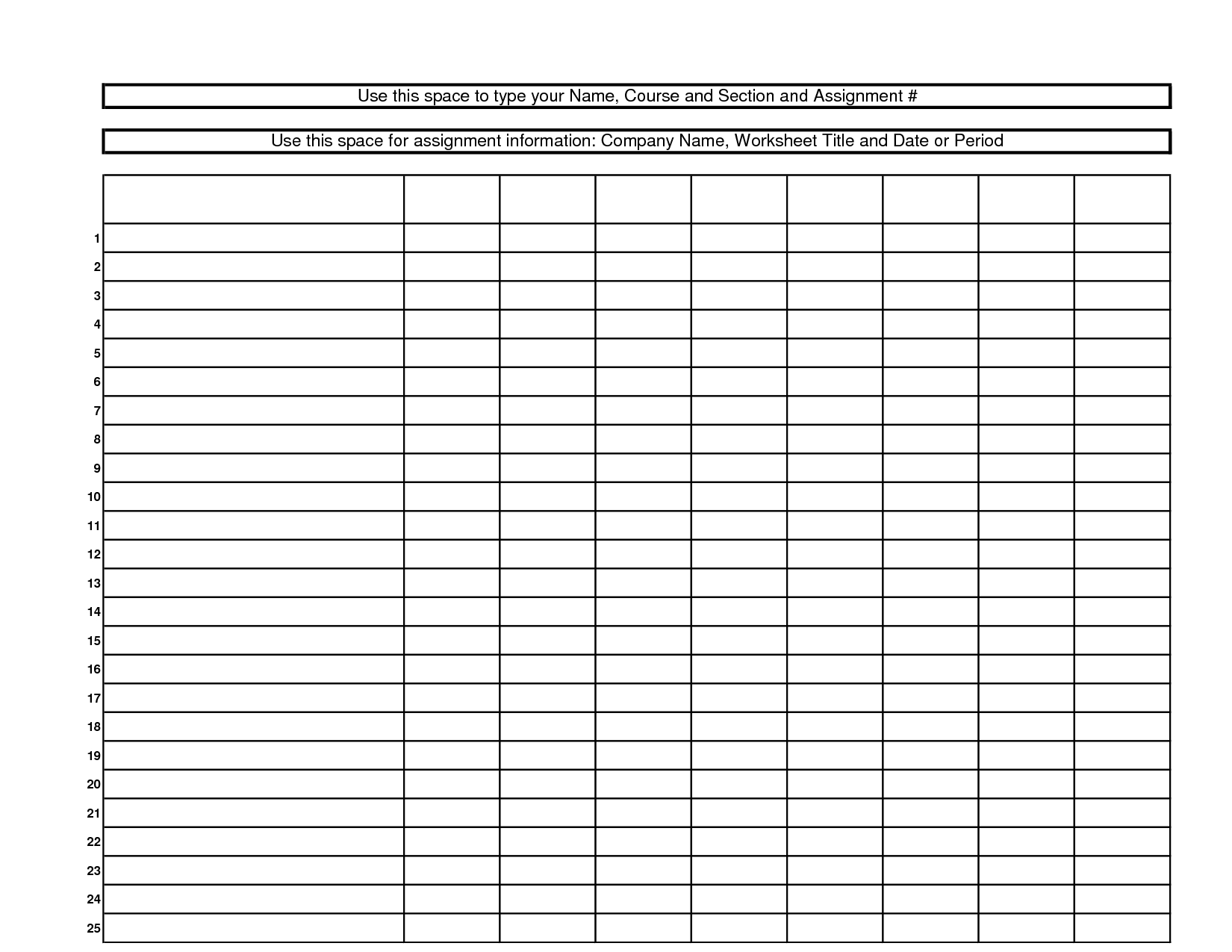

Blank Accounting Worksheet Template are a fun and interesting device for youngsters and grownups, using a blend of education and learning and entertainment. From tinting web pages and challenges to math difficulties and word video games, these worksheets accommodate a vast array of rate of interests and ages. They assist boost critical reasoning, problem-solving, and creative thinking, making them suitable for homeschooling, class, or family members activities.

