General Expenses List In Accounting are a fun and engaging tool for children and grownups, using a mix of education and learning and amusement. From tinting pages and challenges to math obstacles and word video games, these worksheets accommodate a variety of interests and ages. They aid improve vital reasoning, problem-solving, and imagination, making them optimal for homeschooling, classrooms, or family members tasks.

Conveniently available online, worksheets are a time-saving source that can turn any day right into a knowing journey. Whether you need rainy-day tasks or extra knowing tools, these worksheets supply endless possibilities for fun and education and learning. Download and install and appreciate today!

General Expenses List In Accounting

General Expenses List In Accounting

Write the 1 slope intercept and 2 standard form of the equation of the line given the slope and y intercept 8 Slope 2 y intercept 4 Slope Intercept Worksheet by Kuta Software LLC. Find the slope of the line through each pair of points. 9) (8, 10), (-7, 14). 10) (-3, 1), (-17, 2). 11) (-20, -4), (-12, -10).

Slope Review Note Sheet w Answer Key TPT

Free Spending Categories Templates For Google Sheets And Microsoft

General Expenses List In AccountingWrite an equation in point-slope form of the line that passes through the two points given. Use the first point to write the equation. Graph both linear equations on the coordinate plane on the right Make sure you use an input output table with at least 3 ordered pairs for each

Employ our free worksheets to sample our work. Answer keys are included. Printing Help - Please do not print slope worksheets directly from the browser. Accounting Ledger Template Expenses In Accounting Definition Types And Examples

Slope pdf Kuta Software

Free Small Business Expense Report Templates Smartsheet Worksheets

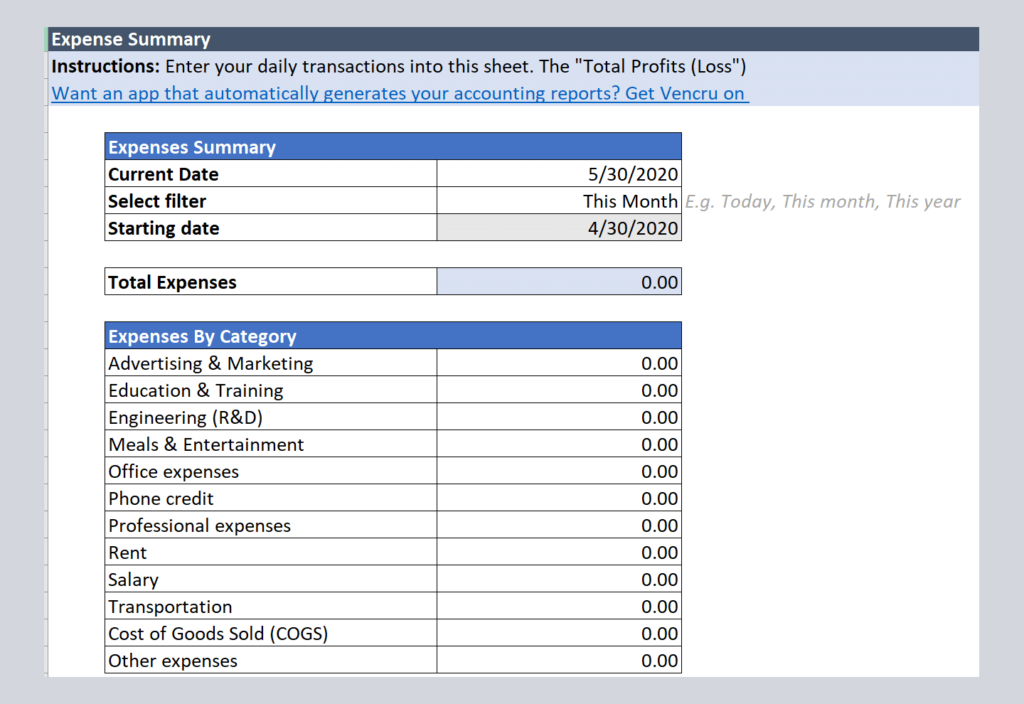

In this one page review worksheet students will review and practice finding the slope of a line from a graph Expense Report Templates Vencru

Use this worksheet to help students review how to find the slope by calculating the rise over the run or the change in y over the change in x Miscellaneous Expenses Expense Accounts FundsNet

