Best App To Track Business Expenses And Mileage are a fun and appealing device for youngsters and adults, supplying a blend of education and enjoyment. From coloring pages and challenges to mathematics challenges and word video games, these worksheets accommodate a large range of passions and ages. They aid enhance essential thinking, analytic, and creative thinking, making them suitable for homeschooling, class, or household tasks.

Easily available online, worksheets are a time-saving resource that can transform any day into a learning journey. Whether you need rainy-day tasks or extra learning tools, these worksheets give unlimited opportunities for enjoyable and education. Download and enjoy today!

Best App To Track Business Expenses And Mileage

Best App To Track Business Expenses And Mileage

Tracing upper and lower case letter worksheets for kids Dot to dot tracing helps the child to write and practice the English letter N and n ADVANCED Letter N Trace and Write Practice – From Tracing to Writing in One Sheet. Free printable letter N uppercase trace and write worksheet. Preschool kids ...

Letter n tracing TPT

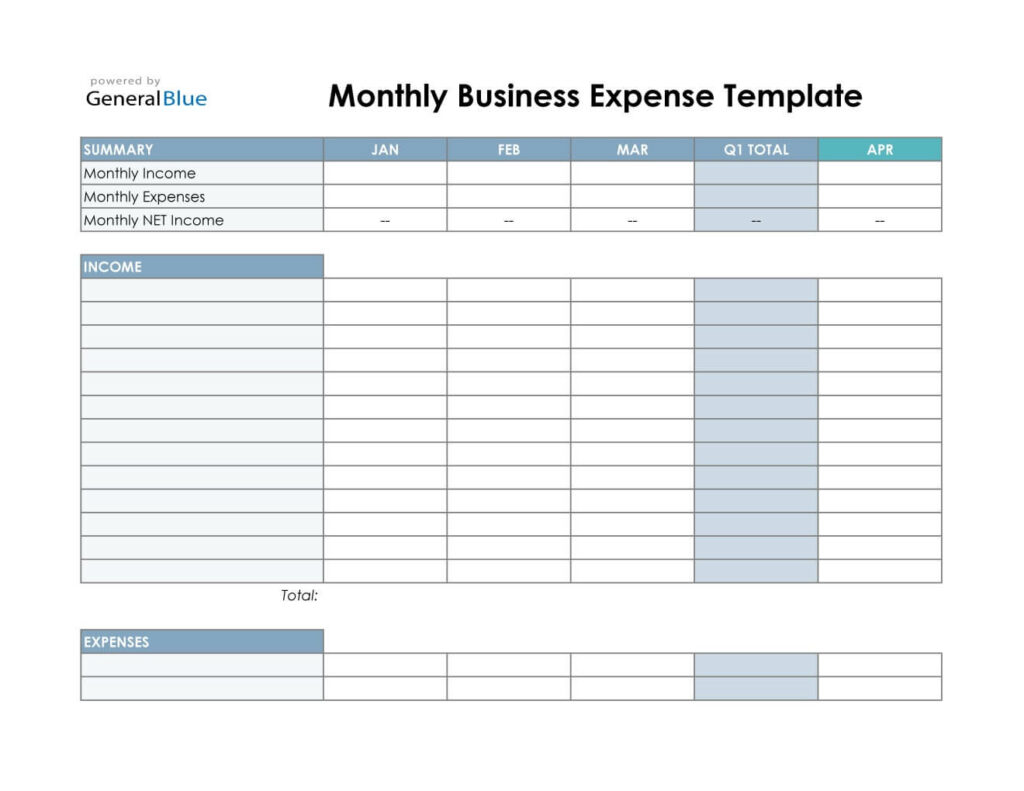

Free Printable Mileage Log Templates For Google Sheets And Microsoft

Best App To Track Business Expenses And MileageHere's a fun and FREE set of printable tracing worksheets to help your students practice writing both uppercase and lowercase forms of ... Download free letter n tracing worksheets for preschool pre k or kindergarten class There are two layouts available with lines and boxes

We have a great collection of free printable letter N tracing worksheets that you can use with students to hit important handwriting standards. Excel Expenses Template Best App To Track Your Expenses Gallery Posted By Ashley Angelina

Free Letter Tracing Worksheets by a Children Illustrator and Teacher

![]()