Quickly accessible online, worksheets are a time-saving resource that can transform any type of day right into a knowing adventure. Whether you need rainy-day activities or additional learning tools, these worksheets provide limitless opportunities for fun and education. Download and take pleasure in today!

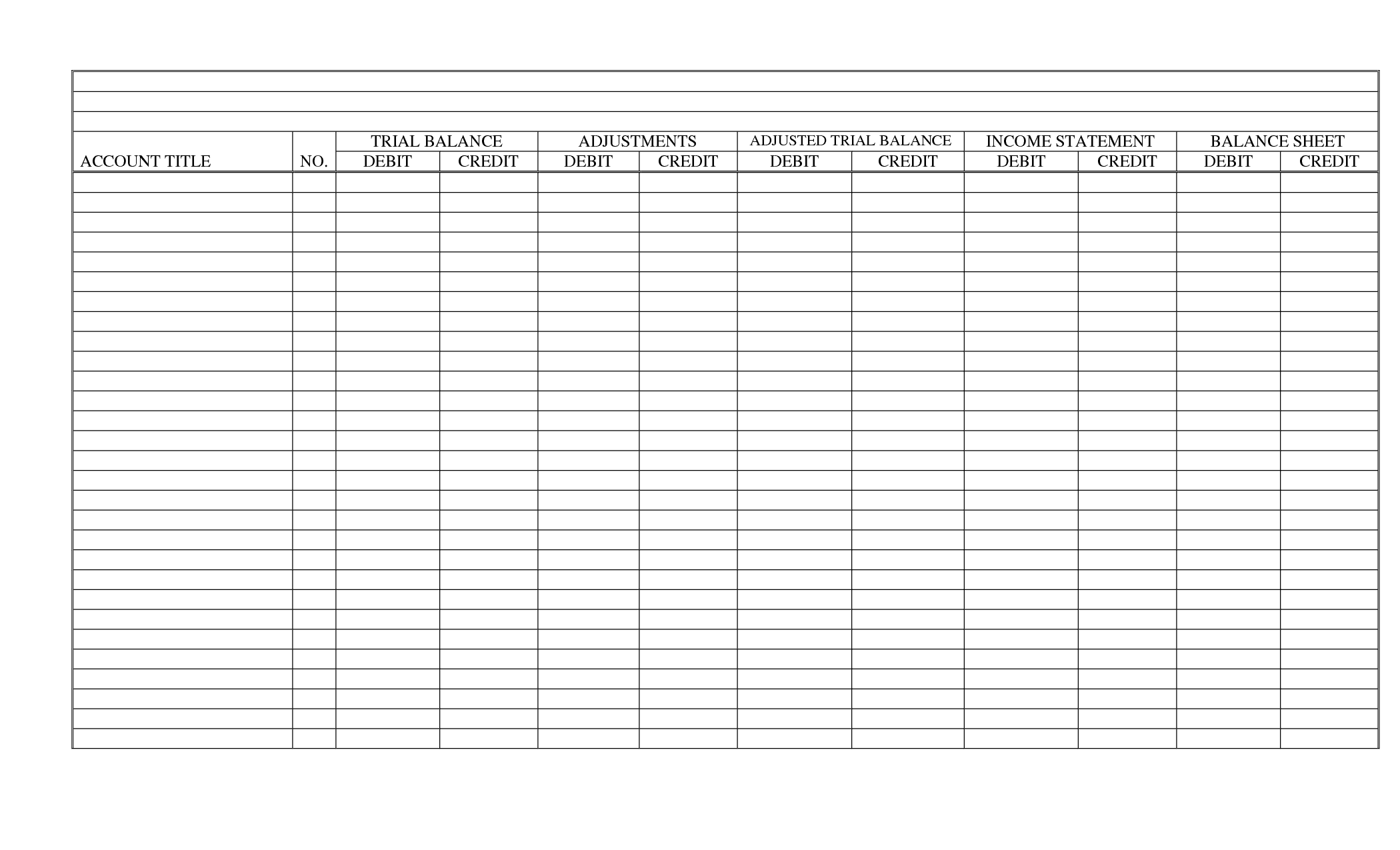

Blank Accounting Worksheet Template

Blank Accounting Worksheet Template

Write an equation in slope intercept form for the cost C after h hours of service b Graph the equation c What will be the total cost for 8 hours of work This resource is a basic level recall activity/notes where students are identifying the slope and y-intercept from a word problem.

