How Do You Calculate Executor Fees In Ny are an enjoyable and interesting device for children and grownups, using a blend of education and learning and amusement. From coloring web pages and problems to math obstacles and word video games, these worksheets accommodate a large range of interests and ages. They help enhance important thinking, analytic, and imagination, making them suitable for homeschooling, classrooms, or household activities.

Quickly available online, printable worksheets are a time-saving resource that can transform any day into a knowing adventure. Whether you require rainy-day activities or supplemental learning tools, these worksheets offer countless possibilities for fun and education and learning. Download and enjoy today!

How Do You Calculate Executor Fees In Ny

How Do You Calculate Executor Fees In Ny

Welcome to The Simplifying Proper Fractions to Lowest Terms Easier Questions A Math Worksheet from the Fractions Worksheets Page at Math Drills What fraction of the students wear glasses? Give the fraction in its simplest form. Question 6: Sarah has £240 and she gives her mum £80.

Simplifying fractions pdf

How Much Fees An Executor Estate In Indiana GuyDiMartinoLaw YouTube

How Do You Calculate Executor Fees In NyThis fraction worksheet is great for testing children in their reducing of fractions. The problems may be selected from easy, medium or hard level of ... Simplify each fraction to its lowest terms 1 9 18 2 8

Below are six versions of our grade 6 math worksheet on simplifying fractions; students are asked to rewrite the given proper fraction in the simplest form. How Do You Calculate Resistance Electricity Magnetism Excel Accounting Spreadsheet

