How To Create A Personal Finance Plan For The New Year are an enjoyable and interesting device for youngsters and grownups, providing a mix of education and enjoyment. From tinting web pages and challenges to mathematics obstacles and word video games, these worksheets cater to a vast array of interests and ages. They assist enhance essential reasoning, analytical, and creativity, making them perfect for homeschooling, classrooms, or family members activities.

Easily available online, printable worksheets are a time-saving resource that can transform any day right into a learning journey. Whether you require rainy-day tasks or supplementary discovering devices, these worksheets supply unlimited possibilities for enjoyable and education. Download and install and take pleasure in today!

How To Create A Personal Finance Plan For The New Year

How To Create A Personal Finance Plan For The New Year

This pack of needs and wants activities has everything you need to teach your students about needs vs wants as part of your social studies curriculum Fee and fun preschool activities on social studies, needs and wants.

16 Kindergarten social studies needs and wants ideas Pinterest

Artreach

How To Create A Personal Finance Plan For The New YearDo you little or big learners have a little trouble distinguishing between needs and wants? That's why I created this Wants vs Needs Learning Pack! Grab our printable compilation of needs and wants worksheets featuring charts and exercises to identify needs and wants and differentiate between the two

Discover the difference between wants and needs with our free social studies worksheet, offering kids a hands-on cut-and-paste sorting ... 43 Love Letter To Her ZainMarlon Personal Finance Flowchart Reddit 2025 Fran Paloma