Expenses Report

Booywinter Blog

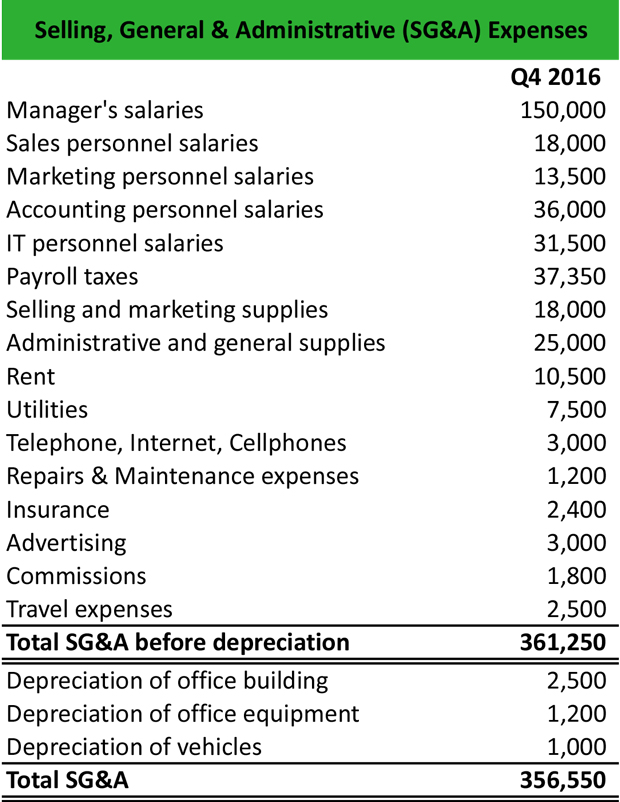

What Is Selling General Administrative Expense SG A Definition

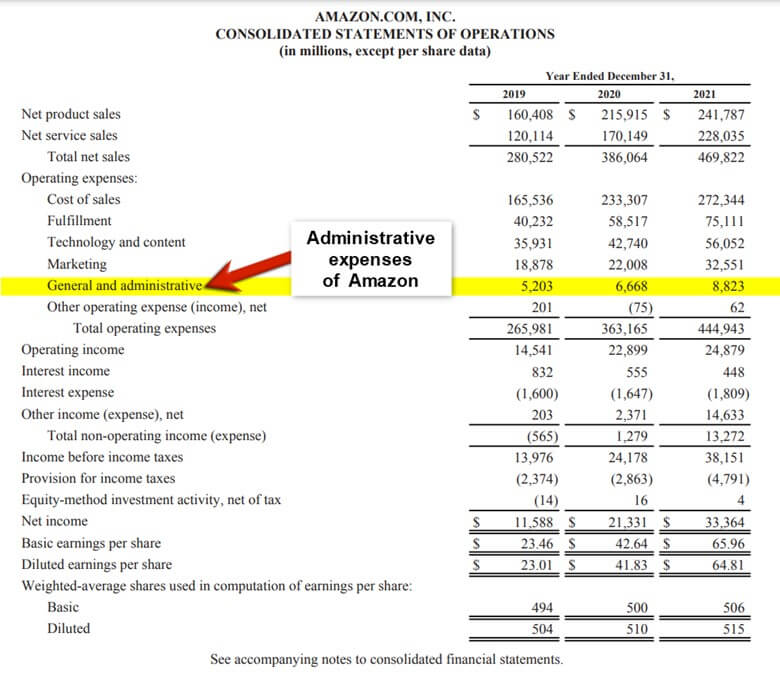

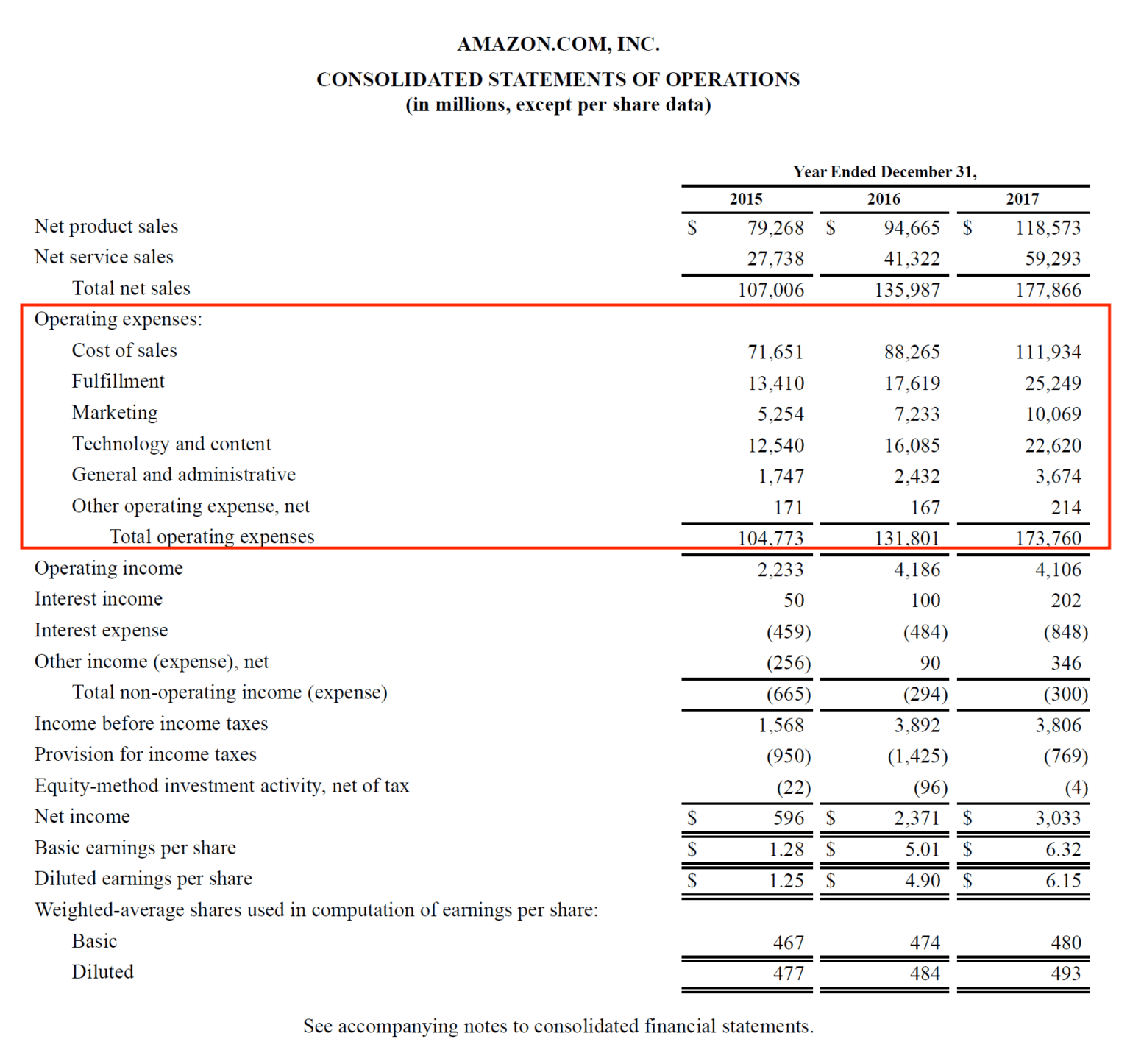

Administrative Expenses Meaning List Real Company Examples

Free Monthly Expense List Templates For Google Sheets And Microsoft