Simplifying fractions answers Corbettmaths

How To Pass Credit Card Fees Along To Customers YouTube

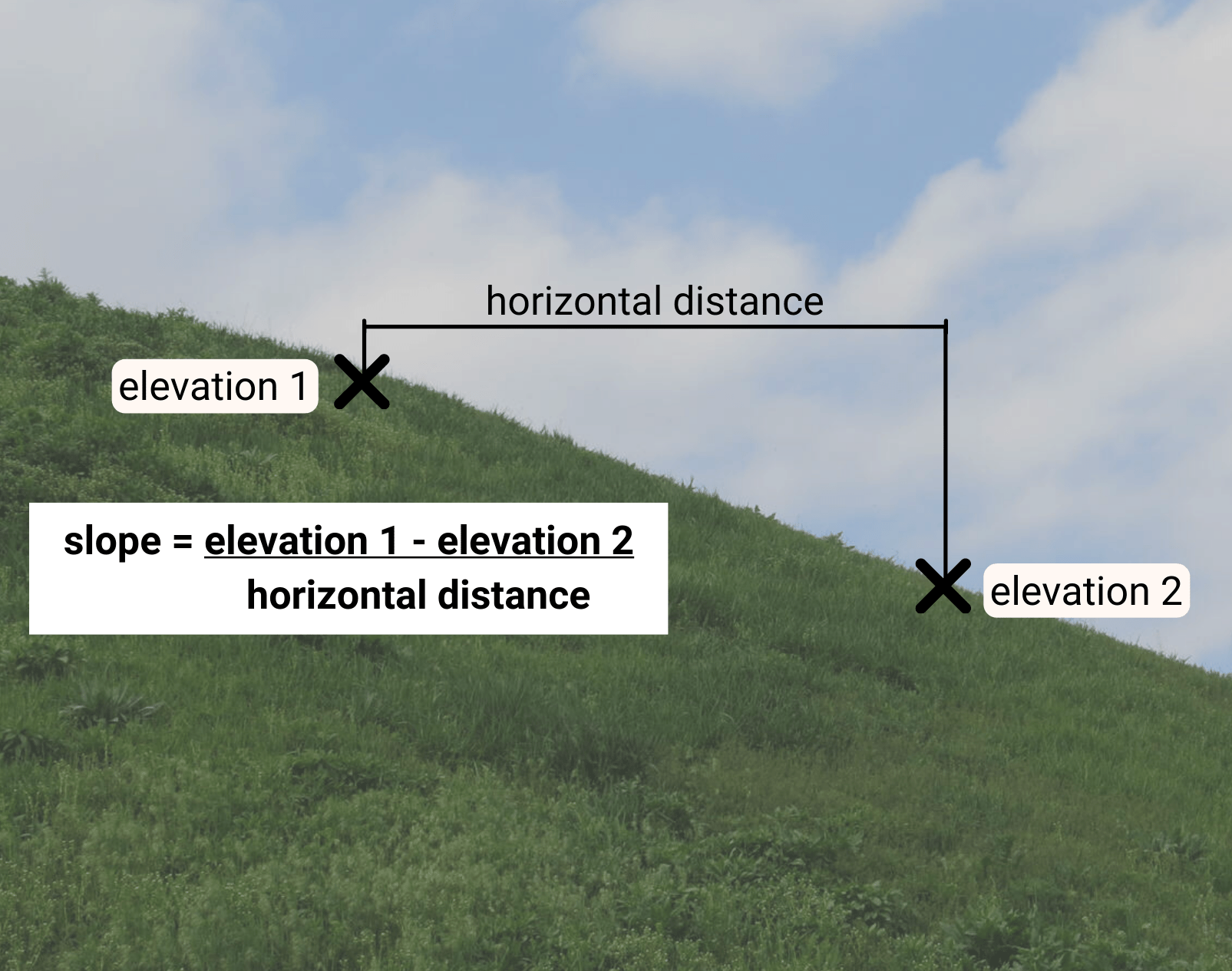

The answer is To find the simplest form of a fraction you determine the greatest common factor of the numerator and the denominator The GCF is 3 How To Calculate The Slope On A Topographic Map Using Contour Lines

Students rewrite the fractions if possible in their simplest form with the lowest possible denominator Free Math Worksheets Grade 5 Printable How To Calculate 95 Confidence Interval In Excel SpreadCheaters Executor Fees In Ontario Alberta B C Other Provinces In Canada