Finding slope from word problems TPT

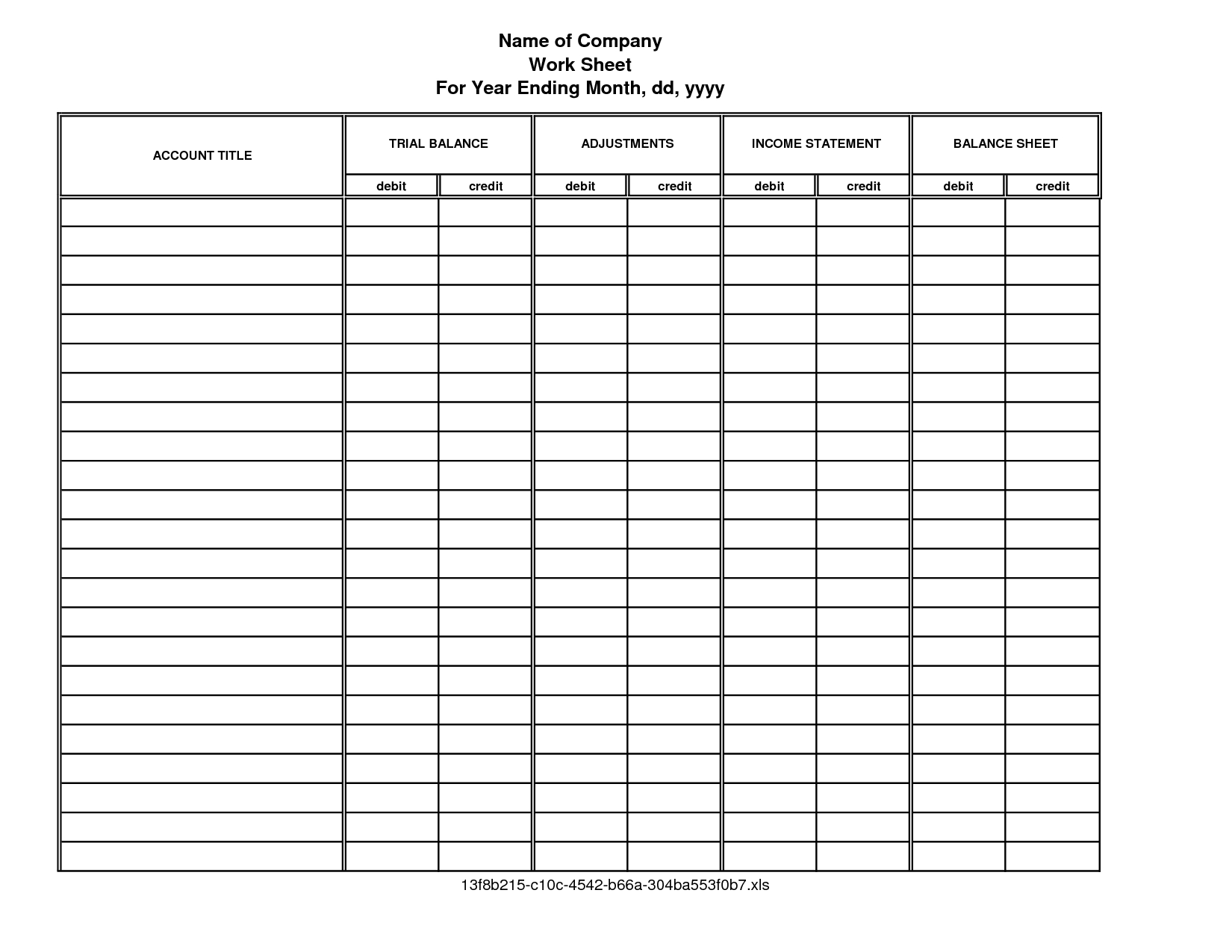

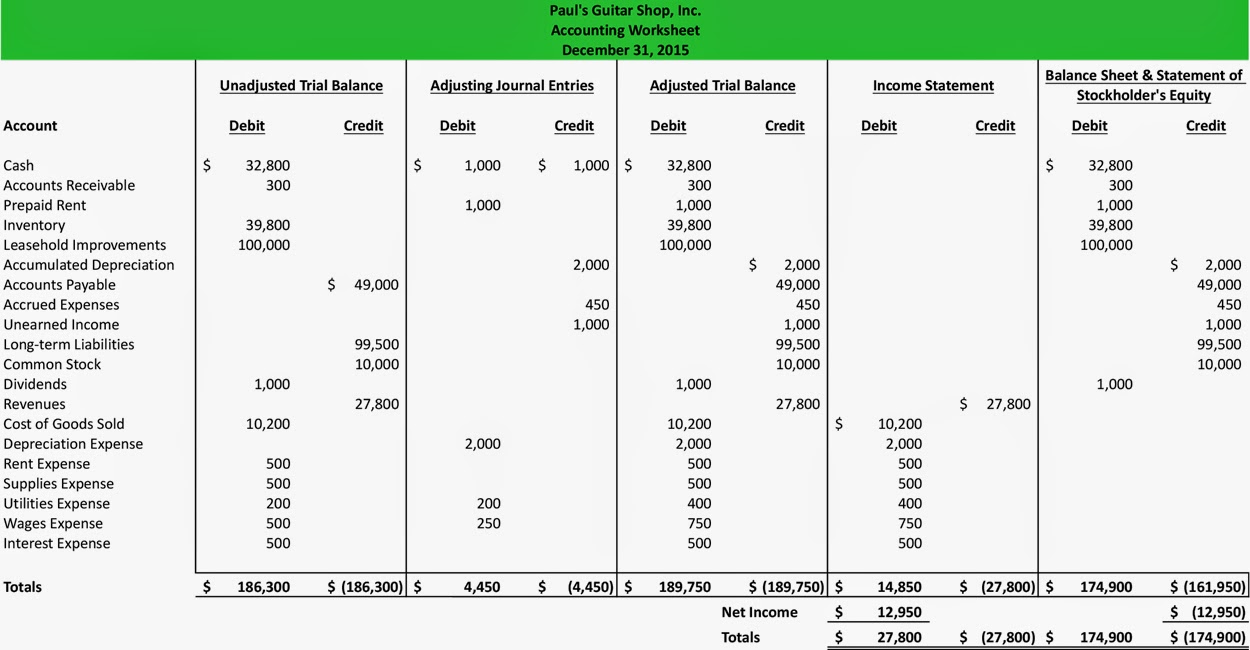

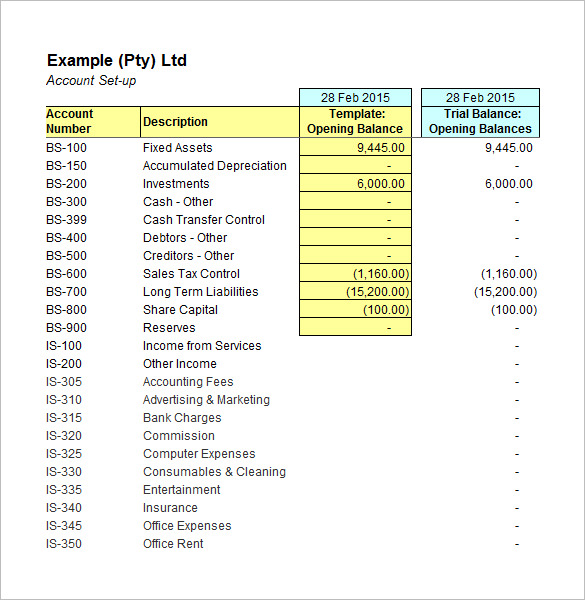

Accounting Worksheet Template Double Entry Bookkeeping

Blank Accounting Worksheet TemplateSlope- word problems quiz for 8th grade students. Find other quizzes for Mathematics and more on Quizizz for free! Suppose that a bike rents for 4 plus 1 50 per hour Write an equation in slope intercept form that models this situation 7 Use the equation you wrote in

