Biweekly Pay Schedule Budget Template are an enjoyable and engaging device for kids and grownups, providing a blend of education and learning and enjoyment. From coloring pages and challenges to mathematics obstacles and word video games, these worksheets accommodate a vast array of passions and ages. They help boost crucial reasoning, analytical, and creative thinking, making them optimal for homeschooling, class, or household tasks.

Quickly available online, printable worksheets are a time-saving resource that can transform any type of day into a knowing journey. Whether you need rainy-day activities or supplementary understanding tools, these worksheets give unlimited possibilities for fun and education and learning. Download and install and delight in today!

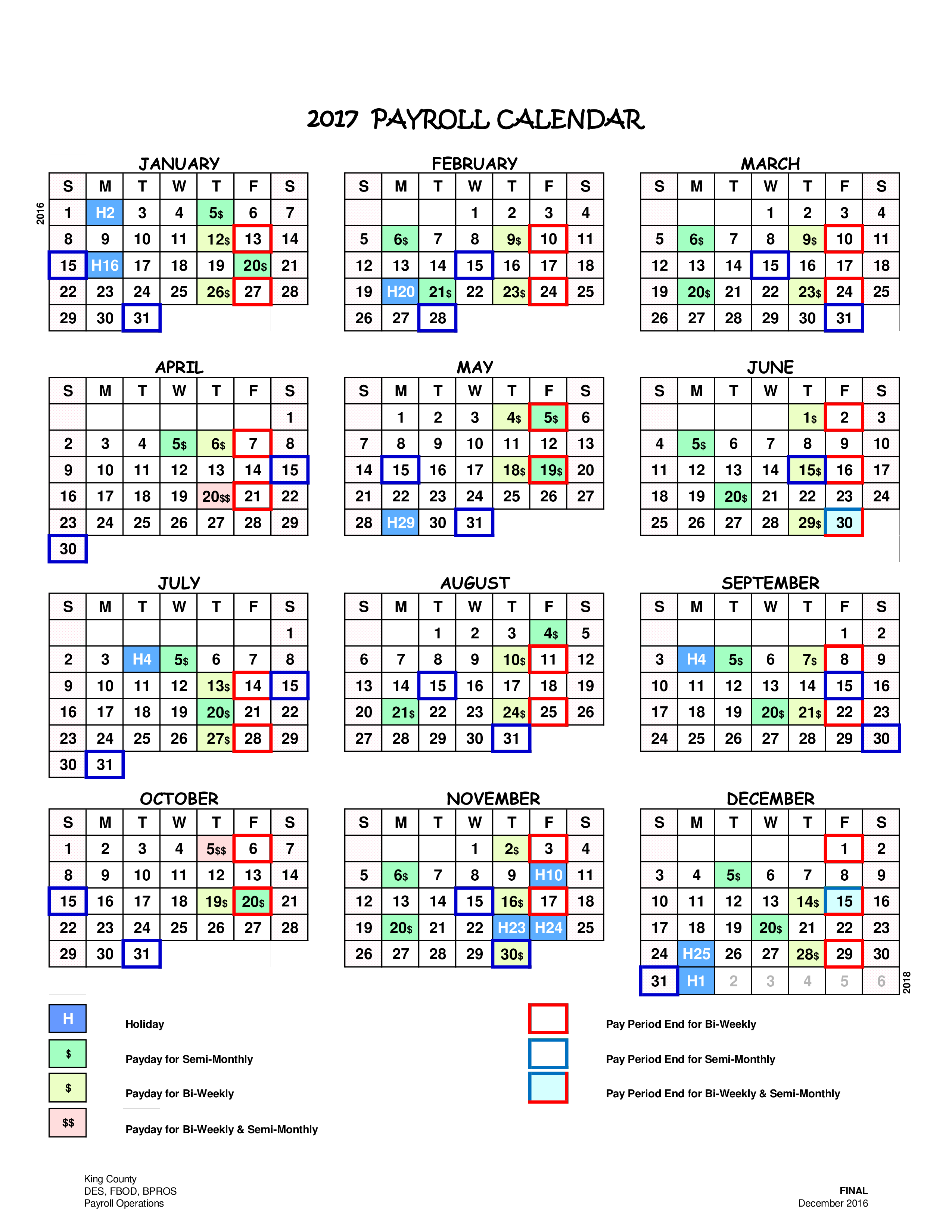

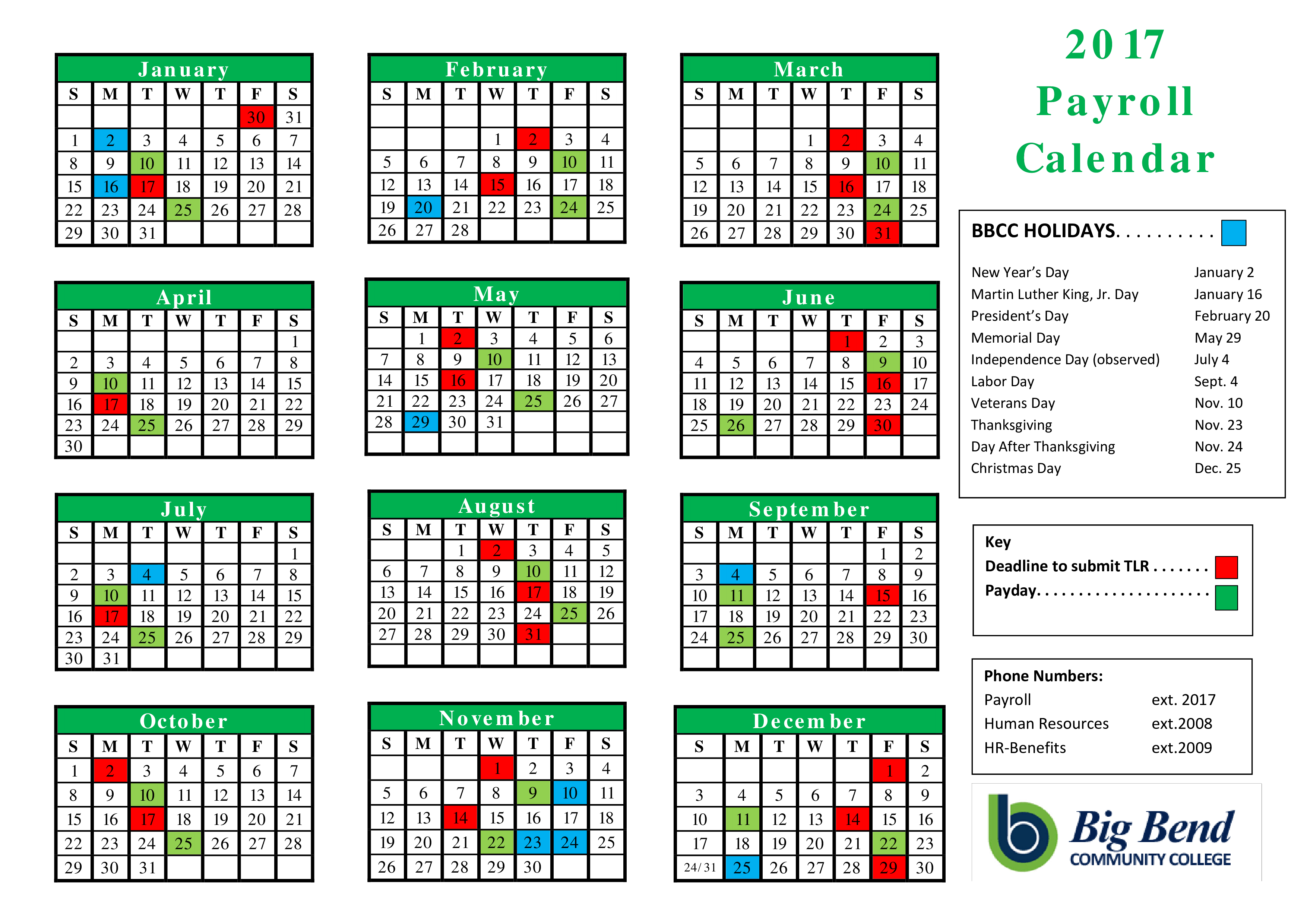

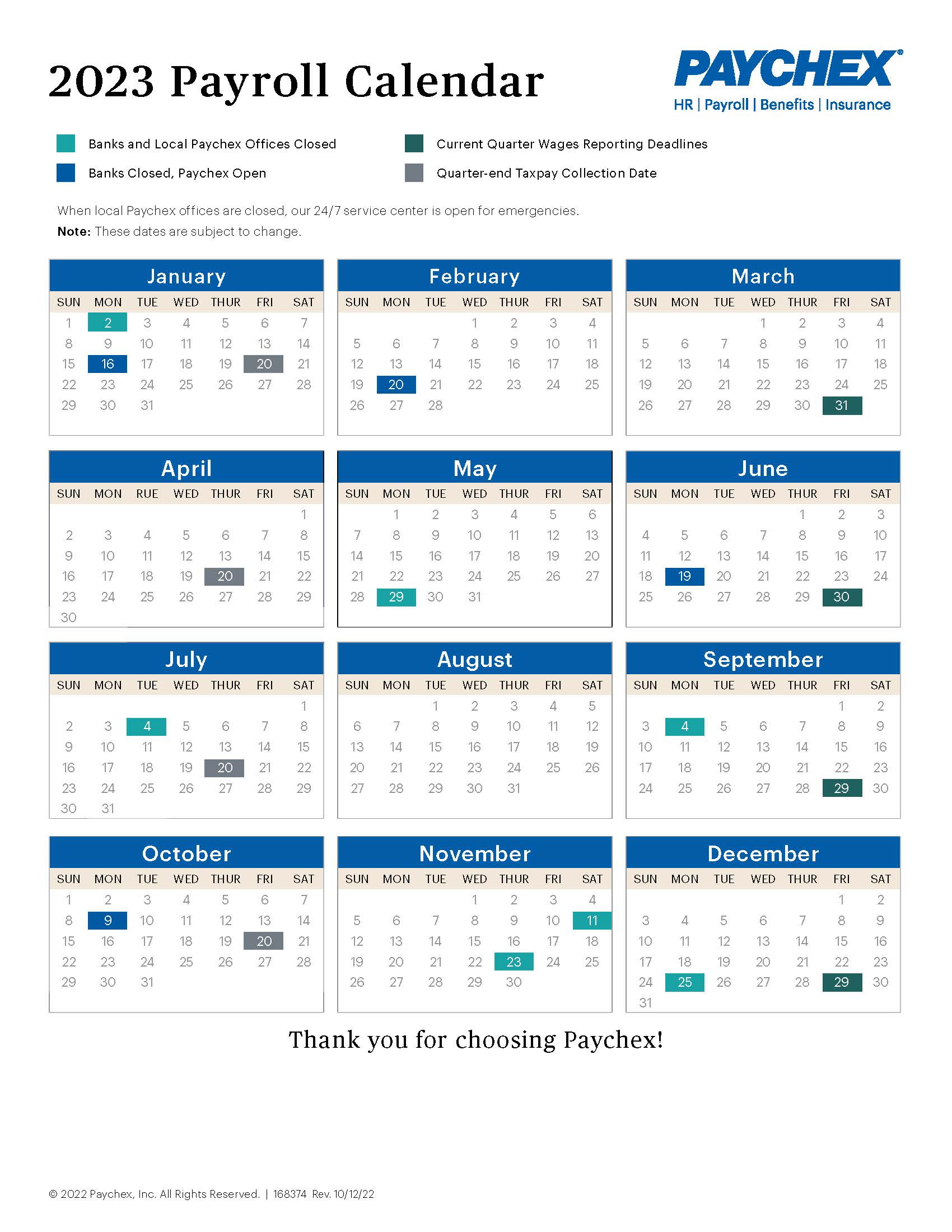

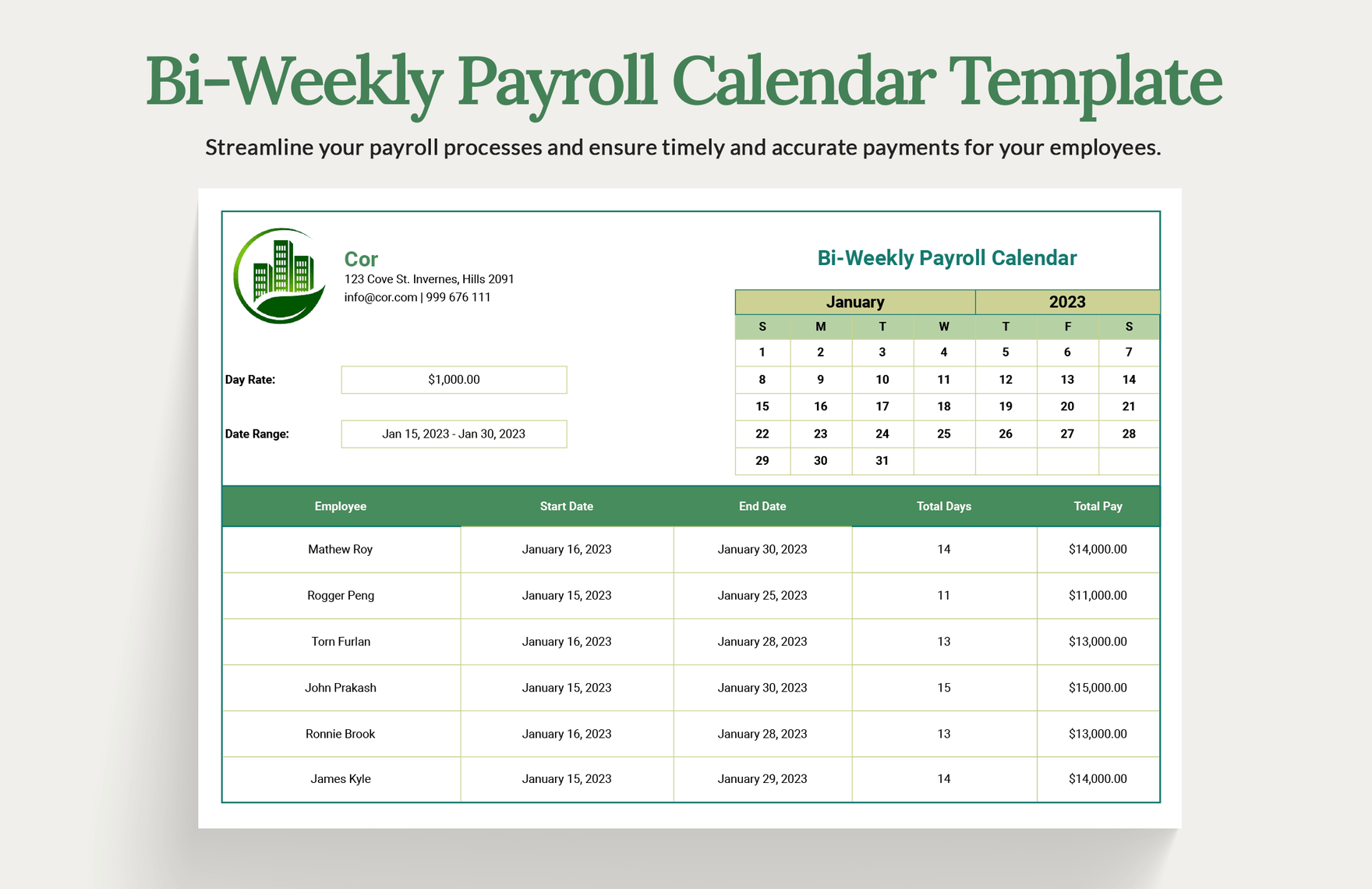

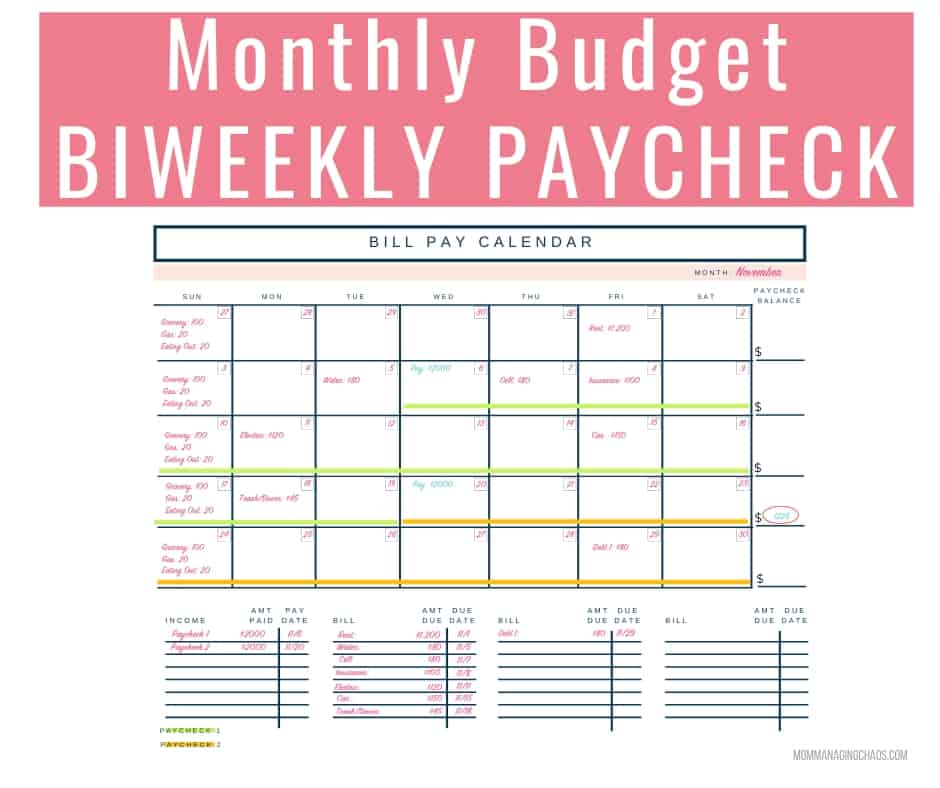

Biweekly Pay Schedule Budget Template

Biweekly Pay Schedule Budget Template

These reading comprehension exercises focus on reading and understanding single sentences Read match sentences match simple sentences to pictures Understand sentences cut paste images to match sentences Read trace sentences trace sentences and match to images Sentence picture unscramble unscramble a sentence and picture These reading worksheets help students move from reading of simple sentences to