Susalery Blog

Free Financial Expense Detailed List Templates For Google Sheets And

Expense Report Templates Vencru

Expenses Meaning Fixed Expenses Meaning Defination Examples

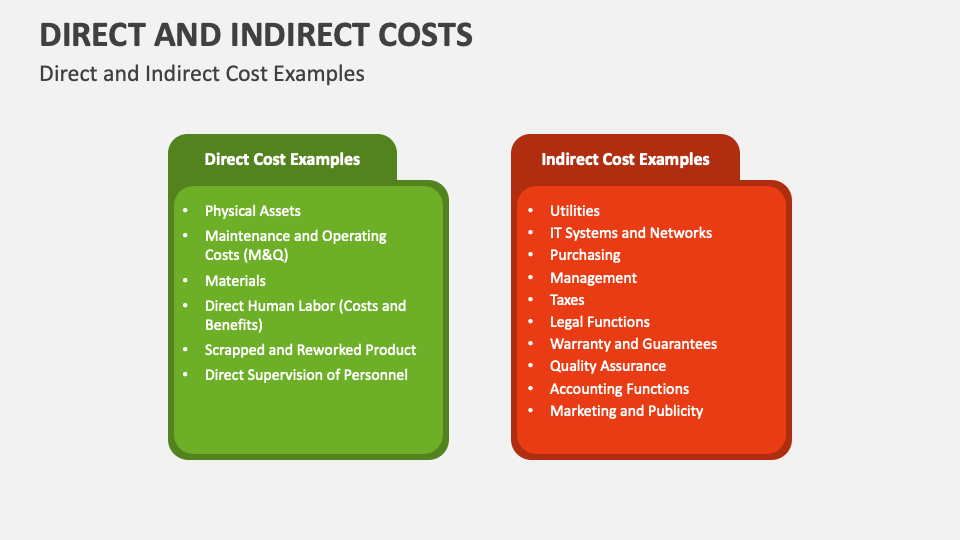

Direct And Indirect Costs PowerPoint And Google Slides Template PPT