How To Complete A Worksheet In Accounting are a fun and engaging tool for kids and grownups, offering a blend of education and amusement. From coloring web pages and puzzles to mathematics challenges and word video games, these worksheets accommodate a wide range of passions and ages. They help enhance important thinking, problem-solving, and creative thinking, making them optimal for homeschooling, classrooms, or family activities.

Quickly easily accessible online, printable worksheets are a time-saving source that can transform any day right into a discovering journey. Whether you require rainy-day activities or additional understanding tools, these worksheets supply endless possibilities for fun and education. Download and delight in today!

How To Complete A Worksheet In Accounting

How To Complete A Worksheet In Accounting

In this lesson you are going to construct multiple objects in a two point perspective Follow the instructions for the worksheet for the first object Follow this step-by-step tutorial to see how a building can be drawn in two point perspective and attempt to copy this in your notebook.

2 point perspective worksheets TPT

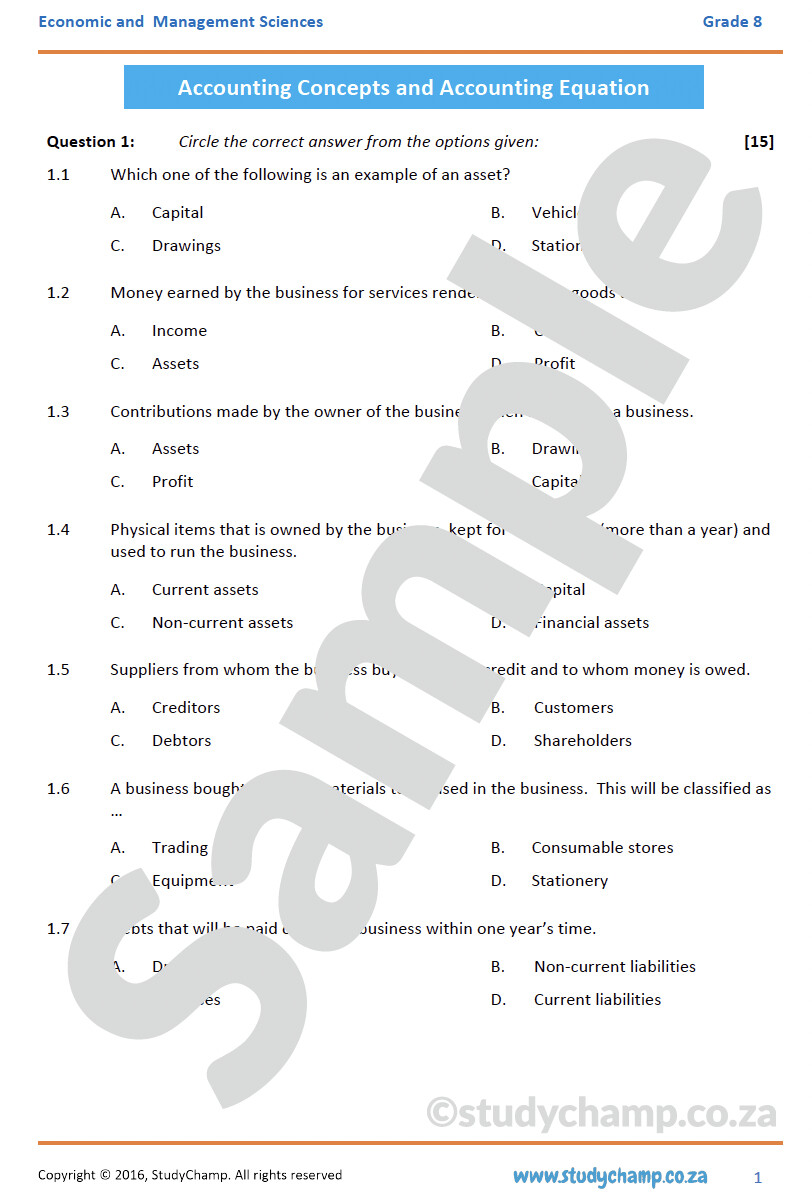

Grade 8 EMS Test Accounting Concepts And Accounting Equation

How To Complete A Worksheet In AccountingStep-by-step instructions and a drawing space for learning two-point perspective drawing techniques: a room. Step by step instructions and a drawing space for learning two point perspective drawing techniques basic boxes

