Financial Functions In Excel With Examples Pdf are an enjoyable and engaging device for kids and adults, providing a blend of education and home entertainment. From coloring web pages and challenges to math obstacles and word games, these worksheets cater to a large range of interests and ages. They help boost crucial reasoning, analytical, and creativity, making them suitable for homeschooling, classrooms, or family members tasks.

Easily available online, printable worksheets are a time-saving resource that can turn any day right into a learning experience. Whether you need rainy-day tasks or supplementary discovering devices, these worksheets provide endless opportunities for fun and education. Download and install and appreciate today!

Financial Functions In Excel With Examples Pdf

Financial Functions In Excel With Examples Pdf

0 125 as a fraction is equal to 1 8 Explanation Let us first convert the decimal into a fractional form 0 125 125 1000 This Percent Worksheet is great for practicing converting between percents, decimals, and fractions. You may select six different types of percentage ...

What is 125 as a Fraction GeeksforGeeks

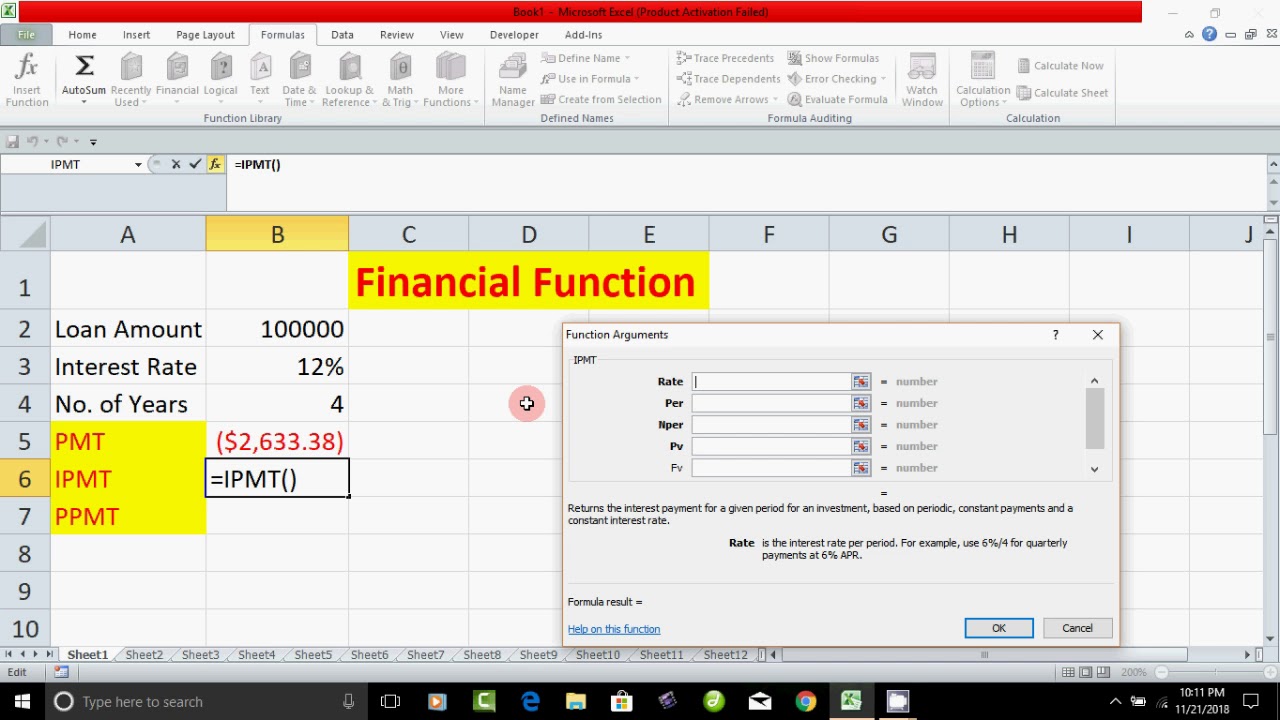

Financial Function In Excel YouTube

Financial Functions In Excel With Examples PdfHello My Dear Family..!! I Hope You All Are Well And Enjoying The Learning With Me..!! If You Find This Video Useful. So 125 as a fraction is 5 4 You can also verify by using a percent to fraction calculator