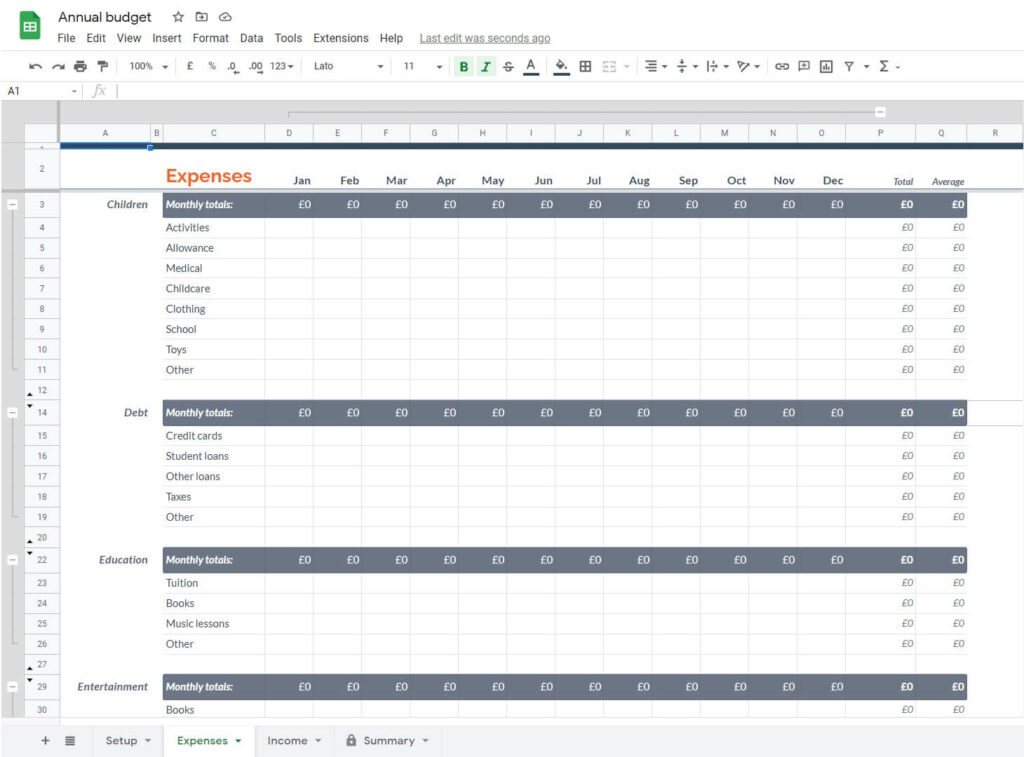

Free Business Expense Tracking Spreadsheet 2025

Make learning fun with free letter N tracing worksheets Featuring narwhal newt and nest designs to help kids practice pen control and letter formation Excel Templates For Expenses

Letter N of the English alphabet coloring and practice writing worksheets for children Excel Business Expense Template Best App To Track Your Expenses Gallery Posted By Ashley Angelina

