How To Calculate Monthly Run Rate In Excel are an enjoyable and appealing tool for children and adults, providing a mix of education and home entertainment. From tinting pages and problems to mathematics challenges and word games, these worksheets cater to a large range of rate of interests and ages. They help improve important thinking, problem-solving, and creativity, making them optimal for homeschooling, classrooms, or family members activities.

Easily accessible online, worksheets are a time-saving source that can turn any type of day into a knowing adventure. Whether you need rainy-day activities or extra understanding tools, these worksheets supply countless opportunities for fun and education. Download and install and take pleasure in today!

How To Calculate Monthly Run Rate In Excel

How To Calculate Monthly Run Rate In Excel

0 125 as a fraction is equal to 1 8 Explanation Let us first convert the decimal into a fractional form 0 125 125 1000 This Percent Worksheet is great for practicing converting between percents, decimals, and fractions. You may select six different types of percentage ...

What is 125 as a Fraction GeeksforGeeks

How To Calculate Required Run Rate In Cricket Simple Method YouTube

How To Calculate Monthly Run Rate In ExcelHello My Dear Family..!! I Hope You All Are Well And Enjoying The Learning With Me..!! If You Find This Video Useful. So 125 as a fraction is 5 4 You can also verify by using a percent to fraction calculator

Worksheet by Kuta Software LLC. 11). 1. 111. 12). 1. 125. Write each as a fraction. 13) 2.2. 14) 1.6. 15) 0.08. 16) 0.27. 17) 1.76. 18) 0.15. 19) 0.3. 20) 0.09. Excel Interest Formula MIT Printable Carta s Pitch Decks Through The Years

