Explain Set Off And Carry Forward Of Losses In Case Of Capital Loss are an enjoyable and appealing tool for youngsters and grownups, providing a blend of education and learning and home entertainment. From coloring web pages and challenges to math obstacles and word video games, these worksheets cater to a large range of passions and ages. They aid boost crucial reasoning, analytic, and imagination, making them excellent for homeschooling, classrooms, or household tasks.

Conveniently easily accessible online, printable worksheets are a time-saving source that can turn any type of day right into an understanding experience. Whether you need rainy-day activities or supplementary understanding devices, these worksheets offer countless possibilities for fun and education and learning. Download and install and appreciate today!

Explain Set Off And Carry Forward Of Losses In Case Of Capital Loss

Explain Set Off And Carry Forward Of Losses In Case Of Capital Loss

The Form 1040 ES package includes worksheets to help you account for differences between the previous and current year s income and calculate The IRS provides Form 1040-ES, Estimated Tax for Individuals, which includes a worksheet to help you calculate your estimated tax payments. You can also use ...

2024 IL 1040 ES Estimated Income Tax Payment for Individuals

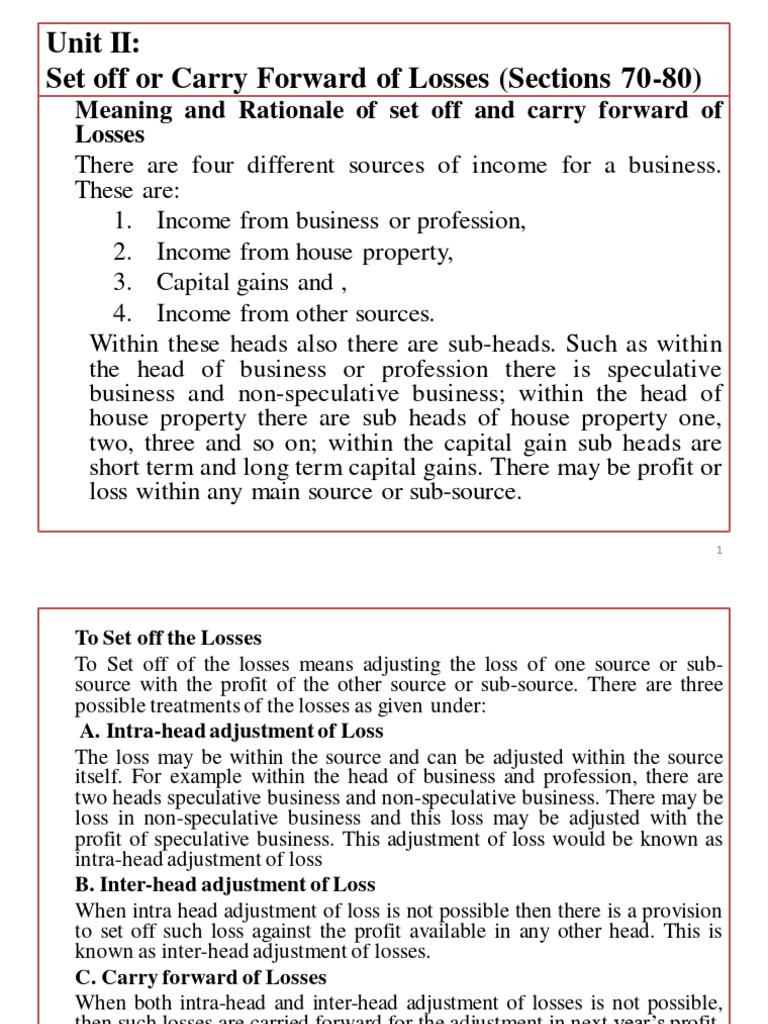

Set Off Carry Forward Of Losses PDF Expense Depreciation

Explain Set Off And Carry Forward Of Losses In Case Of Capital LossStep 1: Gather your financial recordsStep 2: Determine your estimated income and taxesStep 3: Fill out the 2023 Self-Employment Tax and Deduction Worksheet. Use Form 1040 ES to figure and pay your estimated tax Estimated tax is the method used to pay tax on income that is not subject to withholding

Use the Estimated Tax Worksheet to calculate your estimated tax for the next tax year and set up the electronic withdrawal of estimated tax payments. Once you ... Capital Loss How To Calculate Capital Loss With Examples Set Off And Carry Forward Of Losses Loss Carry Forward Income Tax

Estimated tax payments and Form 1040 ES H R Block

SET OFF AND CARRY FORWARD PDF

When you pay income tax in quarterly installments you use IRS Form 1040 ES to report how much money you re sending to the government Set Off And Carry Forward Of Losses Lecture 1 CA Intermediate YouTube

Form 1040 ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments Frequently Asked Questions 1 What are the Capital Gain ITR2 2023 24 Set Off And Carry Forward Of Losses 2023 Income From Business Part 8 Set Off And Carry Forward Of Losses

Clubbing Set Off And Carry Forward PDF

Set Off Carry Forward Of Losses Handwritten Notes PDF

Income Tax Divyastra CH 12 Set Off Carry Forward Of Losses R PDF

Set Off And Carry Forward Of Losses Under Income Tax Act 1961

Analysis Of CBDT Circular On Condonation Of Delay In Filing Refund

MCQ CH 12 Set Off And Carry Forward Of Losses Nov 23 Download

How To Set Off Carry Forward Capital Gains Loss In ITR On ClearTax

Set Off And Carry Forward Of Losses Lecture 1 CA Intermediate YouTube

Set Off And Carry Forward Of Losses Section 70 To 80 Income Tax

Income Tax Introduction Of Set Off And Carry Forward Of Losses