How To Calculate Income Tax On Salary With Example In Excel Fy 2024 25 are a fun and appealing device for youngsters and grownups, using a mix of education and learning and enjoyment. From coloring pages and puzzles to mathematics difficulties and word games, these worksheets satisfy a variety of rate of interests and ages. They aid boost crucial reasoning, analytical, and creativity, making them suitable for homeschooling, class, or family activities.

Conveniently available online, worksheets are a time-saving resource that can turn any day into a discovering adventure. Whether you require rainy-day activities or supplemental understanding devices, these worksheets provide endless possibilities for fun and education. Download and appreciate today!

How To Calculate Income Tax On Salary With Example In Excel Fy 2024 25

How To Calculate Income Tax On Salary With Example In Excel Fy 2024 25

Enjoy this free set of equation and graphing slope intercept form worksheets that come as printable pdf files with complete answer keys Each slope intercept form worksheet shares over 20 various practice problems to help your students to learn and apply their understanding of 13.4 Slope-Intercept Form - Worksheet 4 1 Calculate the slope of the line that passes through the points (−1,−1) and (2,−1). 2 Write the equation −3x−4y= 0 in slope-intercept form. 3 Write the equation −5x+ 3y= −7 in slope-intercept form. 4 Graph the line y= −4 3 x+ 2. x y – 170 –