Converting Between Percents Decimals and Fractions Worksheets

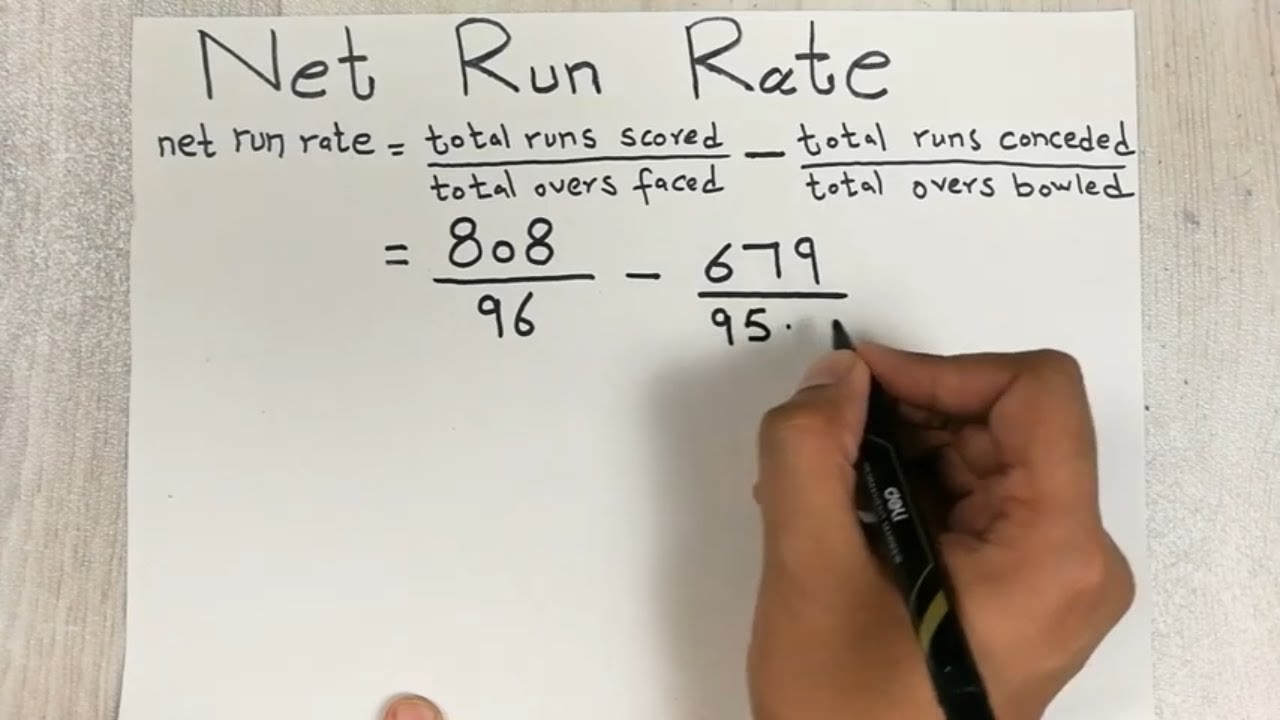

How To Calculate Net Run Rate Cricket Formula YouTube

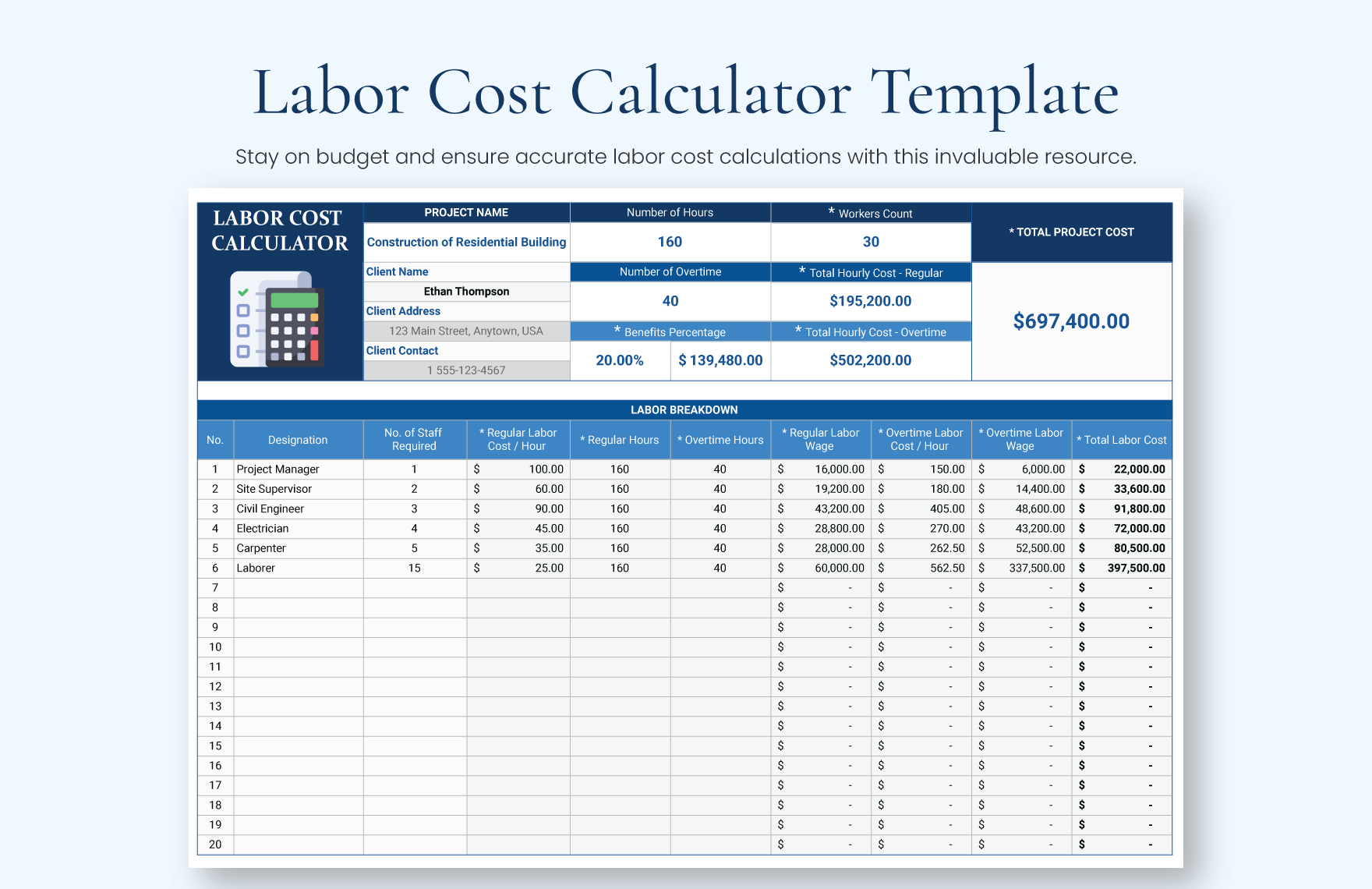

A unit fraction is a fraction in which the numerator is 1 You should learn 125 is one hundred twenty five thousandths Page 20 Re write each Labor Cost Calculator Template Download In Excel Google Sheets

125 as a fraction is 1 8 Explanation You move the decimal to the right three times to get 125 Then you put it over 100 125 100 Then you can reduce that How To Calculate Monthly Compound Interest In Excel Ddr Meaning