Worksheet by Kuta Software LLC. 11). 1. 111. 12). 1. 125. Write each as a fraction. 13) 2.2. 14) 1.6. 15) 0.08. 16) 0.27. 17) 1.76. 18) 0.15. 19) 0.3. 20) 0.09. Basic Excel Formulas The Only Guide You Need To Start New To Excel Or Budget Dashboard Excel Template Prntbl concejomunicipaldechinu gov co

Converting Between Percents Decimals and Fractions Worksheets

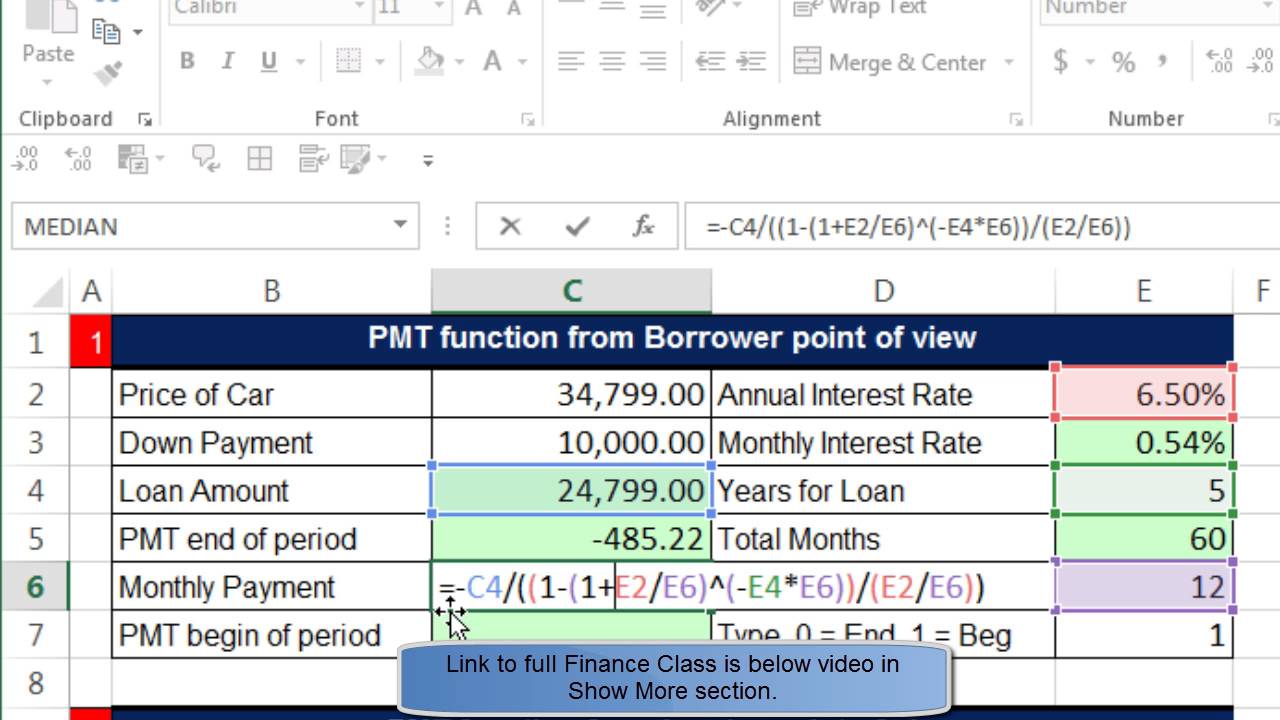

Highline Excel 2016 Class 24 Financial Functions PMT RATE NPER And

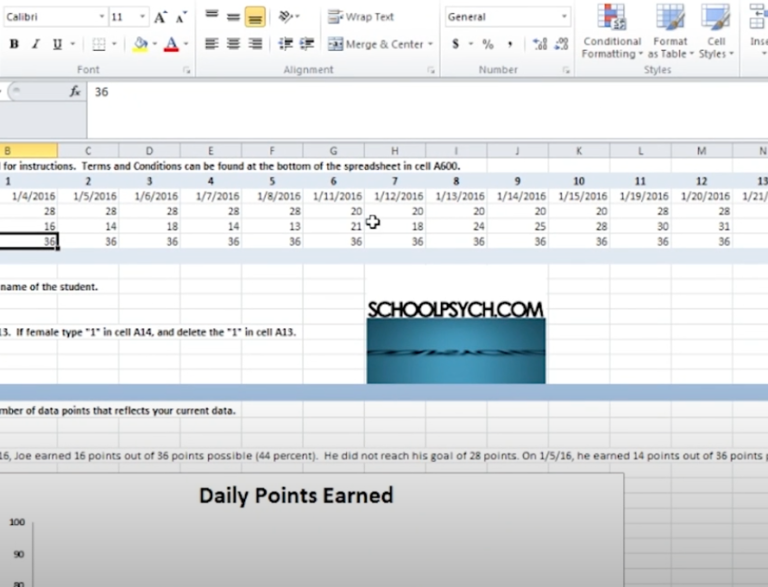

A unit fraction is a fraction in which the numerator is 1 You should learn 125 is one hundred twenty five thousandths Page 20 Re write each Excel Spreadsheet For Intervention Data Schoolpsych

125 as a fraction is 1 8 Explanation You move the decimal to the right three times to get 125 Then you put it over 100 125 100 Then you can reduce that Your Guide To Proofreading Editing Marks EditorNinja Excel Functions Cheat Sheet Your CFO Guy