Graphing Lines In Slope Intercept Form ks ipa Kuta Software

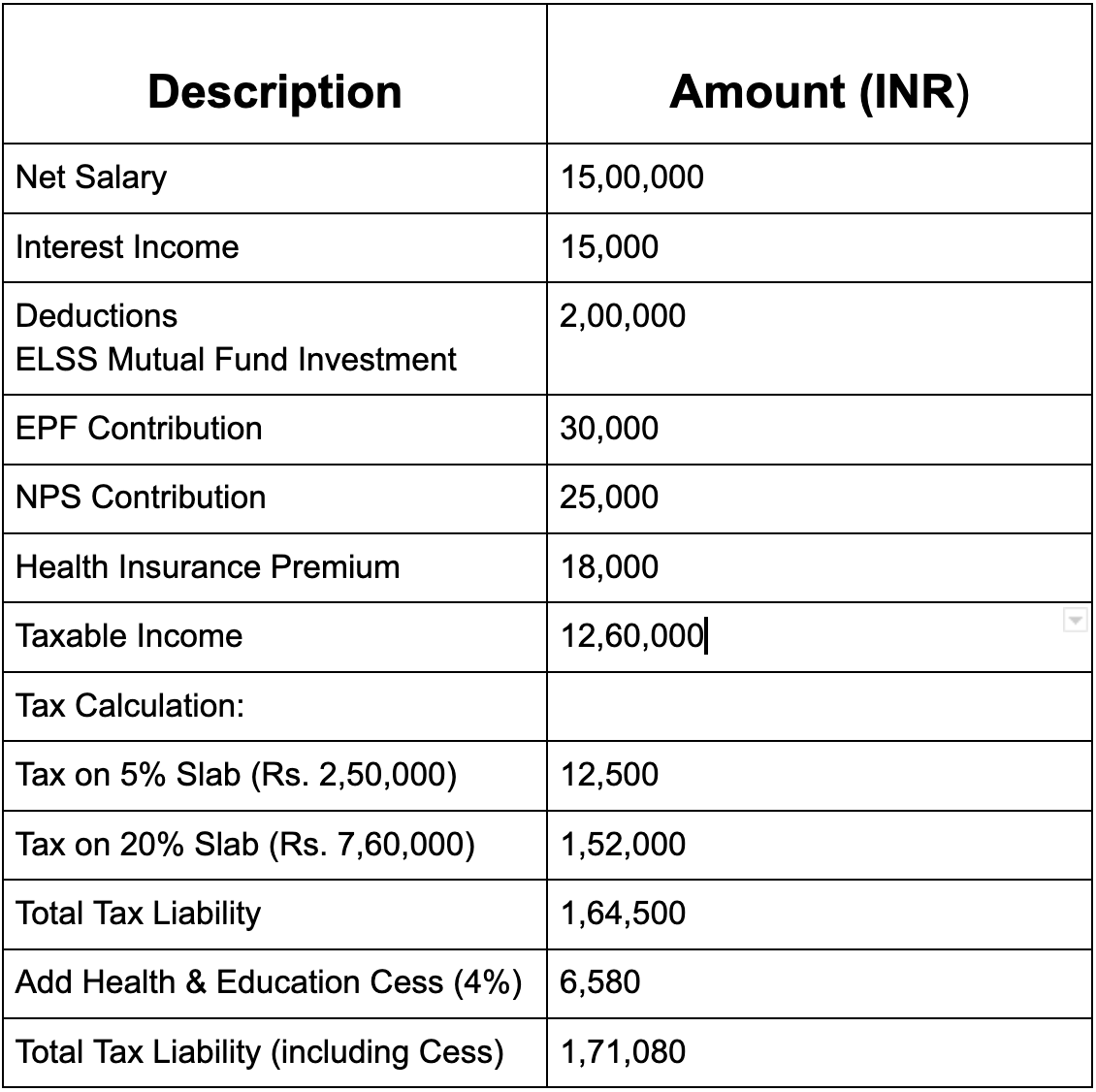

How To Calculate Tax On Income Hotsell Cityofclovis

How To Calculate Income Tax On Salary With Example In Excel Fy 2024 25Write the slope–intercept form of the equation of each line. Find the slope of the following lines. Name a point on each line. Write an equation in point–slope form for the line that passes through the given point with the slope provided. . So Much More Online! Please visit: www.EffortlessMath. . So Much More Online! 5 Worksheet by Kuta Software LLC Write the slope intercept form of the equation of each line given the slope and y intercept 35 Slope 5 3 y intercept 1 36 Slope 5 y intercept 2 Write the slope intercept form of the equation of the line through the given points

[desc_9] [img_title-17] [img_title-16]

13 1 Slope Intercept Form Worksheet 1 Nevada State

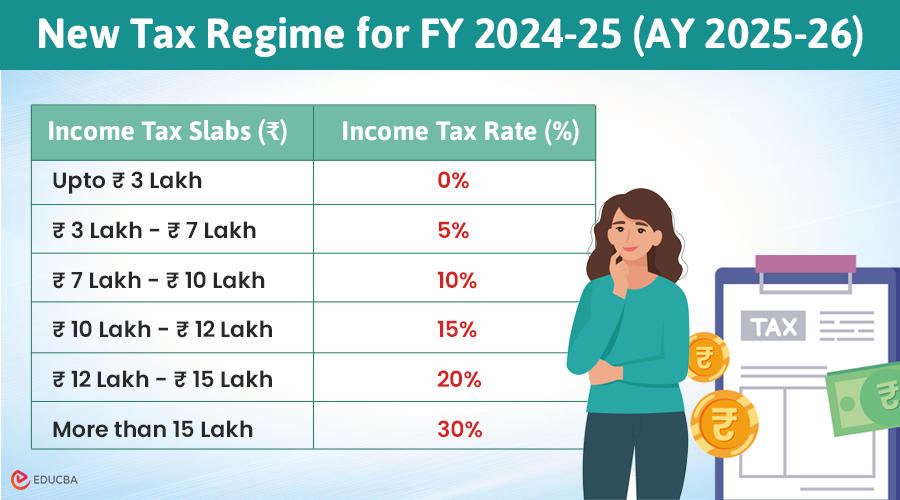

Income Tax For Fy 2025 26

[desc-8] [img_title-11]

Write the point slope form of the equation of the line described Create your own worksheets like this one with Infinite Algebra 1 Free trial available at KutaSoftware [img_title-12] [img_title-13]

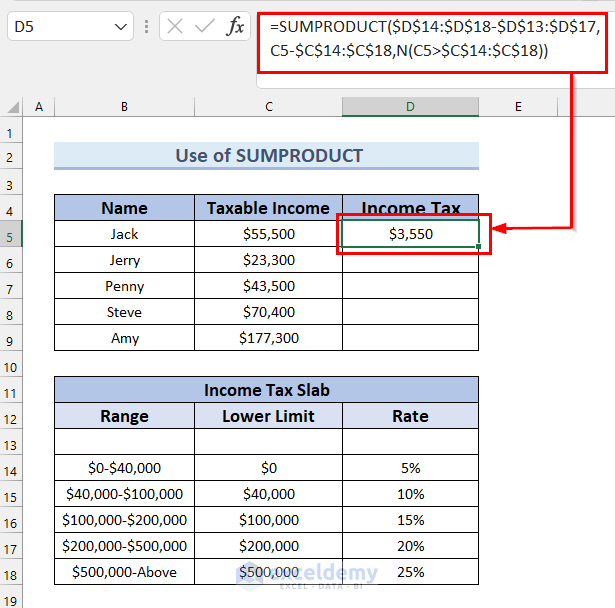

Income Tax Calculator 2025 26 Excel Archives FinCalC Blog

Income Tax Slabs For Fy 2024 25 New Regime Slab

Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

How To Calculate Mat Tax With Example At Makayla Hampton Blog

How To Calculate Income Tax On Salary A Guide

Income Tax Calculator FY 2025 26 Excel DOWNLOAD FinCalC Blog

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]