How To Calculate Percentage Increase In Excel Shortcut are an enjoyable and engaging device for children and grownups, using a blend of education and enjoyment. From coloring pages and problems to math challenges and word games, these worksheets accommodate a variety of rate of interests and ages. They aid enhance essential thinking, analytic, and imagination, making them suitable for homeschooling, class, or household activities.

Conveniently easily accessible online, worksheets are a time-saving resource that can turn any type of day into a learning adventure. Whether you need rainy-day activities or extra understanding tools, these worksheets offer endless possibilities for fun and education and learning. Download and install and delight in today!

How To Calculate Percentage Increase In Excel Shortcut

How To Calculate Percentage Increase In Excel Shortcut

Welcome to The Horizontally Arranged Dividing by 3 with Quotients 1 to 9 100 Questions A Math Worksheet from the Division Worksheets Grab our free printable division worksheets offering basic division, long division, divisibility rules, division word problems and more.

Printable Division Worksheets for Teachers Math Aids Com

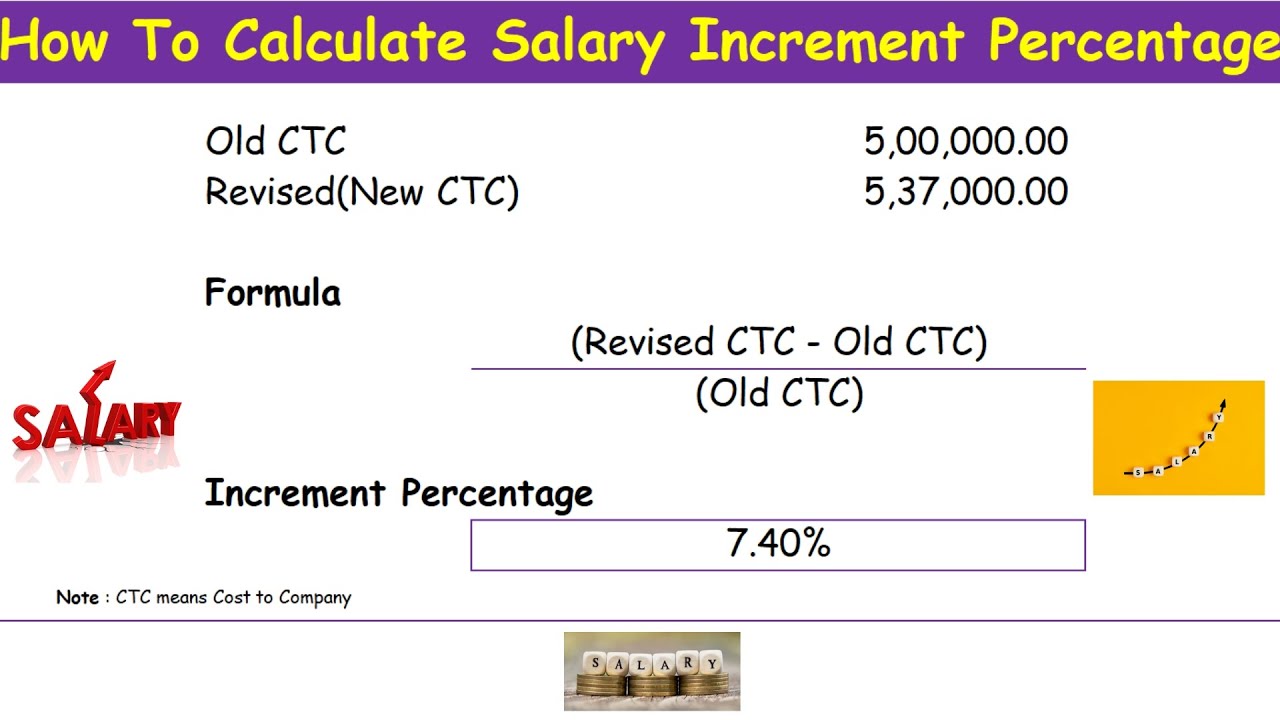

Salary Increment Percentage Calculation In Excel Salary Hike

How To Calculate Percentage Increase In Excel ShortcutWelcome to The Horizontally Arranged Dividing by 3 with Quotients 1 to 12 (100 Questions) (A) Math Worksheet from the Division Worksheets ... Division worksheets for grades 3 6 Start with simple division facts e g 10 2 5 and progress to long division with muti digit divisors