How To Calculate Dynamic DRR In MS Excel DRR Daily Run Rate In

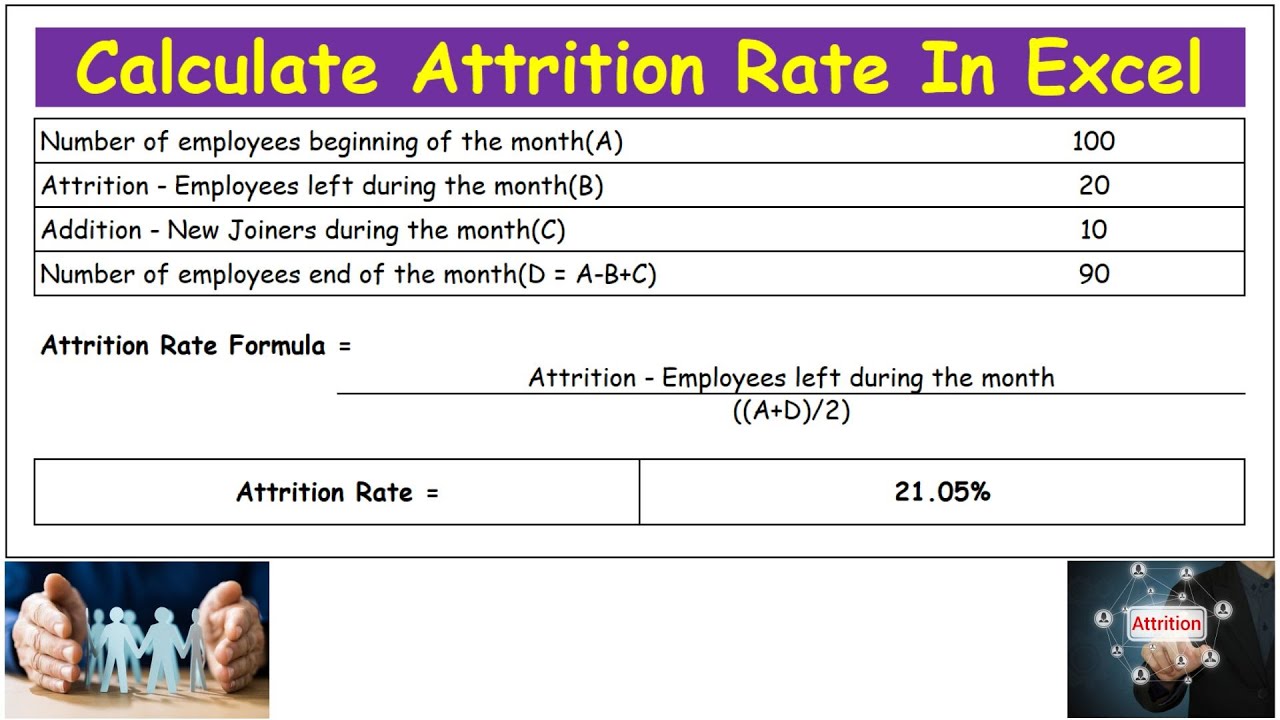

Calculate Attrition Rate In Excel Employee Attrition Report How To

How To Calculate Monthly Run Rate In Microsoft Excel Using Different

How To Calculate Monthly Run Rate In Microsoft Excel With Template

How To Calculate Net Run Rate In Cricket Calculate Net Run Rate With