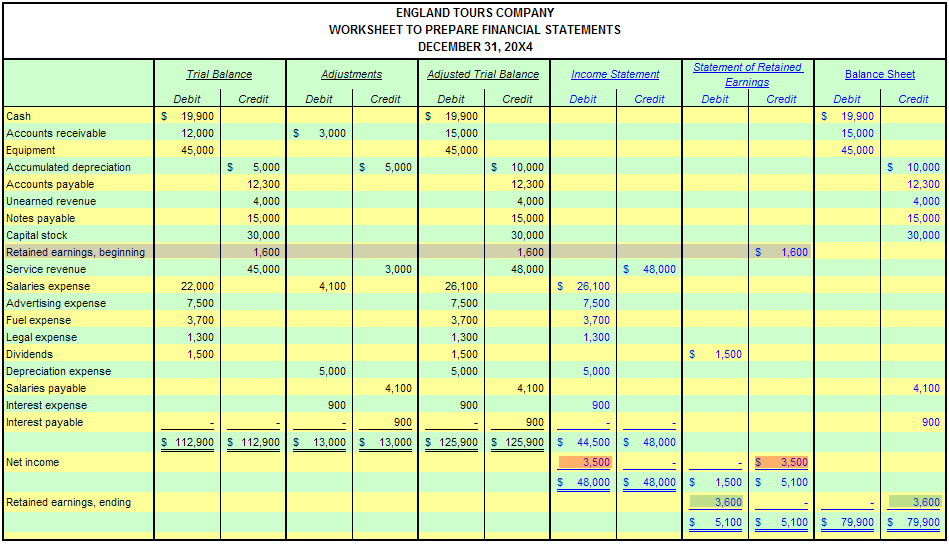

This is a worksheet that shows students how to draw buildings in two-point perspective. Accounting Worksheet Template Double Entry Bookkeeping 49 Finished Accounting Worksheet Isikylamasloka