Surcharge What It Is How It Works Types And Examples 60 OFF

Calculate VAT Excel Formula

The Midweek Experience The Power For Generational Exploits Prophet

The Midweek Experience The Power For Generational Exploits Prophet

Nility Blog

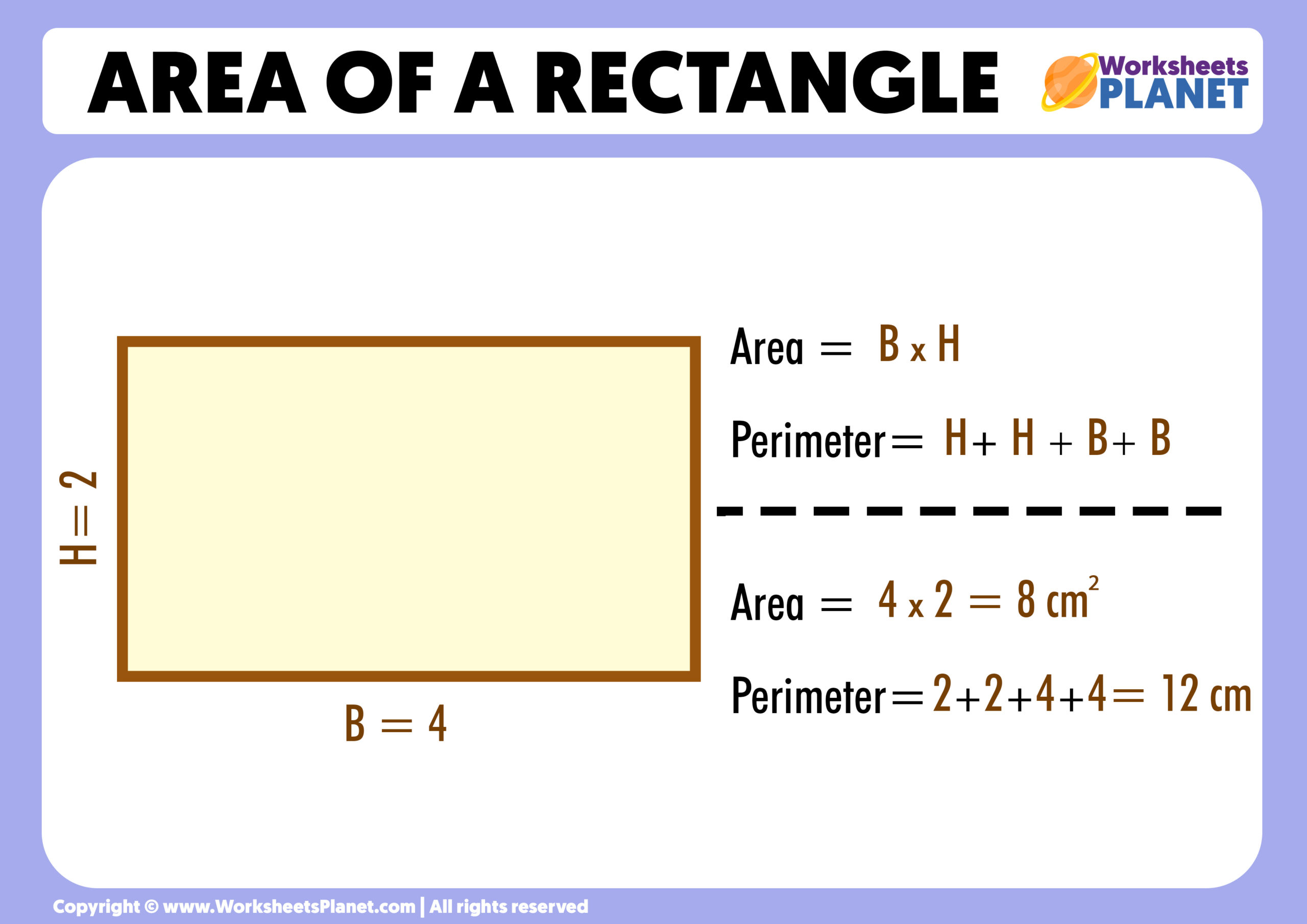