What are wants What are needs Fun Preschool activity sheets

Student Finance Study In The UK With UNI Britannica

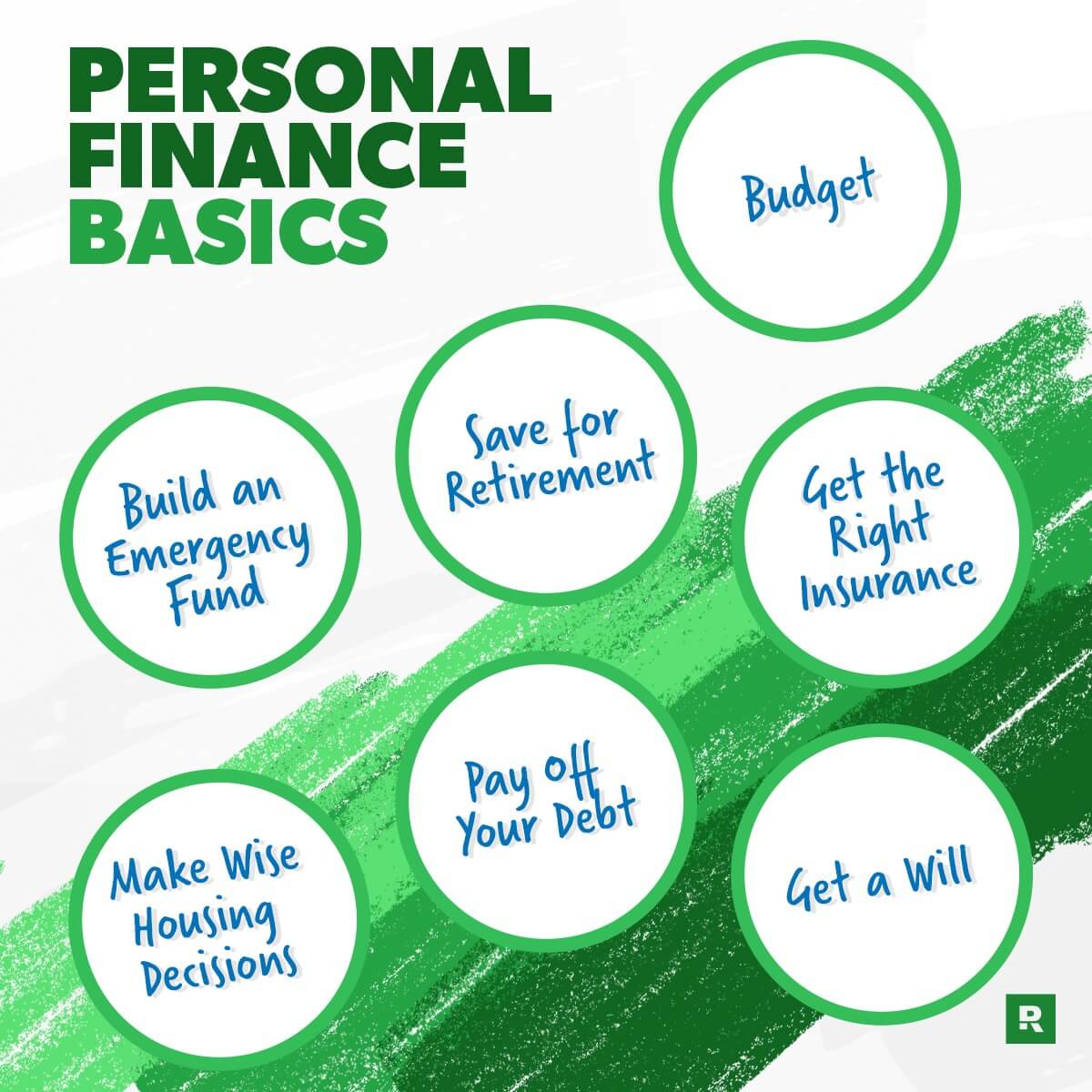

Kids can practice identifying needs and wants by sorting pictures and words in this free social studies worksheet It is an easy cut and paste activity Personal Financial Planning

Kids can practice identifying needs and wants by sorting pictures and words in this free social studies worksheet It is an easy cut and paste activity Financial Plan Excel Template How To Create A Real Estate Agent Profile That Generates Leads