Two Point Perspective

Accounting Worksheet

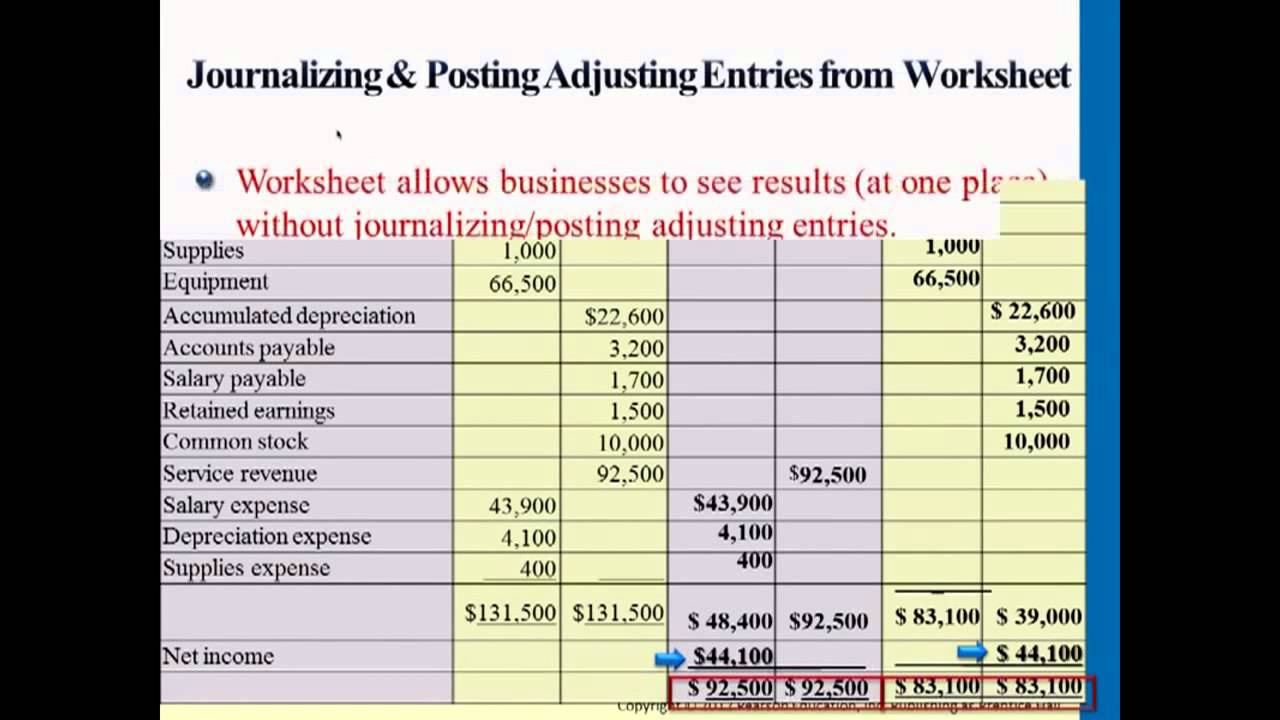

The document provides instructions for completing a two point perspective drawing in 9 steps It includes blank spaces to fill in each step 41 FREE WORKSHEET OF ACCOUNTING PDF PRINTABLE DOCX DOWNLOAD ZIP

