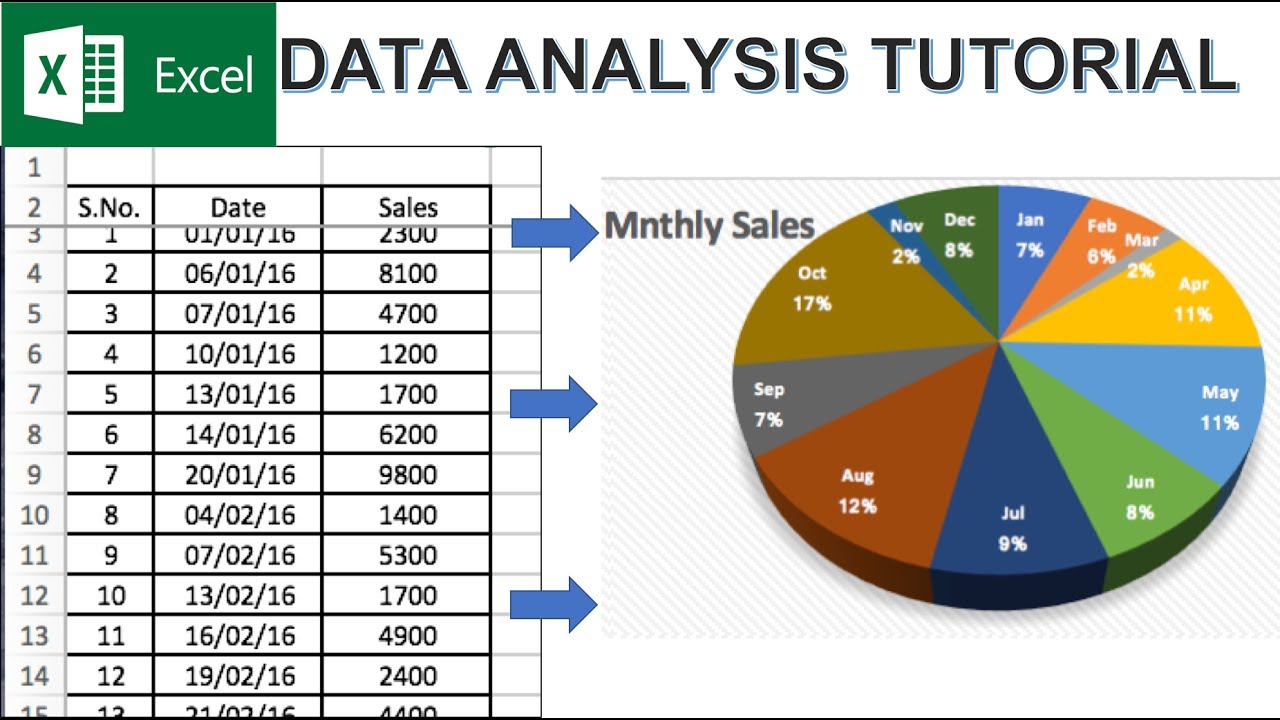

Microsoft Excel For Data Analysis are an enjoyable and engaging device for children and adults, offering a mix of education and learning and entertainment. From coloring web pages and challenges to math challenges and word video games, these worksheets cater to a vast array of rate of interests and ages. They assist improve critical thinking, problem-solving, and creativity, making them suitable for homeschooling, classrooms, or family members tasks.

Conveniently easily accessible online, worksheets are a time-saving resource that can transform any kind of day into a learning adventure. Whether you need rainy-day activities or supplemental learning devices, these worksheets give countless possibilities for fun and education and learning. Download and appreciate today!

Microsoft Excel For Data Analysis

Microsoft Excel For Data Analysis

Part A Name the following covalent compounds 1 CO Part B Write the Chemical Formula for each of the following compounds Covalent compounds are made from two non-metals and so don't follow the normal ionic rules. You can tell if a compound is covalent because it has prefixes ...

Naming Covalent Compounds Type III Worksheet

A Comprehensive Guide On Microsoft Excel For Data Analysis PDF Data

Microsoft Excel For Data AnalysisThis set of worksheets include step-by-step notes on writing covalent compound names and writing covalent compound formulas. There are 6 ... Part A Name the covalent compounds 17 1 CO 2 CO2 Name Part B Write the chemical formula 1 carbon tetrafluoride 2 silicon dioxide

Through this worksheet set, students will learn to identify whether a compound is ionic or covalent by identifying the elements involved. Free Excel Data Analysis Basics Course At YouTube E DAB YouTube Excel Data Analysis Sort Filter PivotTable Formulas 25 Examples

COVALENT COMPOUNDS willamette leadership academy

Learn Microsoft Excel For Data Analysis Codecademy

Name of ionic compounds is composed of the name of the positive ion from the metal and the name of the negative ion Examples NaBr Sodium bromide Excel Templates Data Analysis At Lillian Hecker Blog

Write chemical formulas for the compounds in each box The names are found by finding the intersection between the cations and anions Example The first box is Microsoft Excel Data Analysis And Business Modeling 5th Edition Introduction To Data Analysis Using Microsoft Excel Short Course

Microsoft Excel For Data Analysis Analytics Vidhya

Microsoft Excel For Data Analysis Analytics Vidhya

Microsoft Excel For Data Analysis Analytics Vidhya

Microsoft Excel For Data Analysis Analytics Vidhya

Microsoft Excel For Data Analysis Analytics Vidhya

Excel Analytics Tools Data Analysis Features In Excel Earn Excel

Amazon Microsoft Excel For Data Analysis How Excel Can Be Used

Excel Templates Data Analysis At Lillian Hecker Blog

How To Use Excel s Descriptive Statistics For Data Analysis

Show Tools In Excel At Christopher Stafford Blog