Word problems in Slope-intercept form. When a word problem involves a constant rate or speed and a beginning amount, it can be written in slope-intercept ... 10 Column Worksheet Accounting Journal Entry Worksheet Accounting

Slope word problems TPT

Accounting Worksheets

The rental price for a scooter has a start up fee of 1 00 and then 0 25 for every minutes you use the scooter How much money does it cost you is you rent Blank Accounting Spreadsheet Template Excelxo

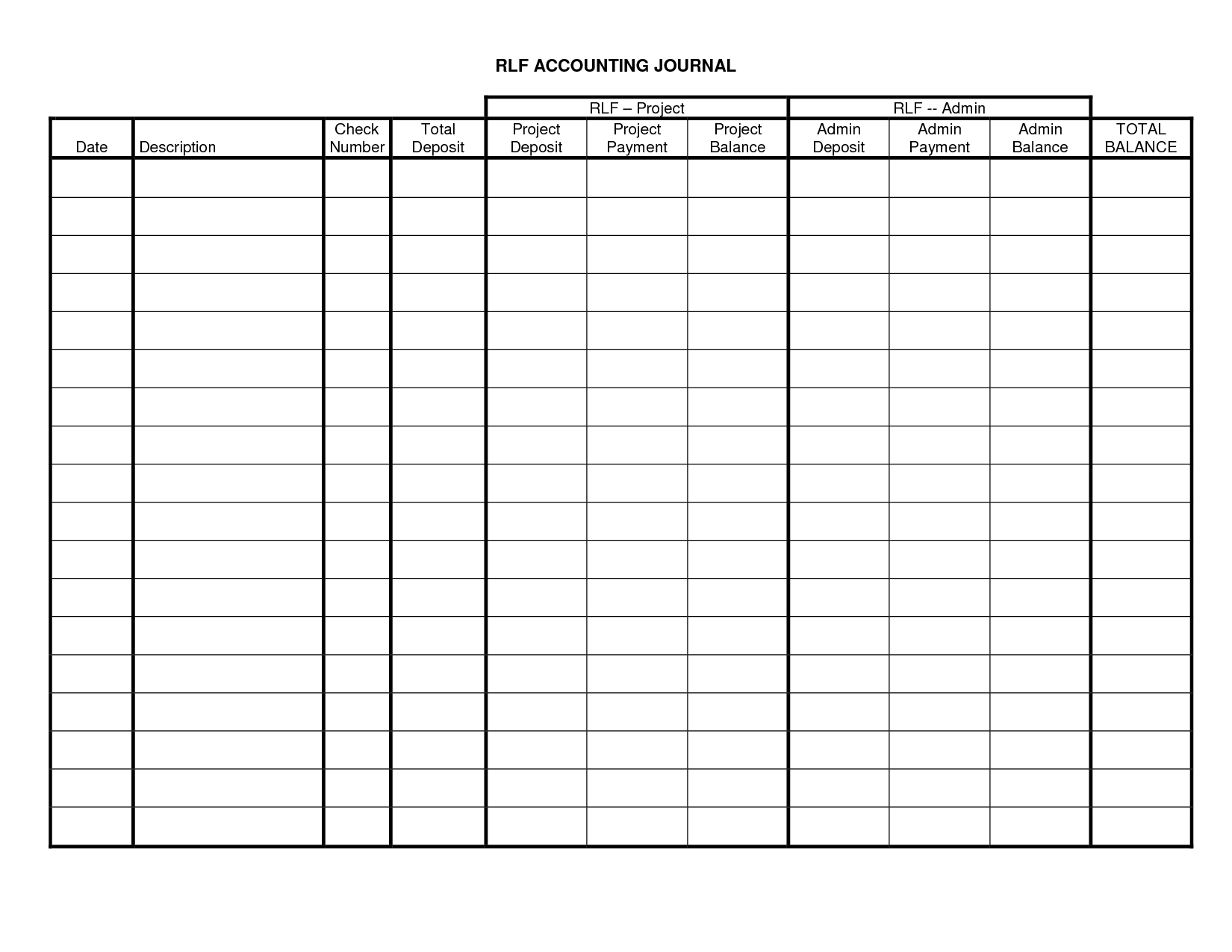

Write an equation in slope intercept form for the cost C after h hours of service What will be the total cost for 8 hours of work 10 hours of work 7 Rufus Bookkeeping Templates Pdf Db excel Accounting Sheets Printables