Oakcase8 MurakamiLab

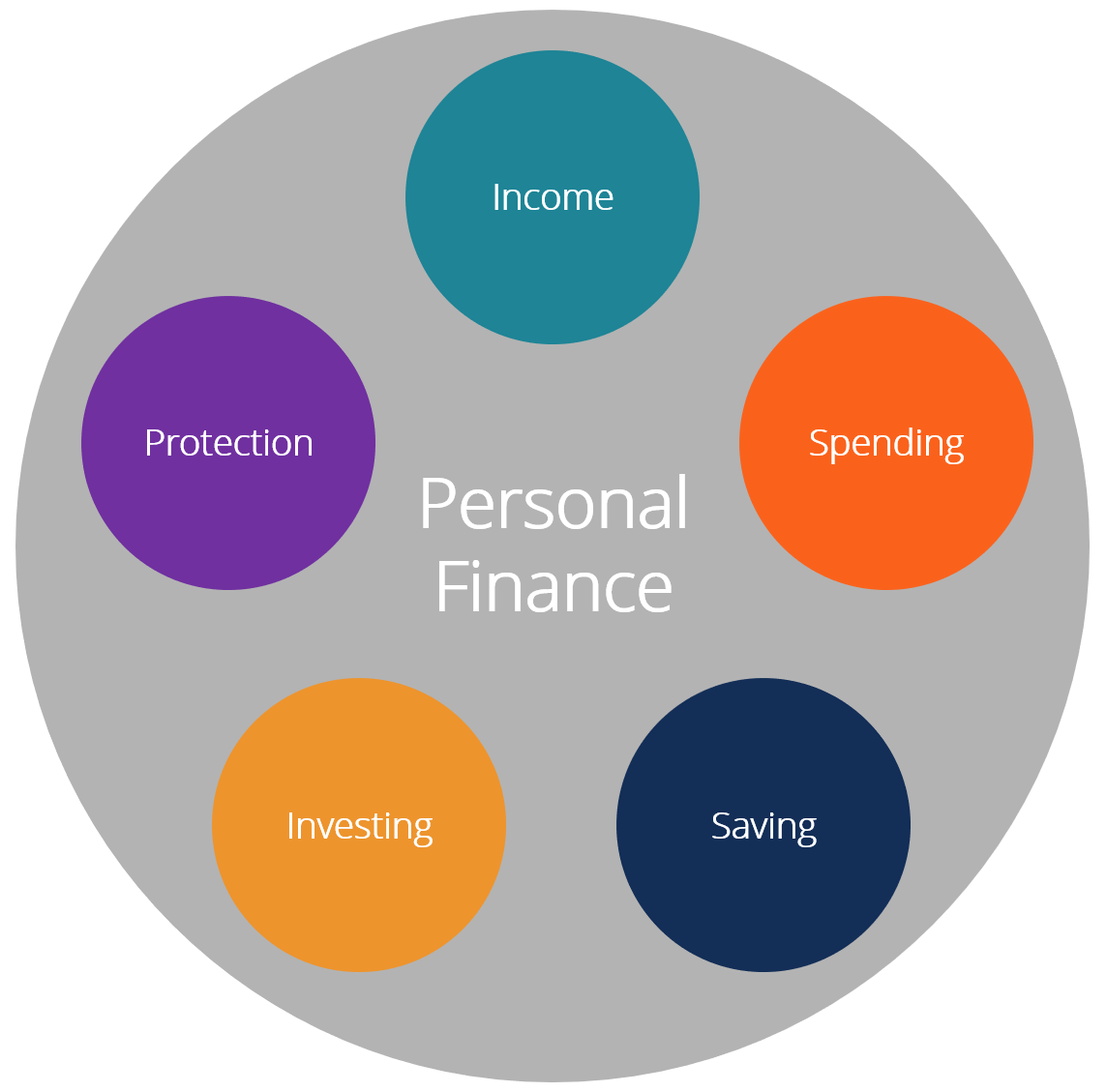

Personal Finance

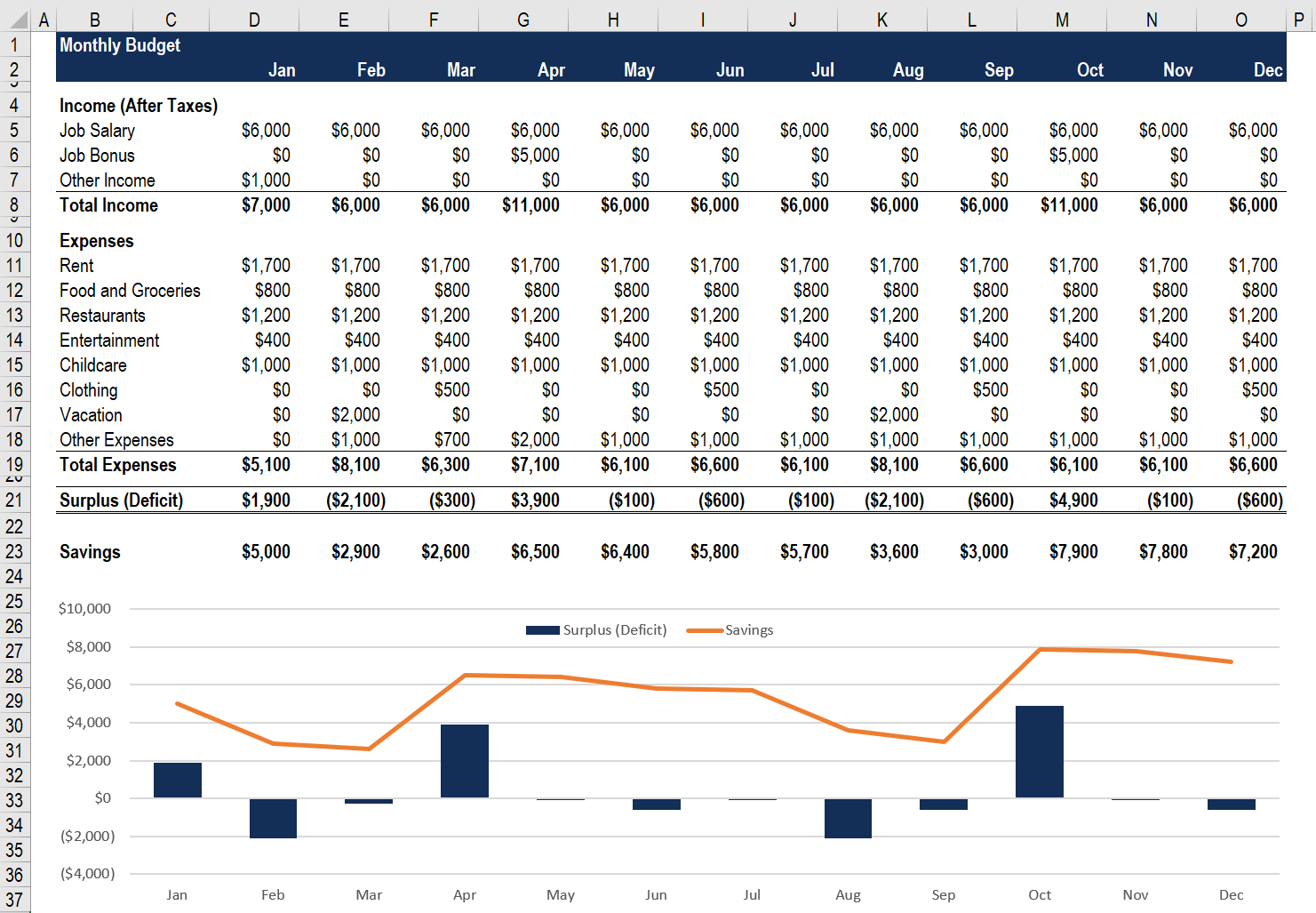

2025 Budget Planner Excel Dennis Williams