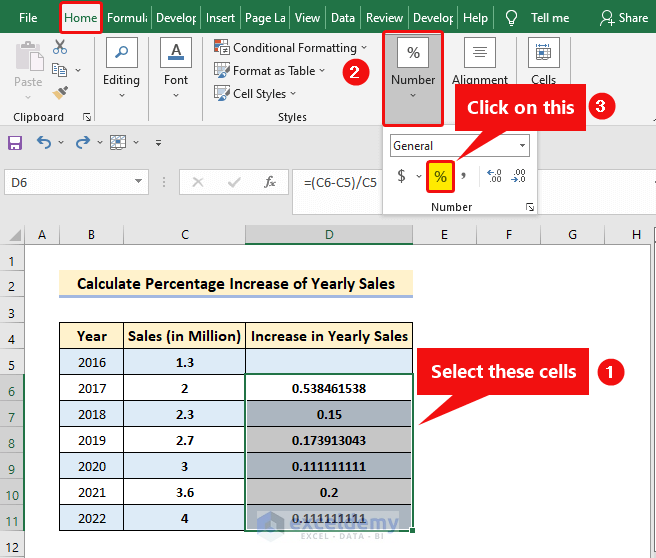

This third grade math resource includes printable and digital math worksheets that give your third graders practice using division strategies to solve problems ... Increase Percentage Formula Excel MIT Printable Increase Percentage Formula Excel MIT Printable