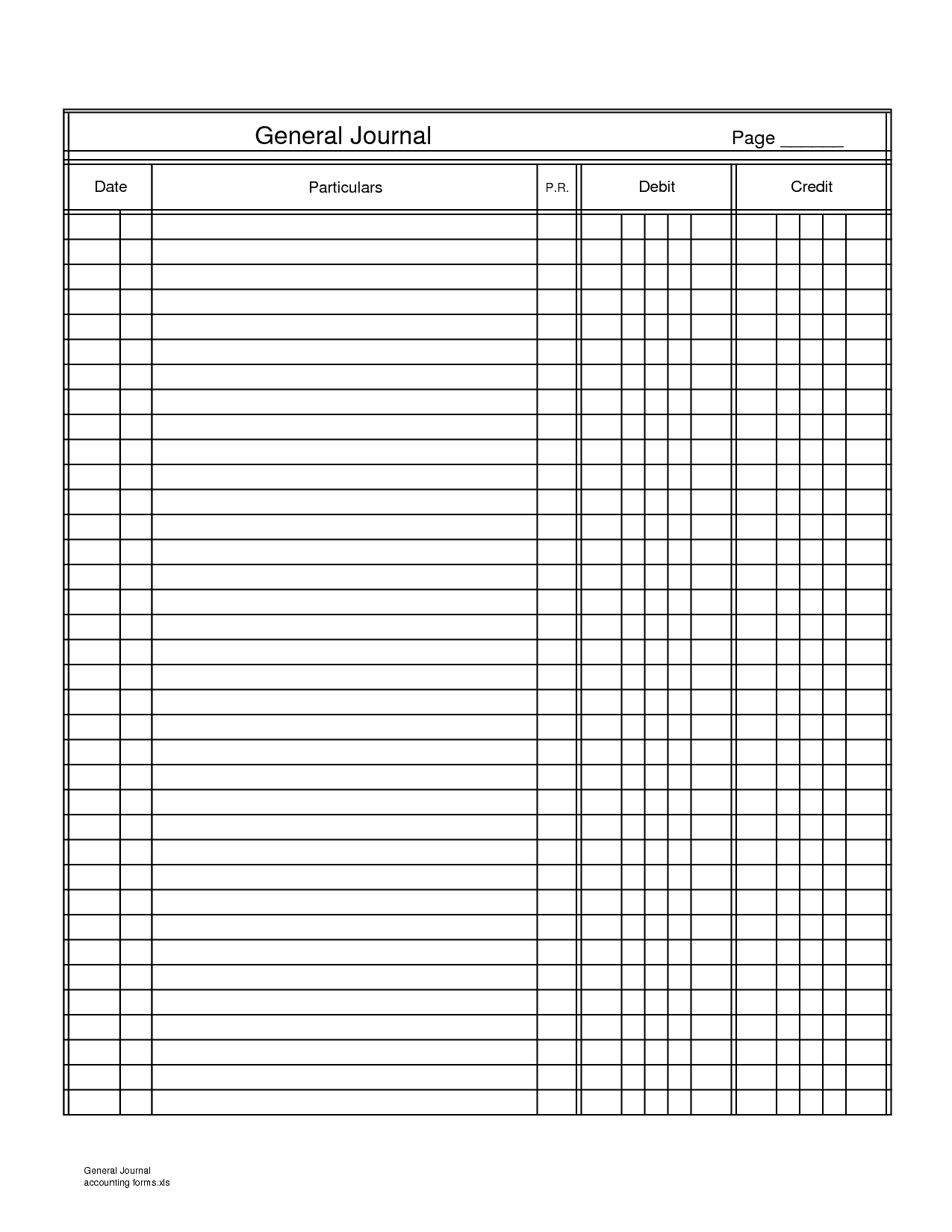

Step 1 Draw a horizon line Step 2 Draw a vanishing point Step 3 Draw a square or rectangle Step 4 Draw orthogonals from the corners to the vanishing Free Printable Bookkeeping Sheets General Ledger Free Office Form Accounting Worksheet Accountancy Knowledge