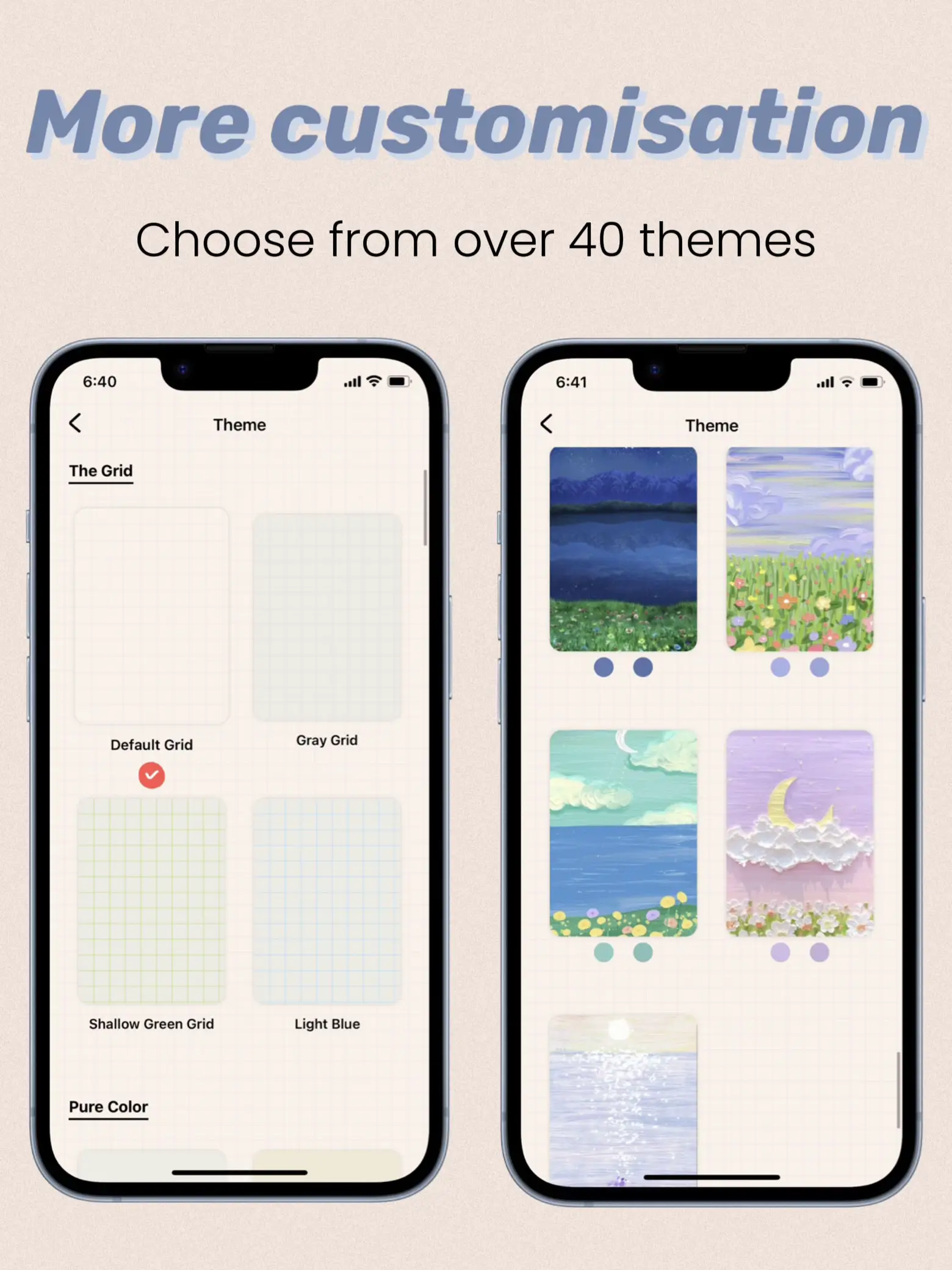

Expense Tracker

![]()

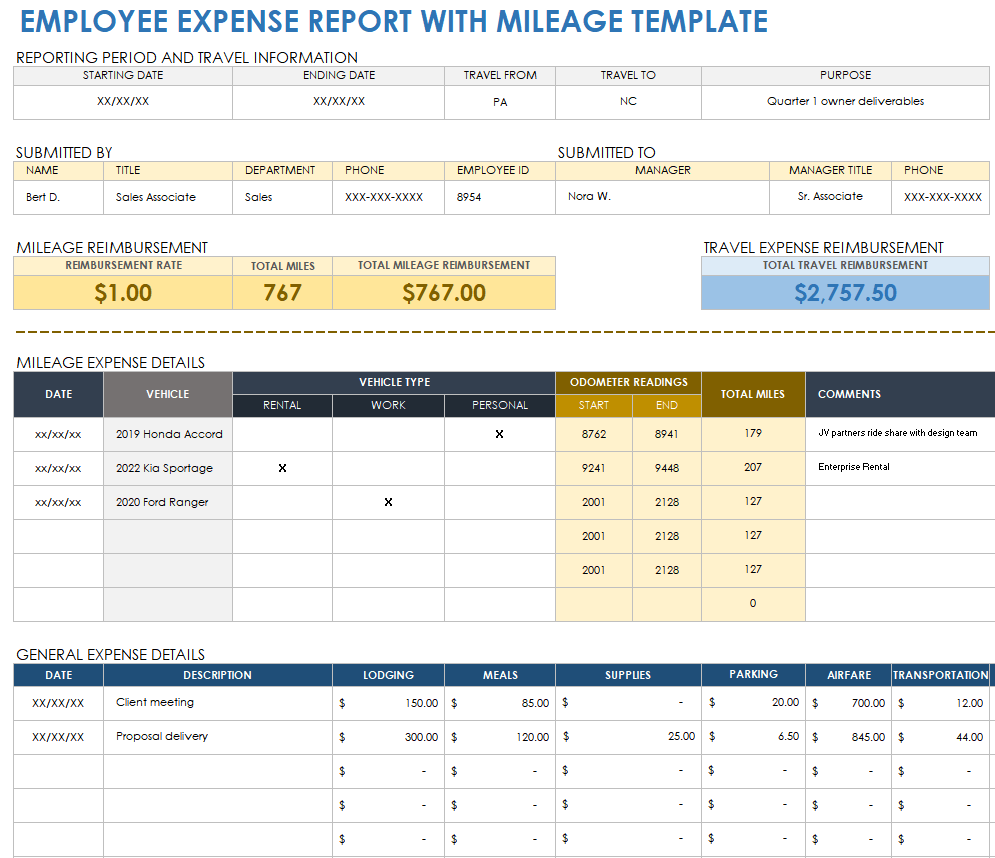

Free Excel Expense Report Templates Smartsheet Worksheets Library

![]()

FREE Australian Small Business Income Expense Tracking

Free Excel Expense Report Templates Smartsheet Worksheets Library

Business Expenses

Excel Spreadsheet For Business Expenses Expense Spreadsheet

Excel Spreadsheet For Business Expenses Expense Spreadsheet

Excel Templates For Expenses

Best App To Track Your Expenses Gallery Posted By Ashley Angelina

Best App To Track Your Expenses Gallery Posted By Ashley Angelina