Division Worksheets Free and Printable Math Worksheets 4 Kids

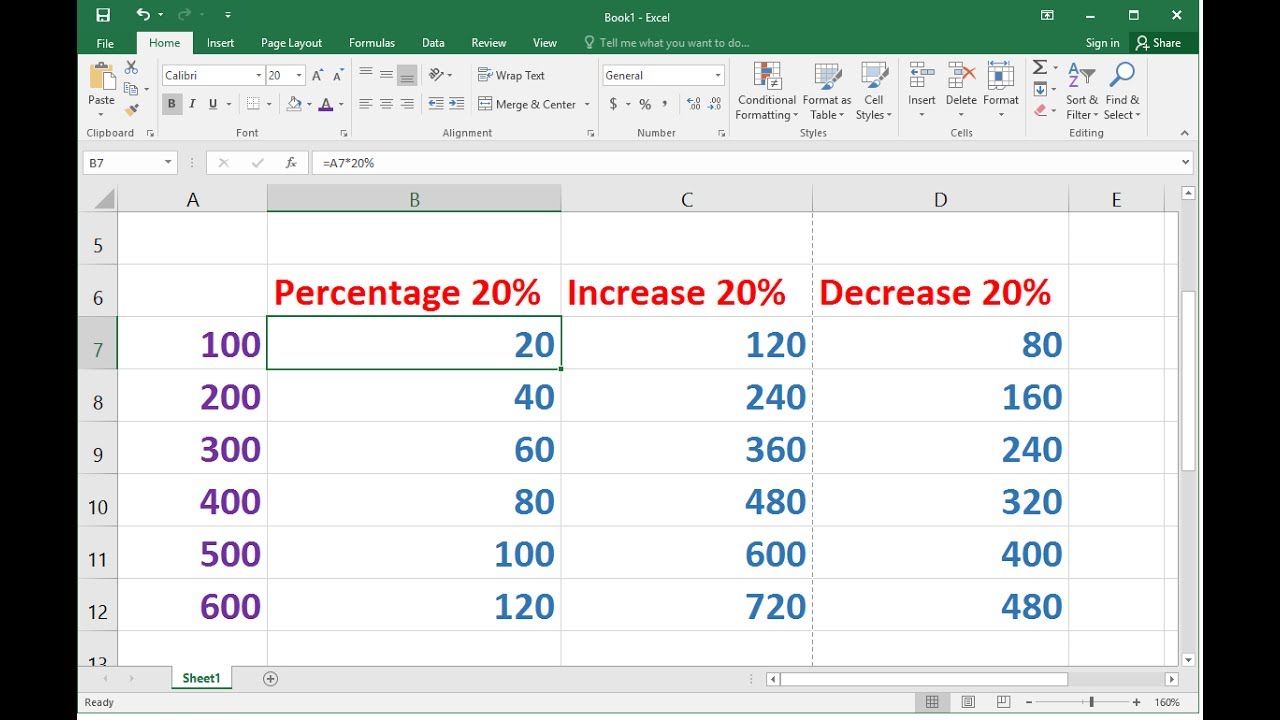

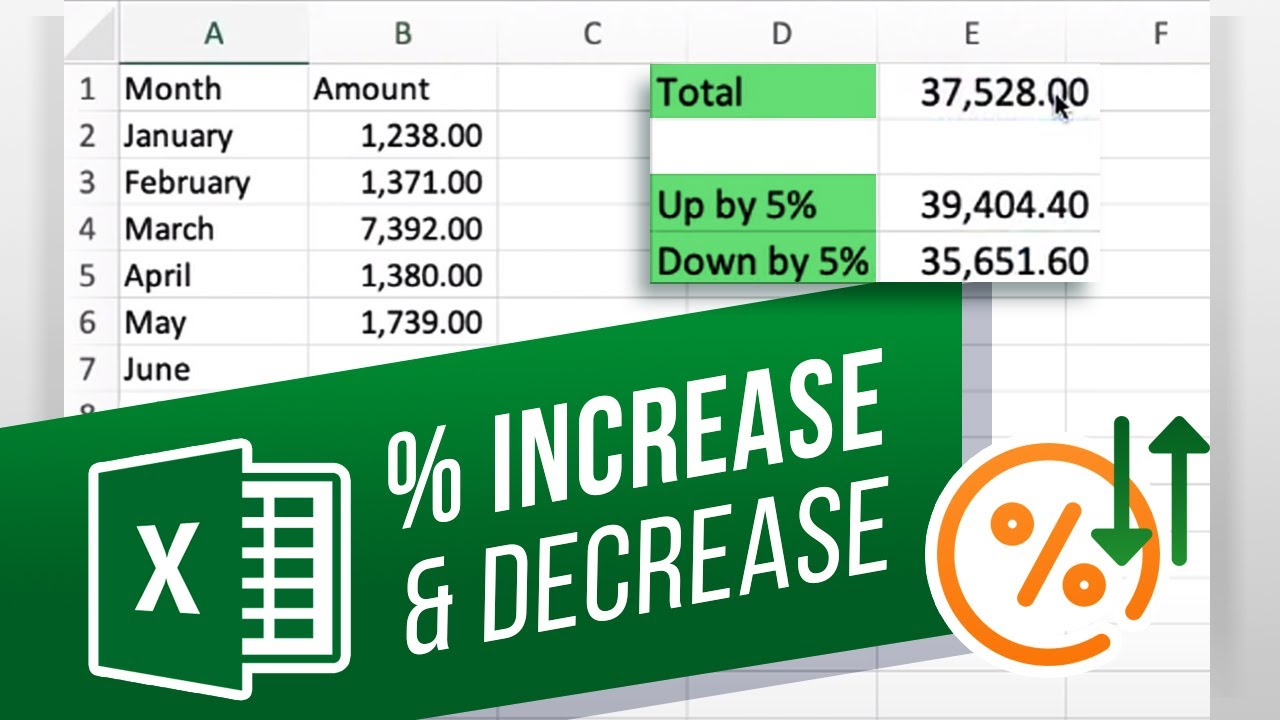

How To Calculate PERCENTAGE INCREASE And DECREASE In Excel YouTube

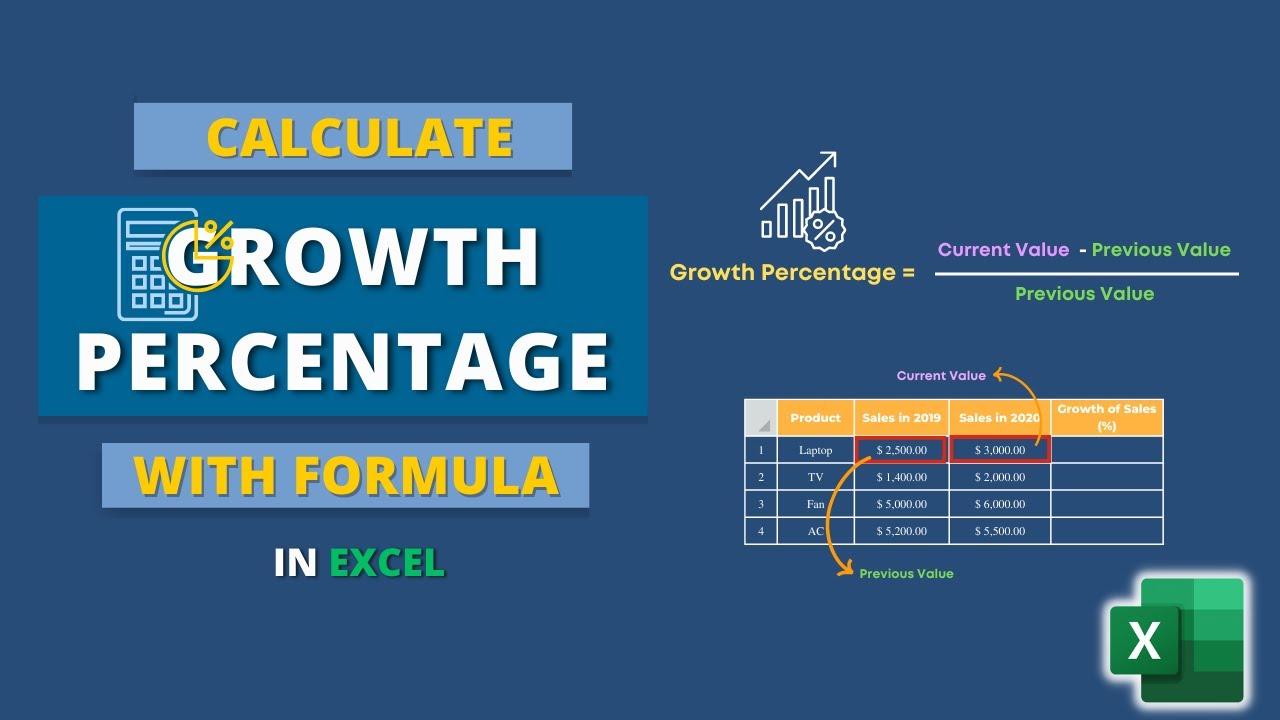

Third grade division worksheets get your child to divide and conquer Try these third grade division worksheets with your math savvy third grader Calculate Growth Percentage In Excel

An unlimited supply of worksheets to practice basic division facts grades 3 4 The worksheets can be made in html or PDF format both are easy to print How To Calculate Percentage Increase In Excel Sheetaki How To Calculate Percentage Increase Or Decrease In Excel