reading full paragraphs and short passages. Read and color - color a picture based on the details in the text. Read and draw - draw a picture from the description in the text. Short passages - read the text and complete sentences from the text

Leveled Reading Worksheets For Grade 1 K5 Learning

Pay Period 2025 Calendar Ren Vanwal

Biweekly Pay Schedule Budget TemplateFree 1st grade math worksheets, organized by topic. Number charts, addition, subtraction, telling time, comparing & ordering numbers, counting money, measurement, geometry, word problems and more. No login required. Short stories followed by reading comprehension questions at a grade 1 level Fiction and non fiction texts range between 50 120 words long Free Reading Worksheets Grade 1 Printable

Phonemic awareness and phonics worksheets including phoneme recognition, substitution and manipulation, consonant blends, short & long vowels, digraphs and syllables. Free | Worksheets | Phonics | Grade 1 | Printable. Free Printable Biweekly Bill Planner Best Calendar Example 2024 Biweekly Payroll Calendar Template Excel Excel Miran Tammara

Grade 1 Reading Passages And Paragraphs Worksheets K5 Learning

Csu Payroll Calendar 2025 Zachary Leach

Students read a sentence repeatedly rewrite it and answer questions about it Free Reading Worksheets Grade 1 Printable Bi Weekly Paycheck Calendar 2025 Bobby M Eason

Comprehension exercises for first grade These worksheets introduce basic comprehension concepts and skills such as comparing and contrasting recognizing main ideas cause and effect prediction and fact vs fiction Some students will need help in reading the texts and exercises Ucsf Biweekly Calendar 2025 Liam Cowan Pay Period 2024 Biweekly Definition Tate Morganica

2025 Budget Planner Excel Dennis Williams

Bi Monthly Pay Calendar 2025 Micah Hart

Bi Monthly Pay Calendar 2025 Micah Hart

2025 Biweekly Pay Schedule Janel Linette

Pay Schedule 2024 Biweekly Trude Hortense

How To Budget Monthly Bills With Biweekly Paychecks Weekly Budget

Pay Period Calendar 2025 Federal Codee Devonna

Bi Weekly Paycheck Calendar 2025 Bobby M Eason

Bi Weekly Friday Pay Calendar 2024 Dulcy Glennis

12 Month Budget Printable