Personal AI Your Ultimate Personalized Digital Assistant

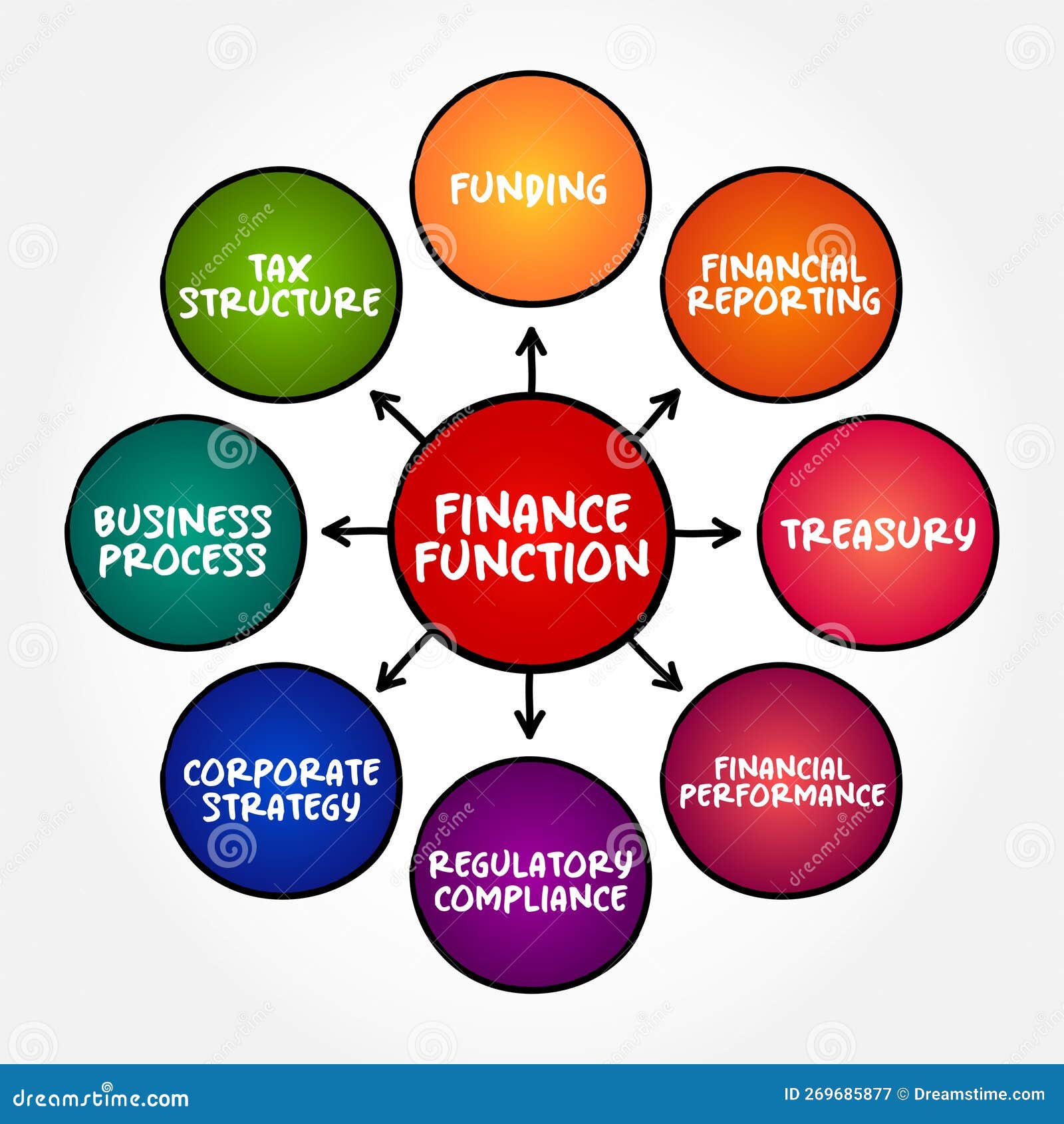

Personal Finance Software

