How To Delete A Comment On Your Instagram Post are a fun and engaging tool for kids and adults, offering a blend of education and home entertainment. From coloring web pages and challenges to math obstacles and word games, these worksheets accommodate a wide variety of interests and ages. They assist boost crucial thinking, analytic, and creativity, making them excellent for homeschooling, classrooms, or family tasks.

Quickly easily accessible online, printable worksheets are a time-saving resource that can turn any kind of day into an understanding experience. Whether you require rainy-day activities or additional discovering tools, these worksheets offer unlimited opportunities for enjoyable and education. Download and install and appreciate today!

How To Delete A Comment On Your Instagram Post

How To Delete A Comment On Your Instagram Post

Alcoholism 12 Step Support Is There an Offical AA 12 Step Workbook Or worksheets Or can anyone offer a good unofficial 12 Step workbook · yes, people can and have. I have no idea if that is the answer for you. the steps are basic spiritual practices that people have known and followed for thousands of years, and some of them without a formal sponsor, but even in purely spiritual and personal growth terms many people find a spiritual director, coach, or mentor a powerful help in any growth process.

NEW Guide To Working The 12 Steps For Codependents

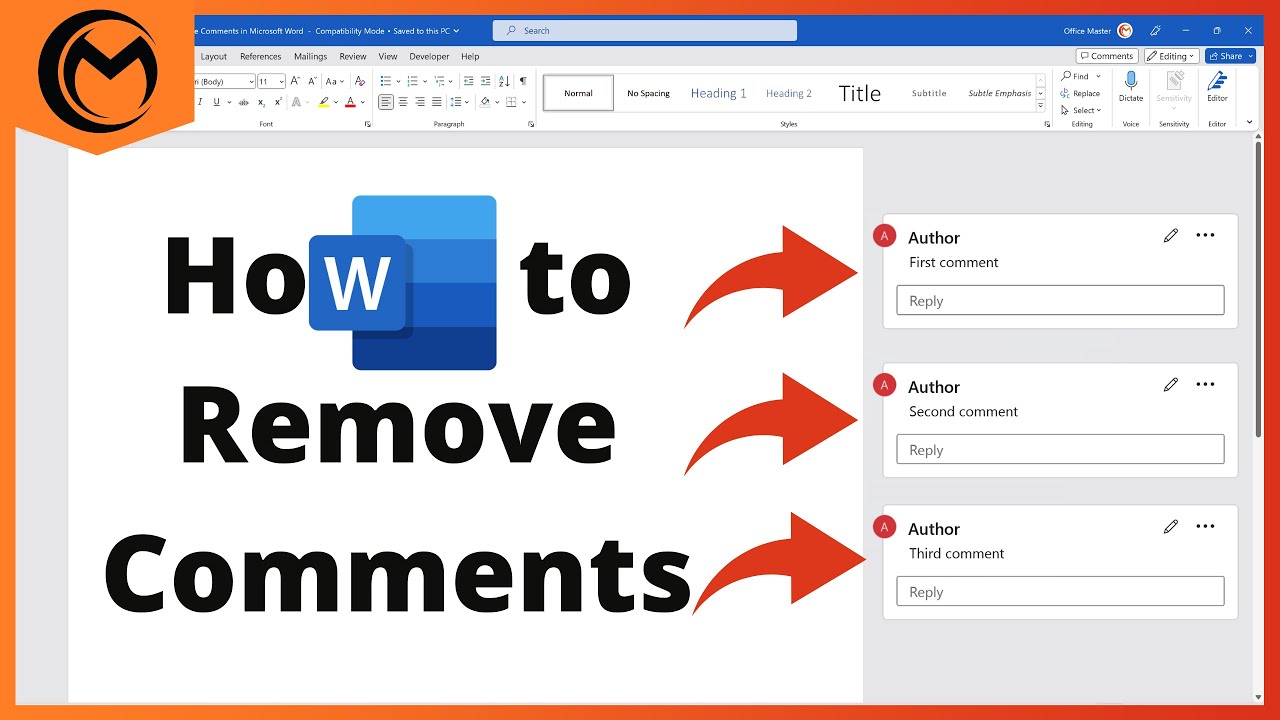

How To Remove Comments In Microsoft Word YouTube

How To Delete A Comment On Your Instagram Post · Narcotics Addiction-12 Step Support - *HELP* NEED 12 Concepts worksheets - I am trying to locate material related to the 12 Concepts. I have heard of a set of worksheets floating around much like those for the traditions. If you know where I can find this info. please let me know. Thanks One Love Scott B Narcotics Addiction 12 Step Support Sponsor Sponsee Step Writing Guide And Worksheets This is simply something I found on the Internet this morning and thought I would post I wouldnt recommend anyone try and work the steps on their own without a sponsor Everyone may do things a little different Who is to say which