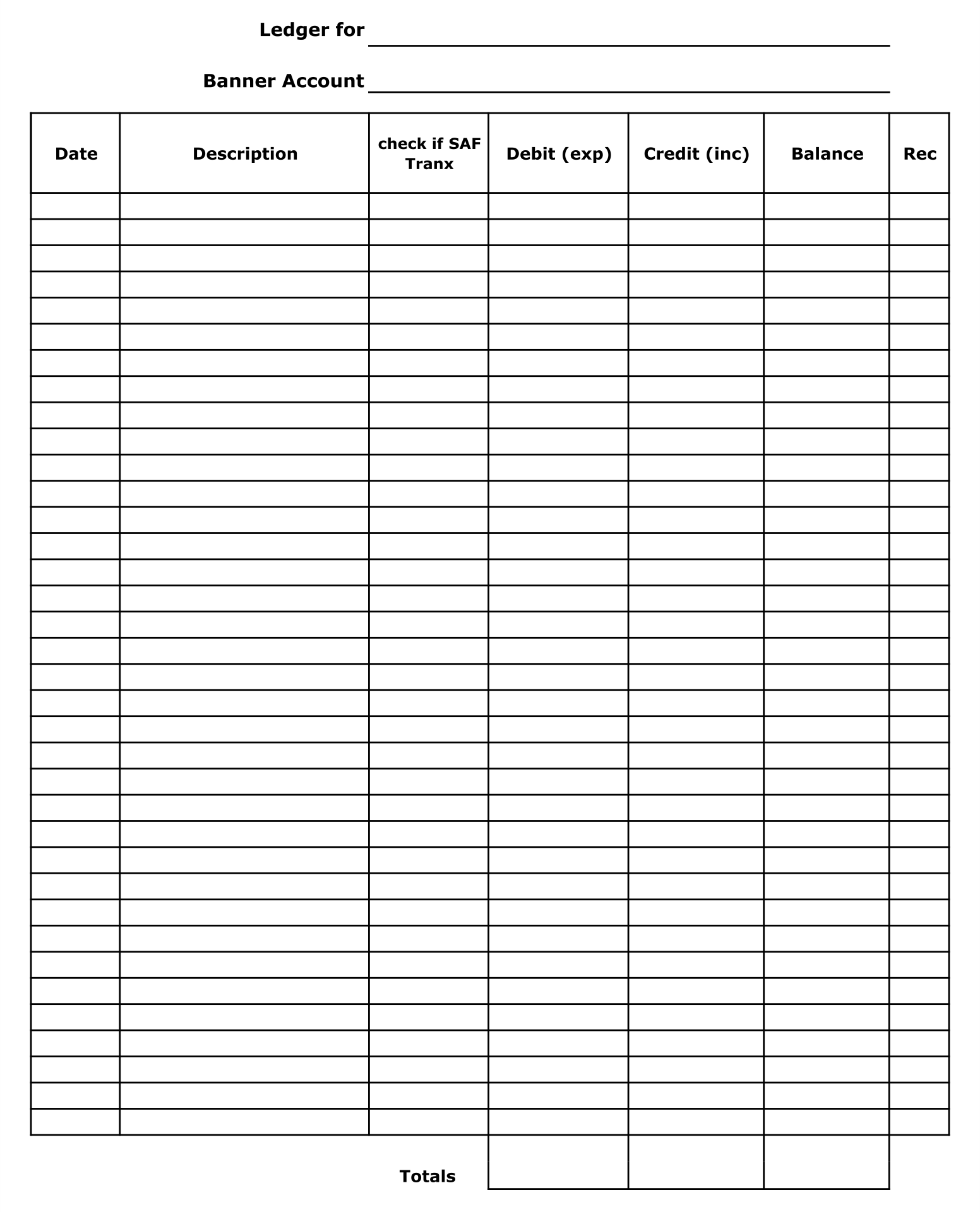

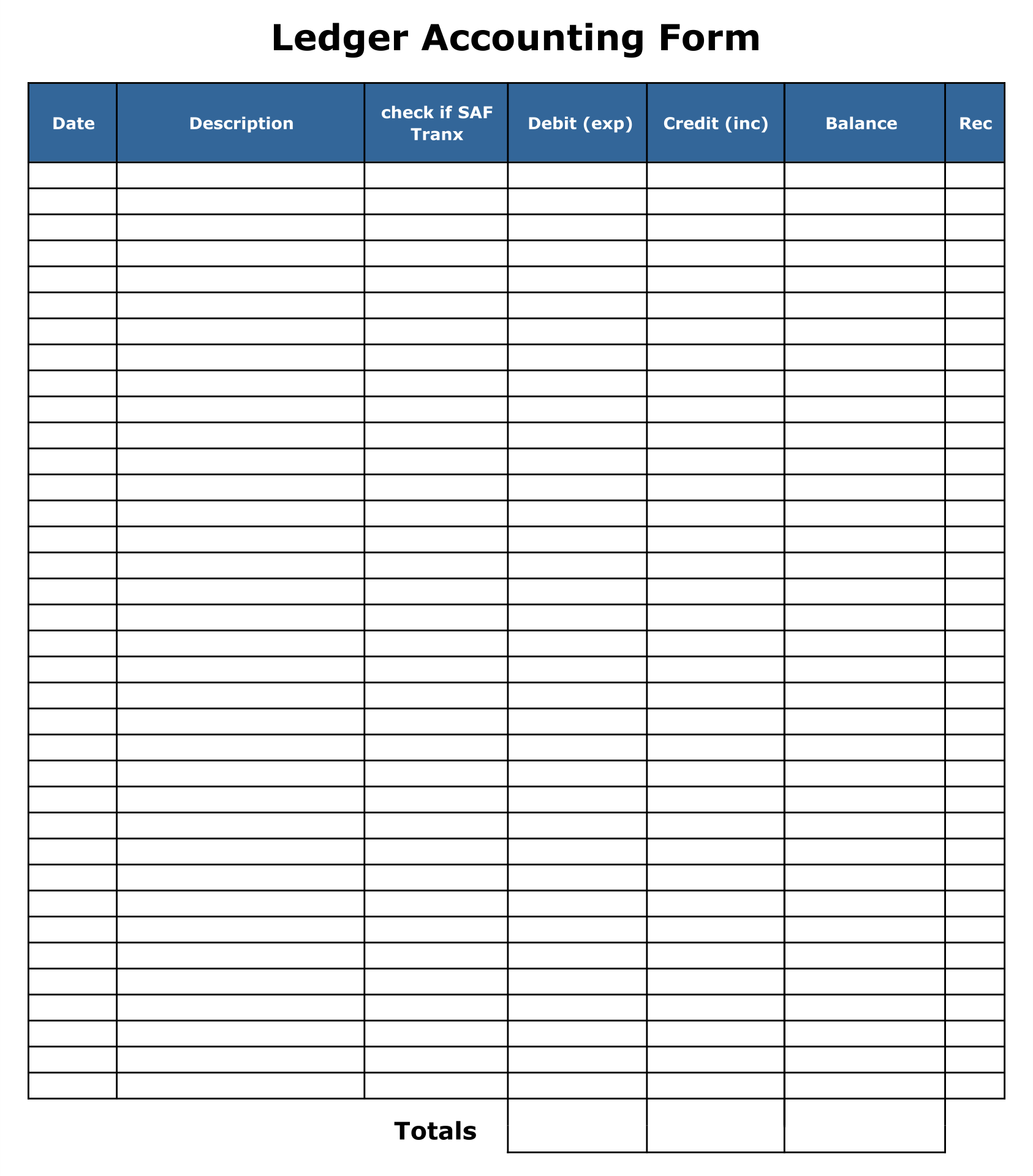

Accounting Ledger Sheets Printable

Accounting Sheets Printables