Free Printable Bookkeeping Worksheets

What Is An Accounting Worksheet

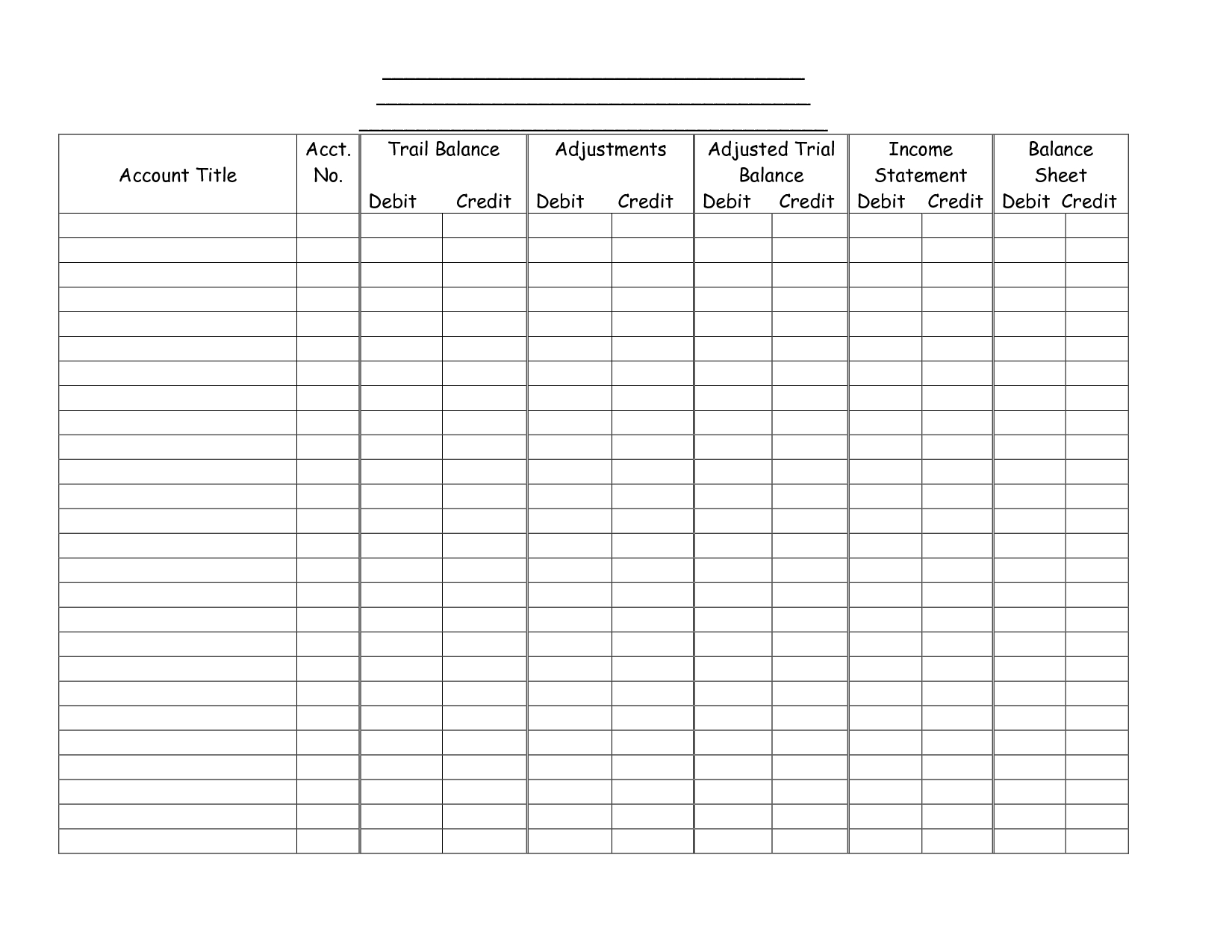

Blank Accounting Worksheet Template 1 Down Town Ken More Throughout

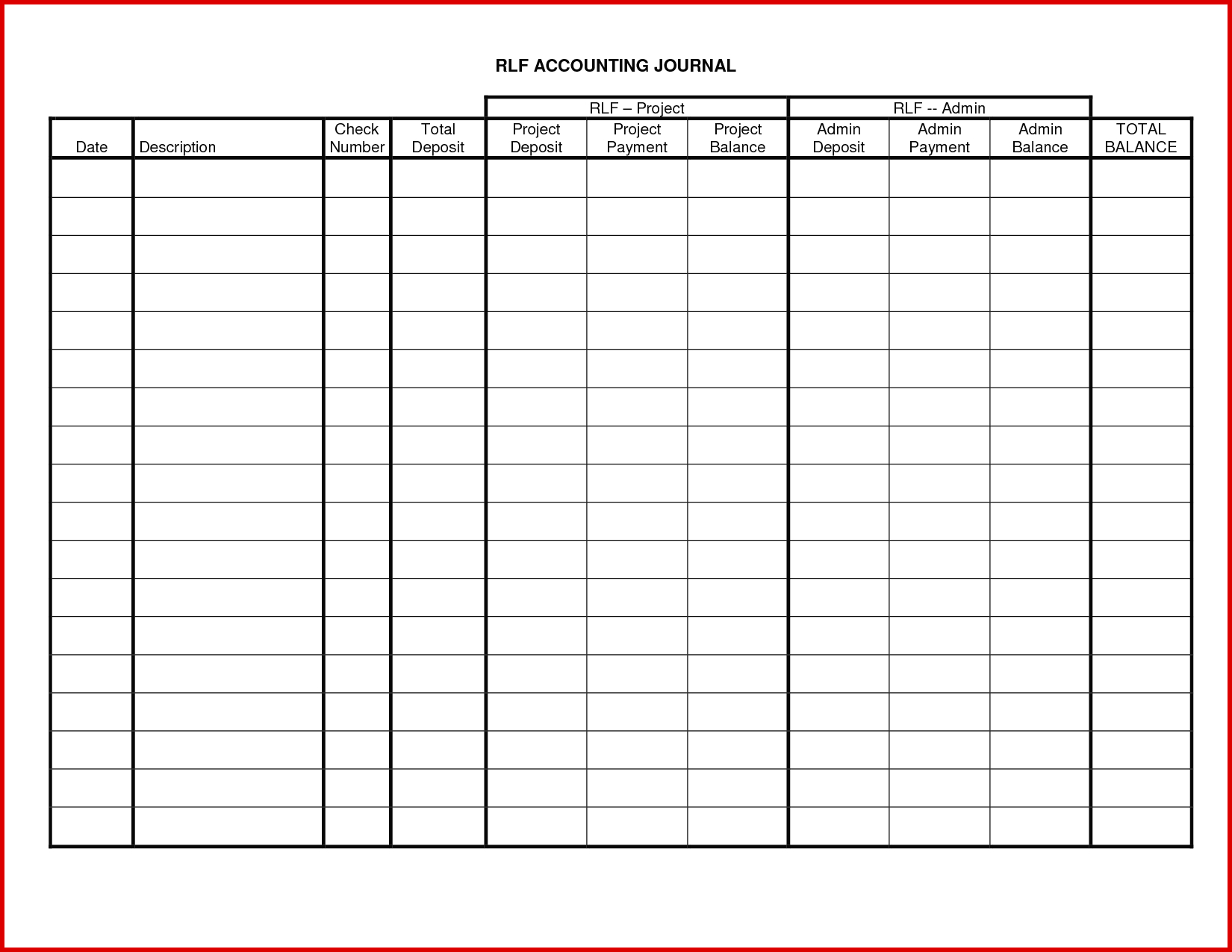

Accounting Journal Template Accounting Spreadshee Accounting General

Free Business Accounting Worksheets Excelxo