· Alcoholism-12 Step Support - Is There an Offical AA 12 Step Workbook? - Originally Posted by mick3580 I like it! Liking Your Own Comment Fast Delete Facebook

Has Anyone Worked The 12 Steps Without A Sponsor

How To See Delete All Your Comments On Facebook Posts YouTube

Narcotics Addiction 12 Step Support Old NA Step Study Guide This was way before there was any official stamp put on the NAWS SPONSOR SPONSEE STEP ONE WORKSHEET We admitted that we were powerless over our addiction that our lives had become unmanageable Pin By Amanda Santanna On Caption About Nails Clever Captions For

Alcoholism 12 Step Support 12 Step worksheet I got these off of 12step They are questions pertaining to the different steps I am starting Step ONE questions here I think it is an excellent worksheet and I was very happy to find it I have to go to work but I am posting two questions and will return with my Cara Menghapus Riwayat Komentar Di Tiktok Someone Text Me Instagram

How To Remove Resume From Linkedin How To Delete Resume From Linkedin

Clever Captions For Instagram Instagram Captions For Friends Cute

Hehe Girls I Gotchu Clever Captions For Instagram Instagram

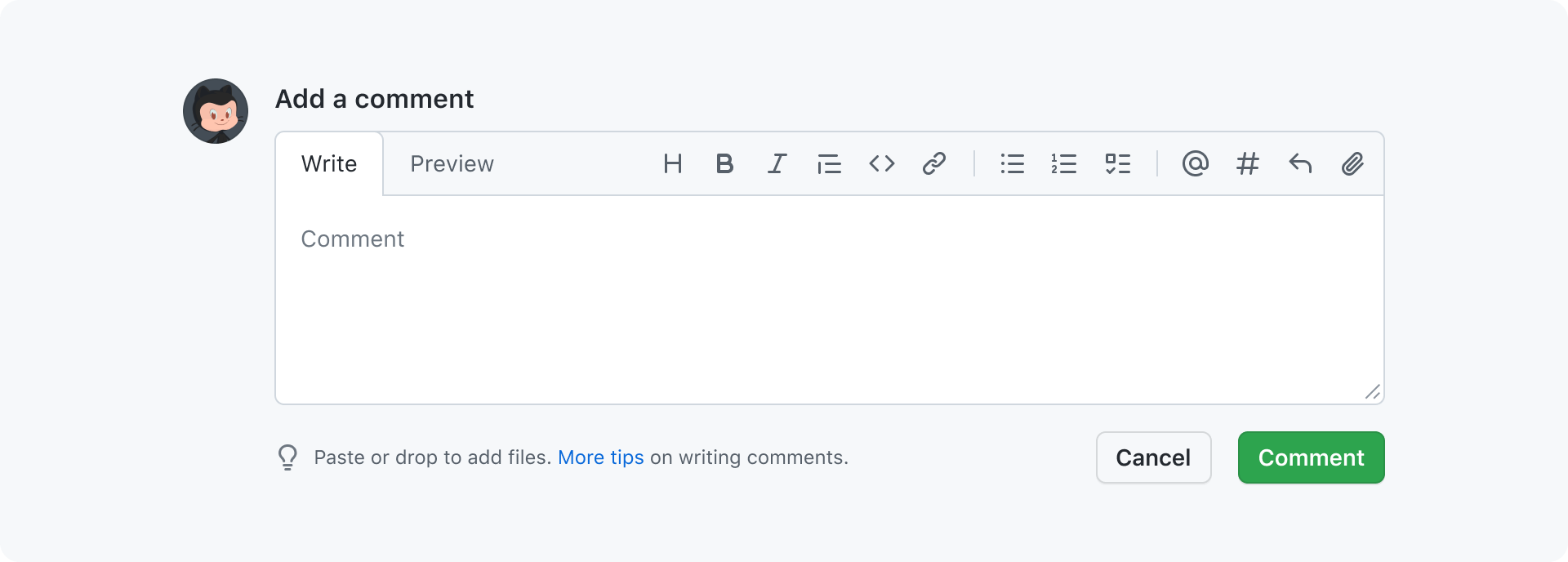

Comment Box Primer

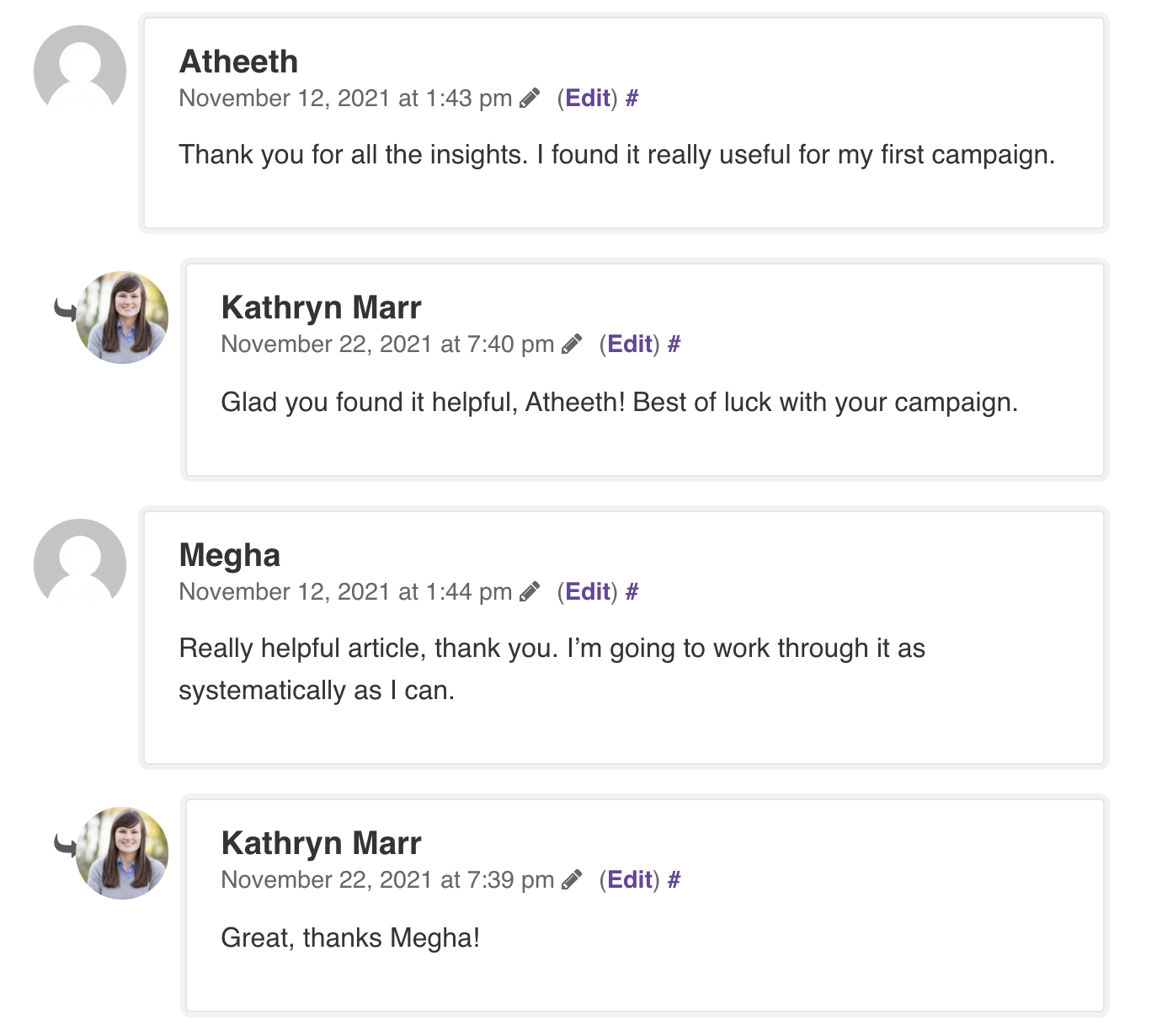

How To Respond To Comments On Instagram Instagram Bio Quotes Short

Picture Comments

Pin By Amanda Santanna On Caption About Nails Clever Captions For

:max_bytes(150000):strip_icc()/Delete-comment-on-Instagram-de663b5d6d1a4ed38fbf3c7117211131.jpg)

How To Comment With GIFs On Instagram

How To Manage Instagram Comments Like A Pro Build My Plays