Free Blank Spreadsheets ChuckAyala Blog

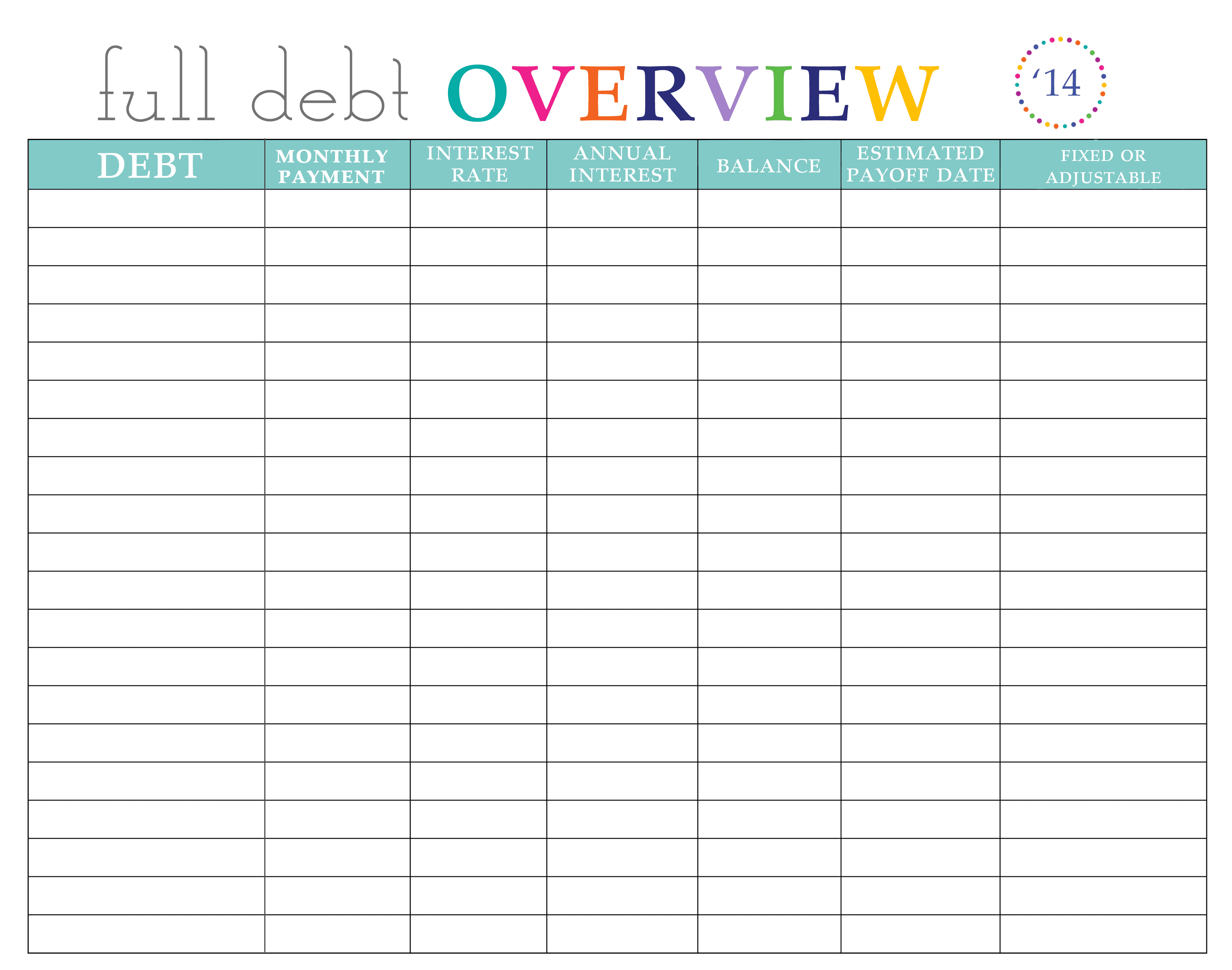

Bookkeeping Basics Worksheet

Accounting Worksheets

Accounting Sheets Printables

Blank Accounting Spreadsheet Template Excelxo

Blank Accounting Spreadsheet Template Excelxo

Accounting Worksheet Accounting Spreadshee Accounting Practice

Basic Accounting Worksheet