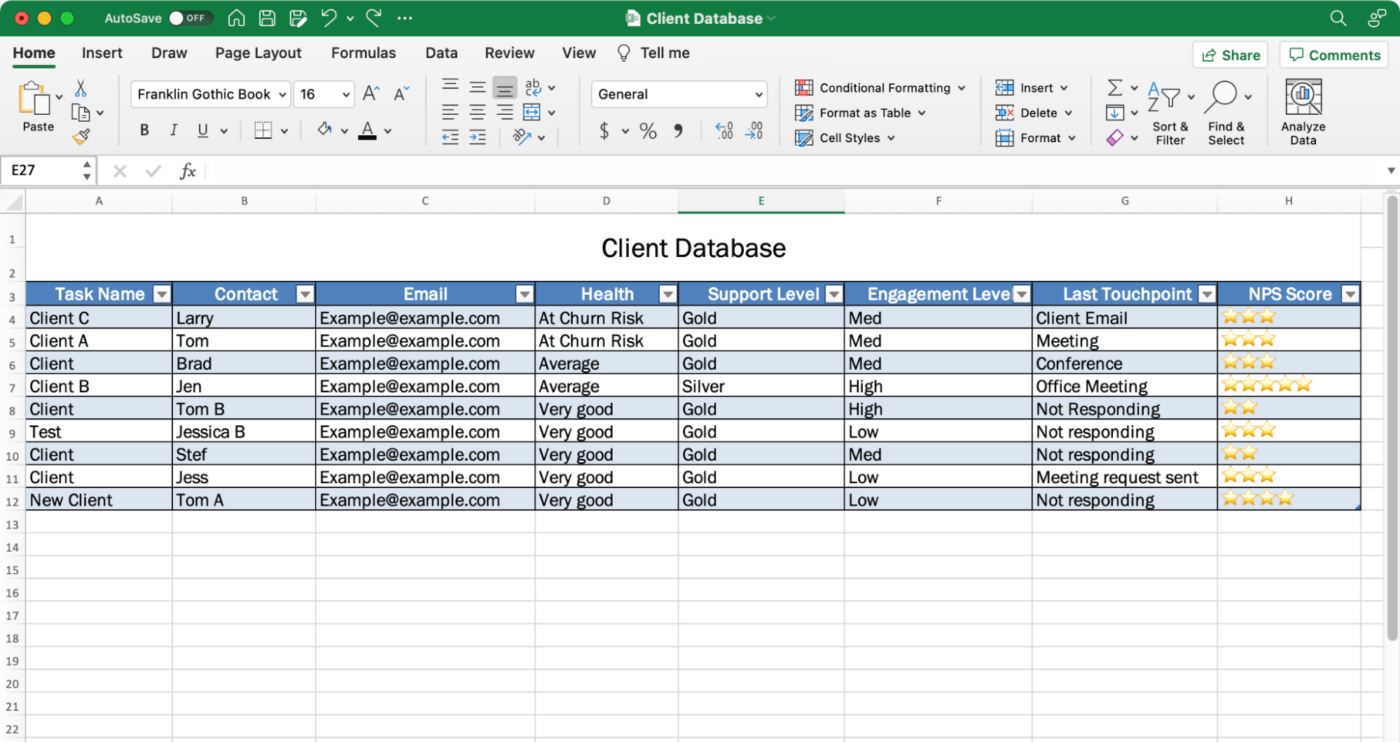

Database Design Excel Template Www designinte

Excel Template Personal Budget

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)