How To Calculate Monthly Payments In Excel Using Formulas 43 OFF

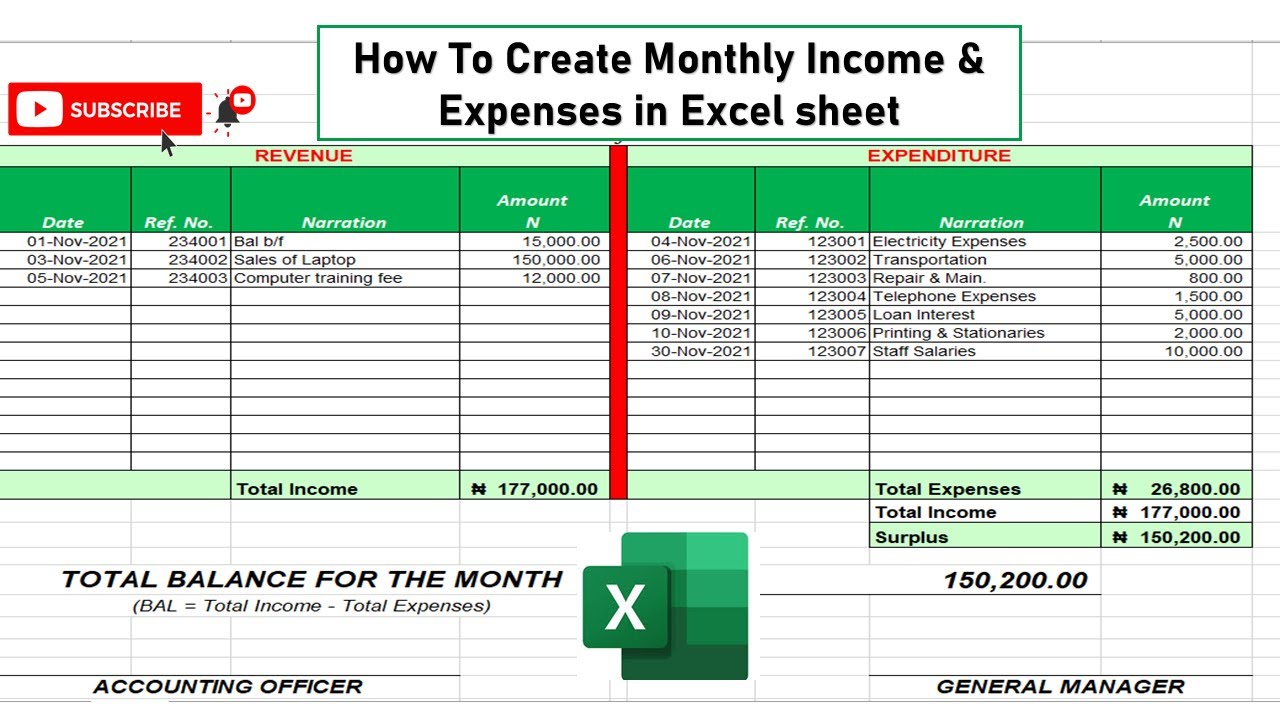

How To Create An Income And Expense Report In Excel Infoupdate

Labor Cost Calculator Template Download In Excel Google Sheets

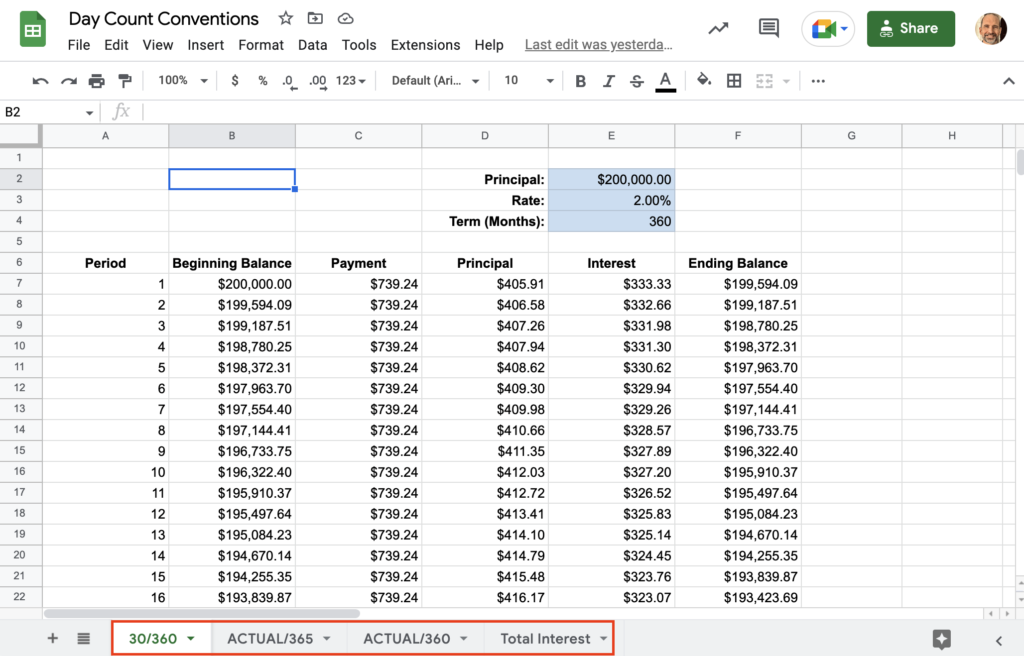

30 360 Actual 365 And Actual 360 Day Counts Sheets Help

Yearly Income Calculator Top Sellers Cityofclovis