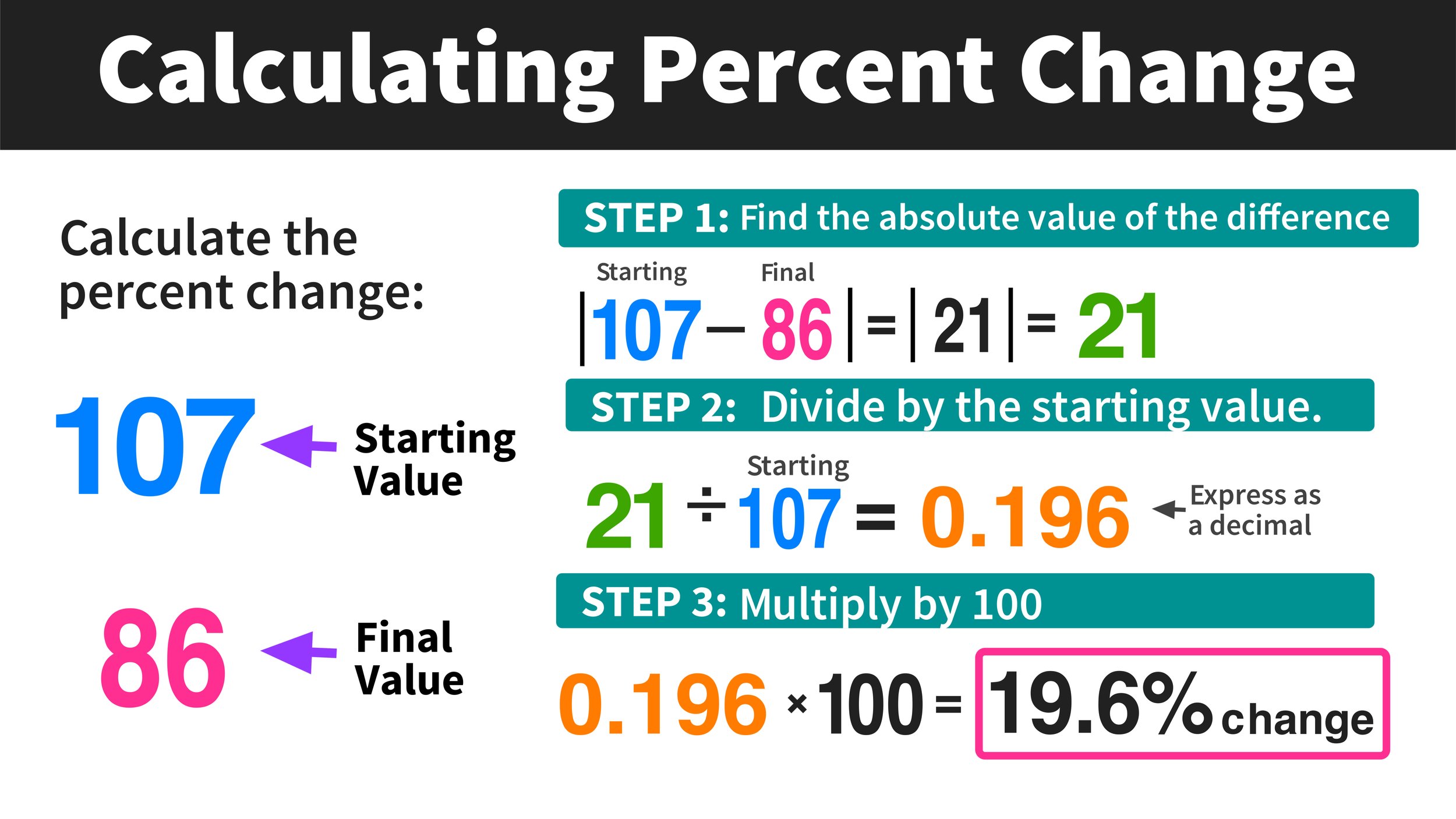

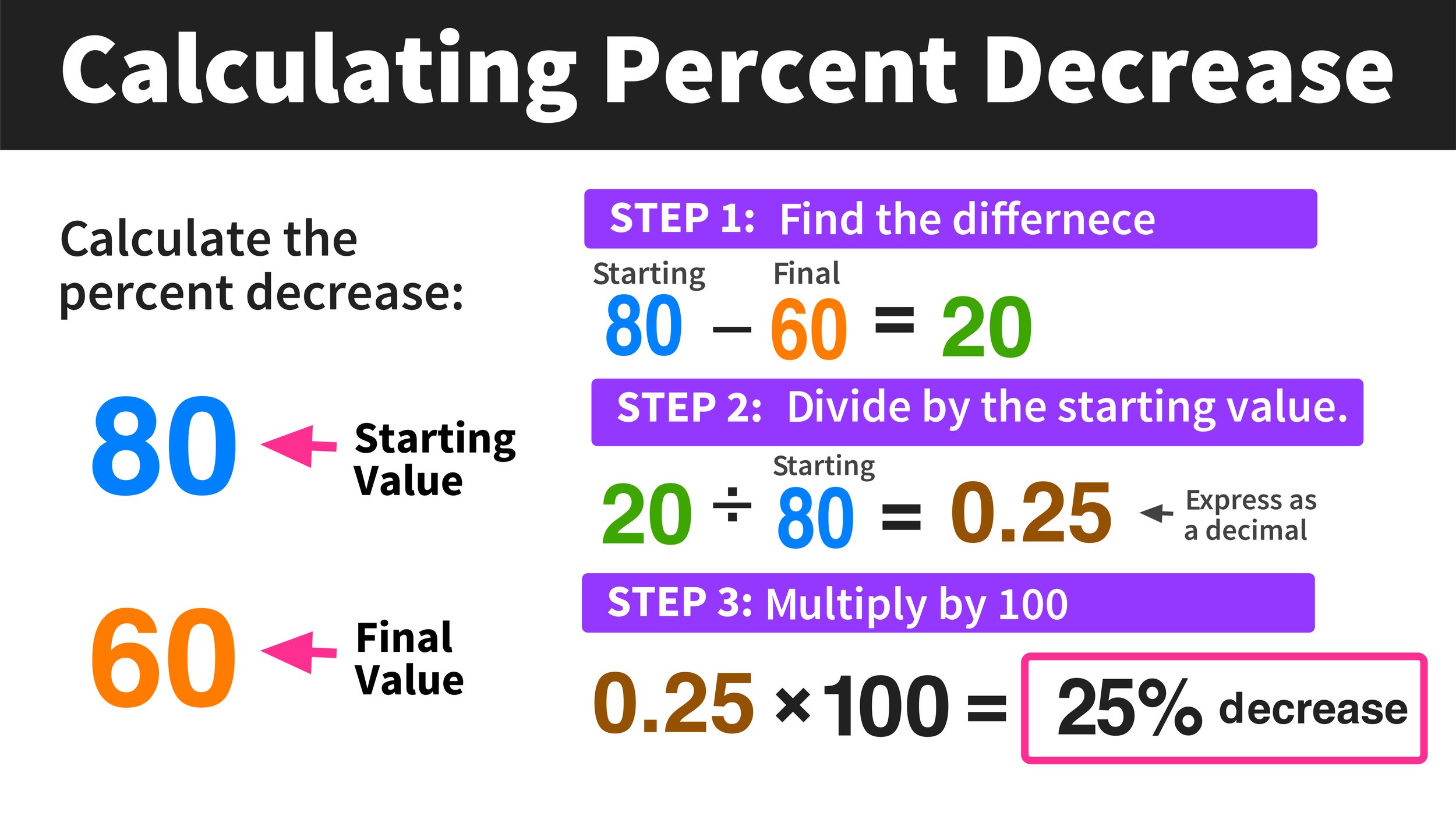

Calculating Percent Change In Easy Steps Mashup Math 46 OFF

Calculate

Miserable Telegrama Delegaci n Compute Increase Percentage Triturado