Personal Financial Planning

![]()

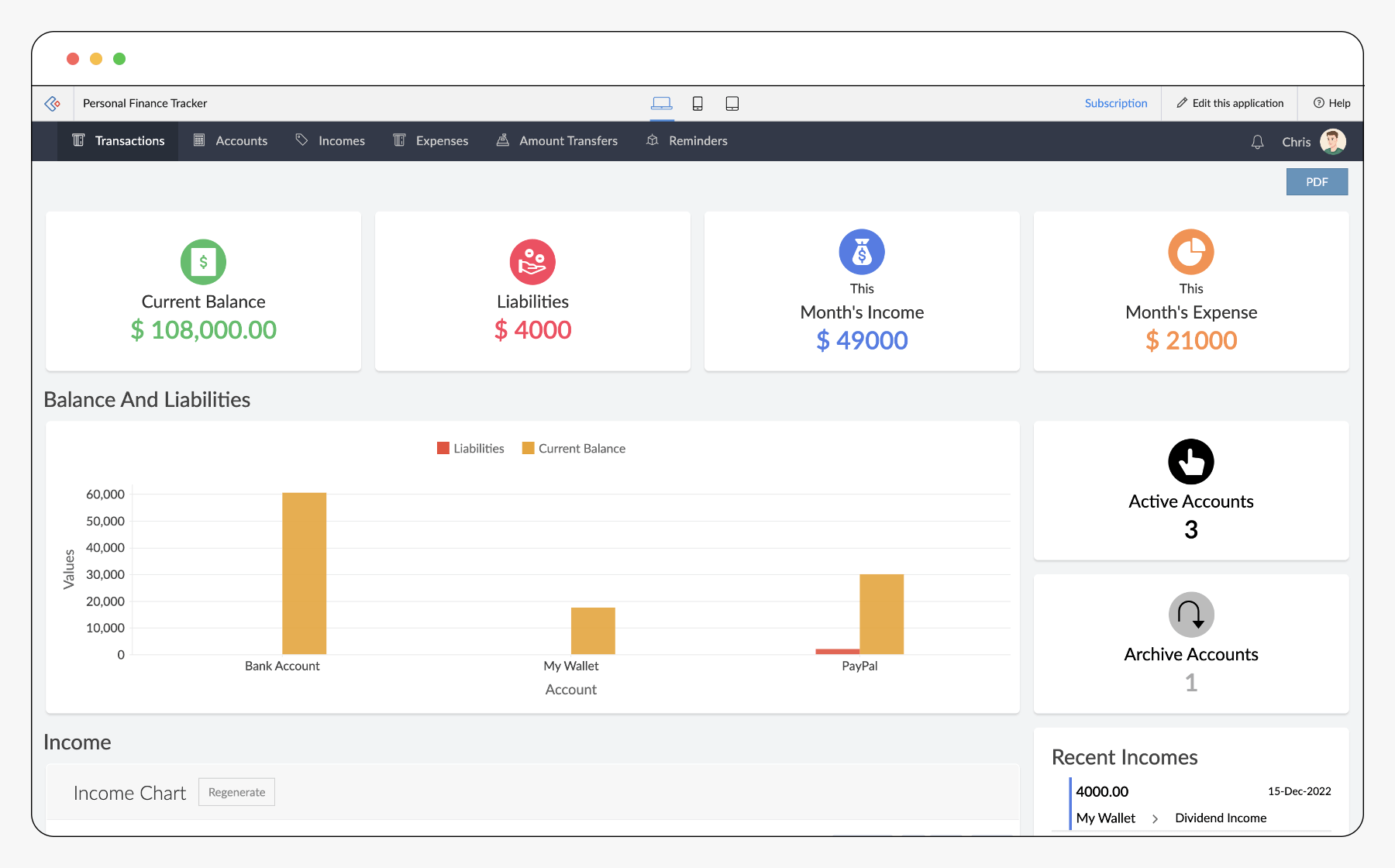

Personal Finance Tracker Dashboard Advanced Excel Tool Other Levels

Home Finance Excel Template