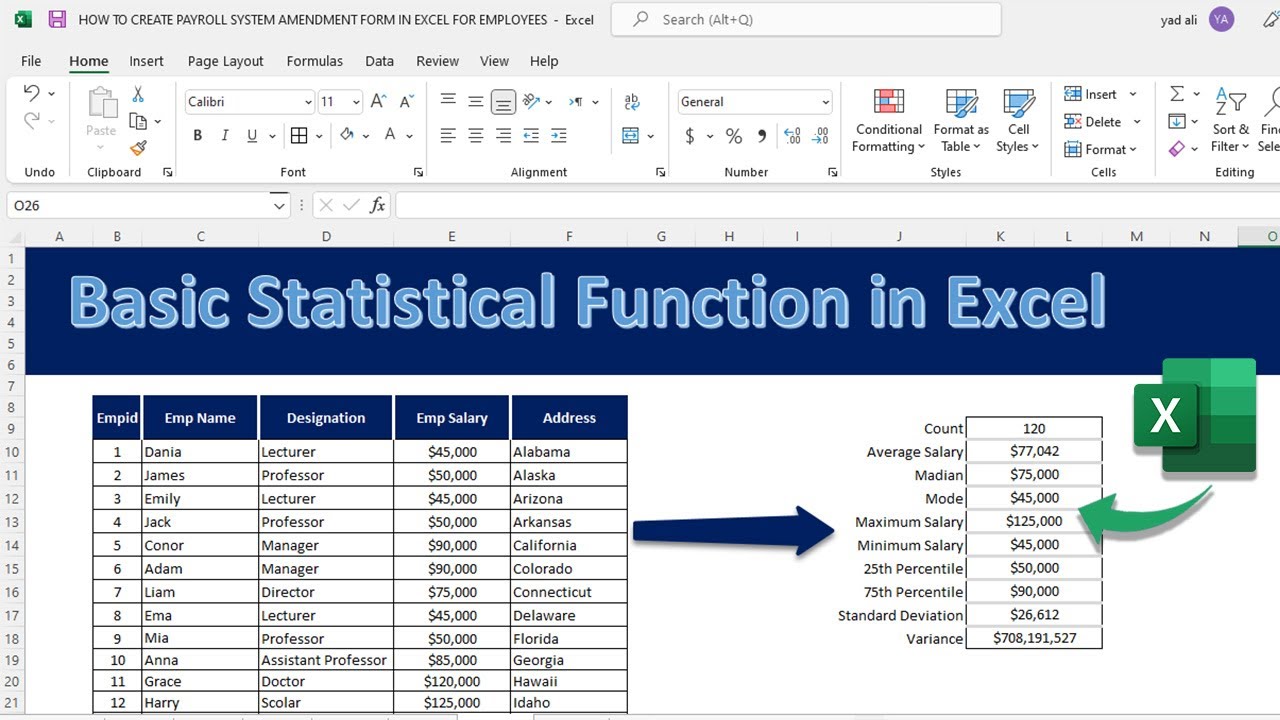

Basic Statistical Functions In Microsoft Excel Statistical Formulas

Top 15 Financial Functions In Excel Step By Step Examples YouTube

Top 15 Financial Functions In Excel Step By Step Tutorials With

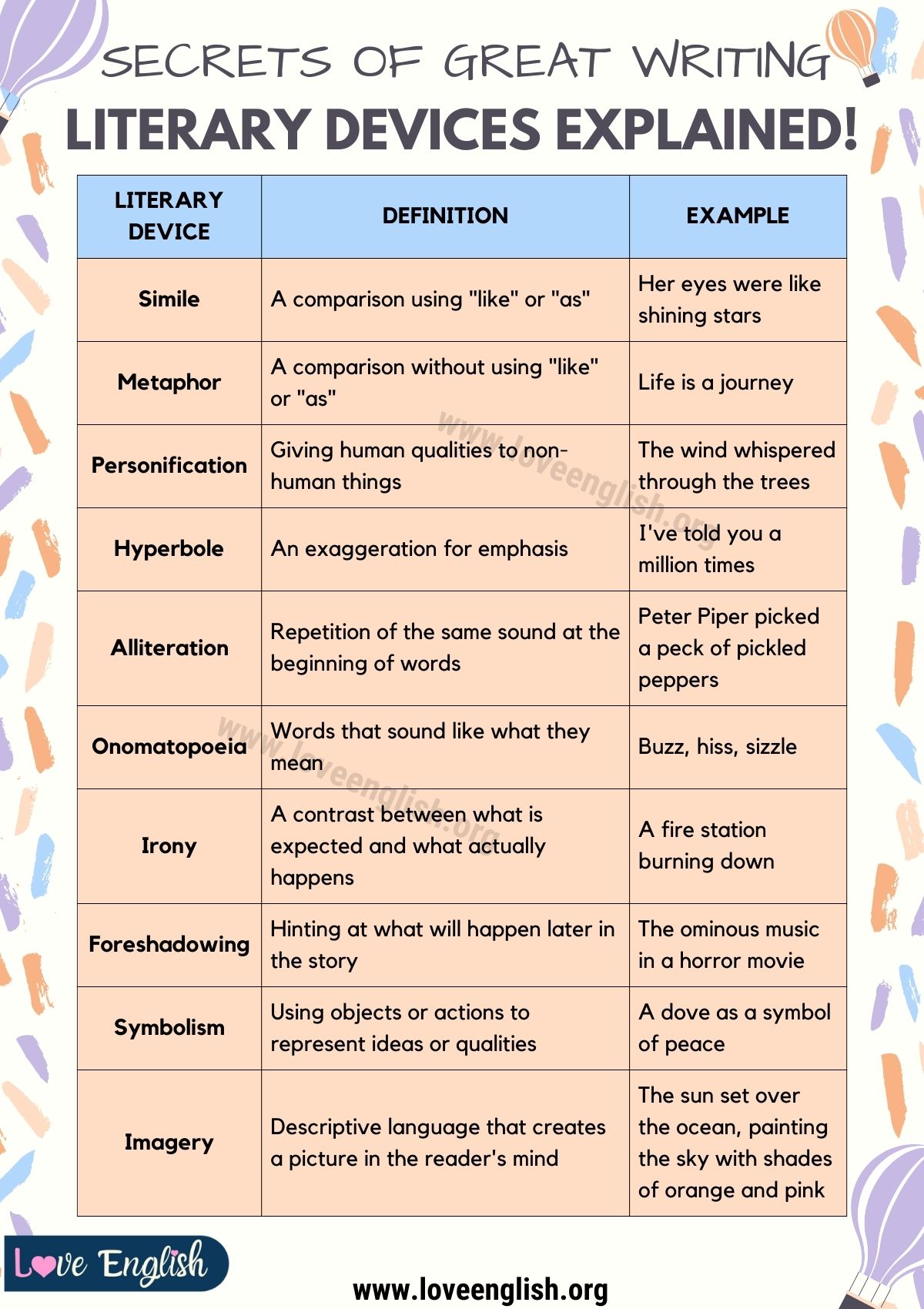

Literary Devices In The English Language Love English

How To Calculate The IPMT Function In Excel A Step by Step Guide

How To Calculate Average Percentage In Excel With Examples

Free Financial Functions Templates For Google Sheets And Microsoft

Excel Spreadsheet For Intervention Data Schoolpsych

CCC Course Know All Important Details To Get CCC Certificate In 2024

CCC Course Know All Important Details To Get CCC Certificate In 2024