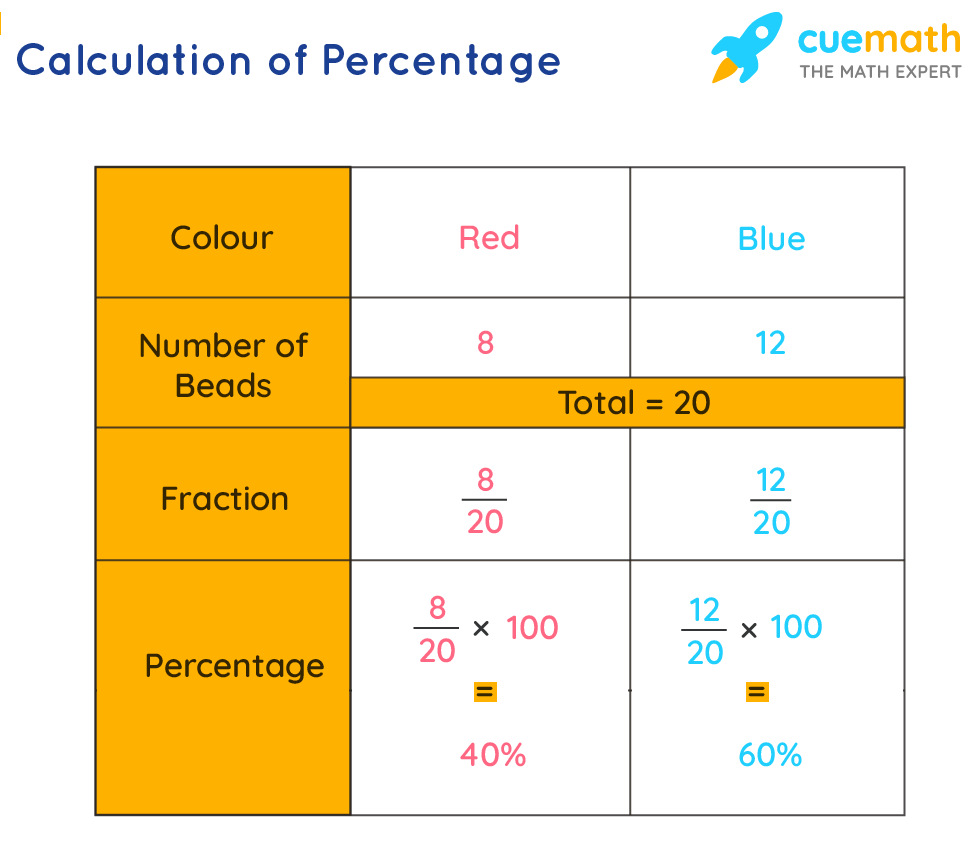

How To Get Percentage Store Cityofclovis

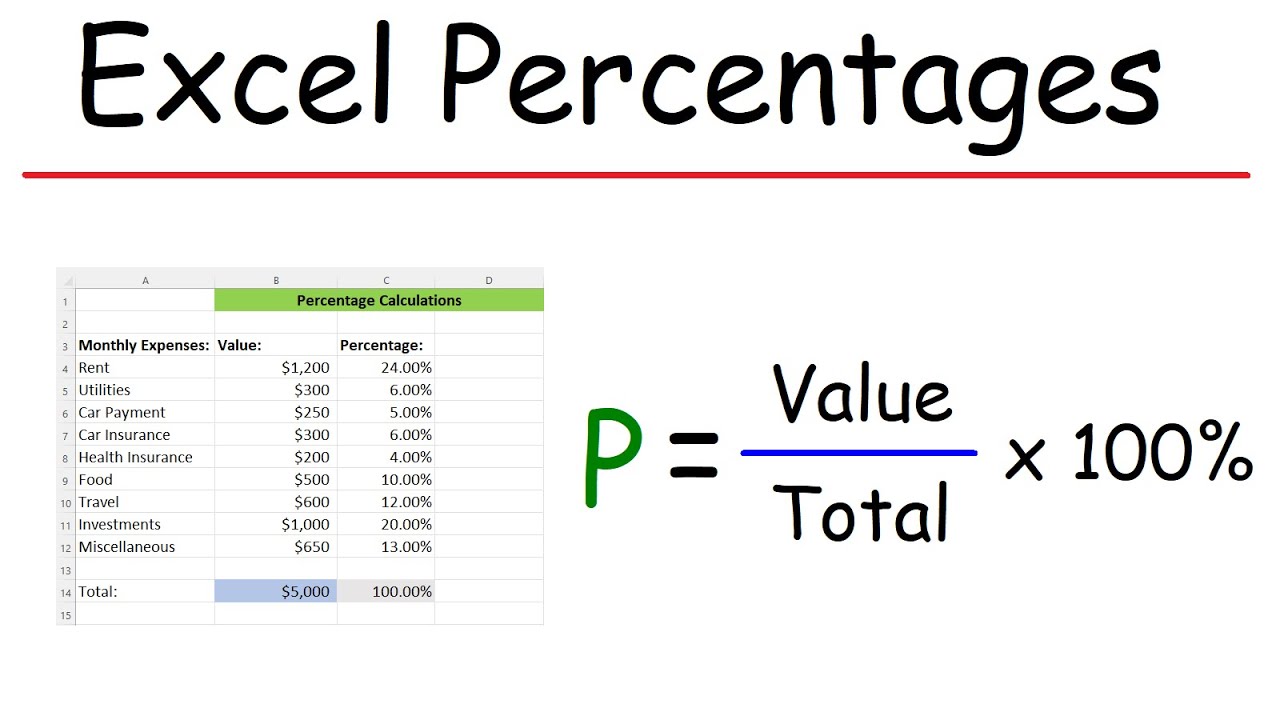

Calculating Percentages

Increase Decrease Calculator

Percentage Calculator Excel Template

Calculate Growth Percentage In Excel

How To Calculate Percentage Increase In Excel Examples With All Criteria

How To Calculate Percentage Increase Or Decrease In Excel Calculate