FREE 9 Sample Accounting Worksheet Templates In PDF MS Word Excel

Accounting Worksheet Accounting Spreadsheet Accounting Spreadsheet

41 FREE WORKSHEET OF ACCOUNTING PDF PRINTABLE DOCX DOWNLOAD ZIP

Accounting Worksheet Accountancy Knowledge

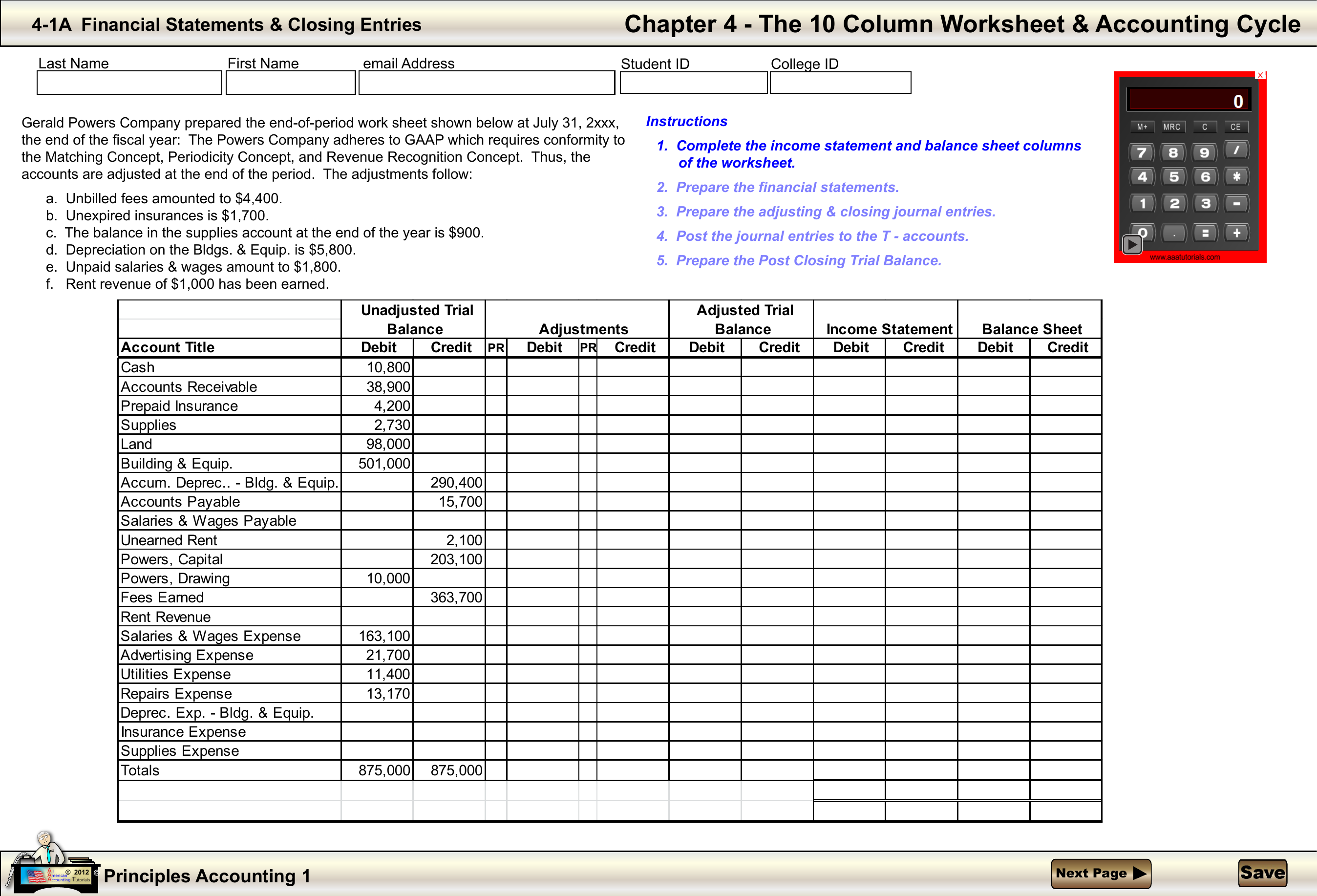

Chapter 4 The 10 Column Worksheet Accounting Cycle