Area Of A Rectangle Formula Example

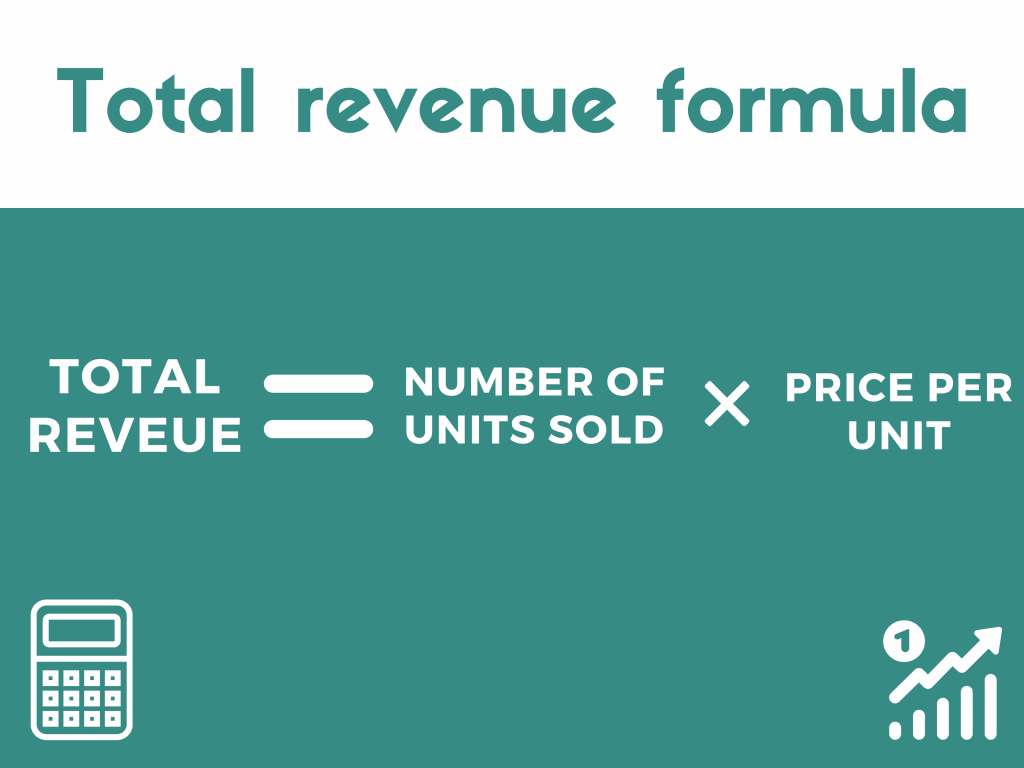

Total Revenue

How To Calculate The Slope On A Topographic Map Using Contour Lines

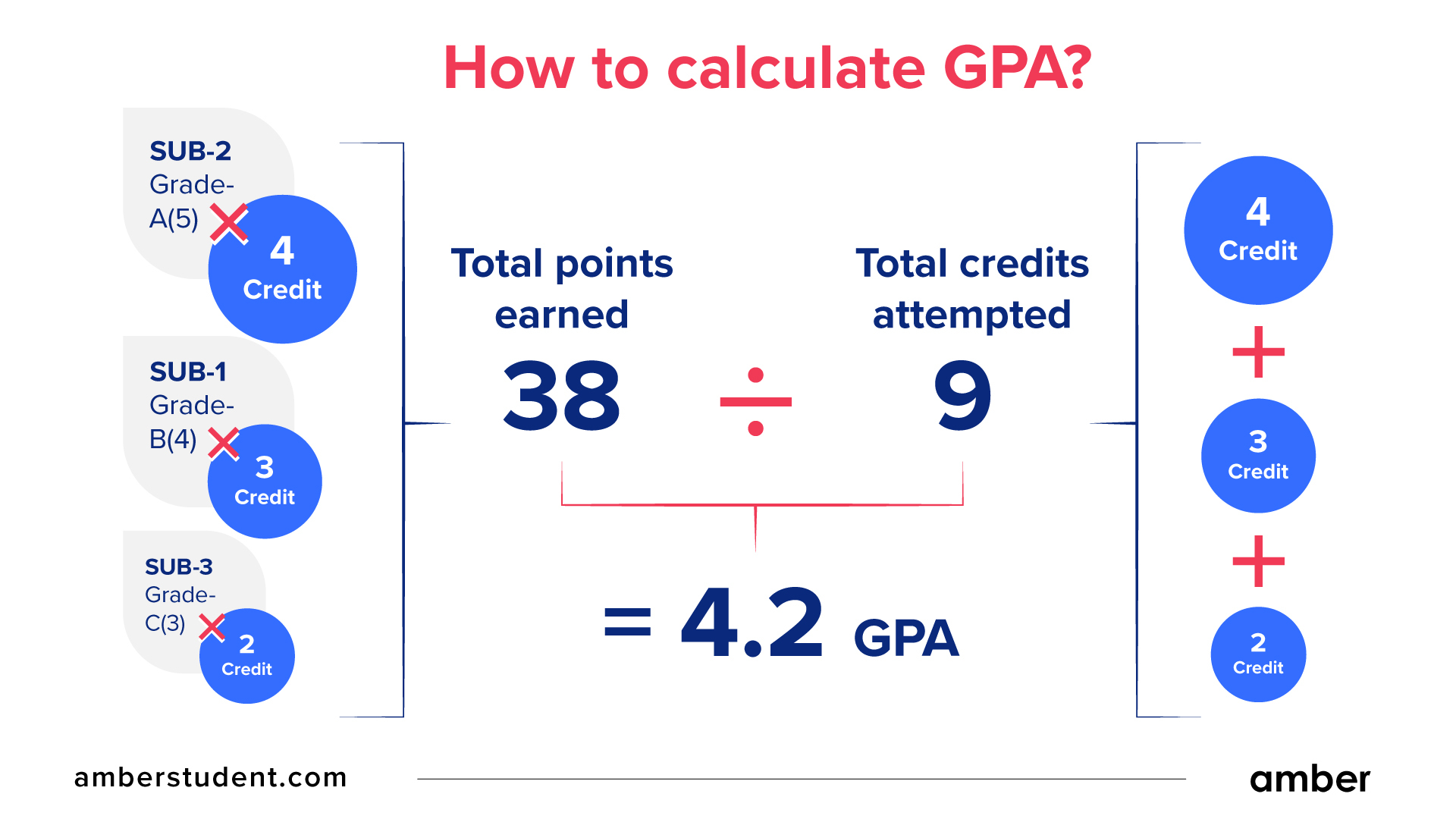

What Is A 3 Point Gpa

Executor Fees How To Calculate Executor Support