Average Cost Of Living Comparison By State are a fun and appealing device for youngsters and adults, providing a mix of education and home entertainment. From coloring web pages and challenges to mathematics difficulties and word video games, these worksheets satisfy a variety of rate of interests and ages. They assist improve important reasoning, analytic, and creative thinking, making them excellent for homeschooling, class, or family activities.

Easily available online, printable worksheets are a time-saving source that can turn any kind of day right into a discovering journey. Whether you need rainy-day activities or supplementary discovering devices, these worksheets supply unlimited possibilities for enjoyable and education. Download and install and appreciate today!

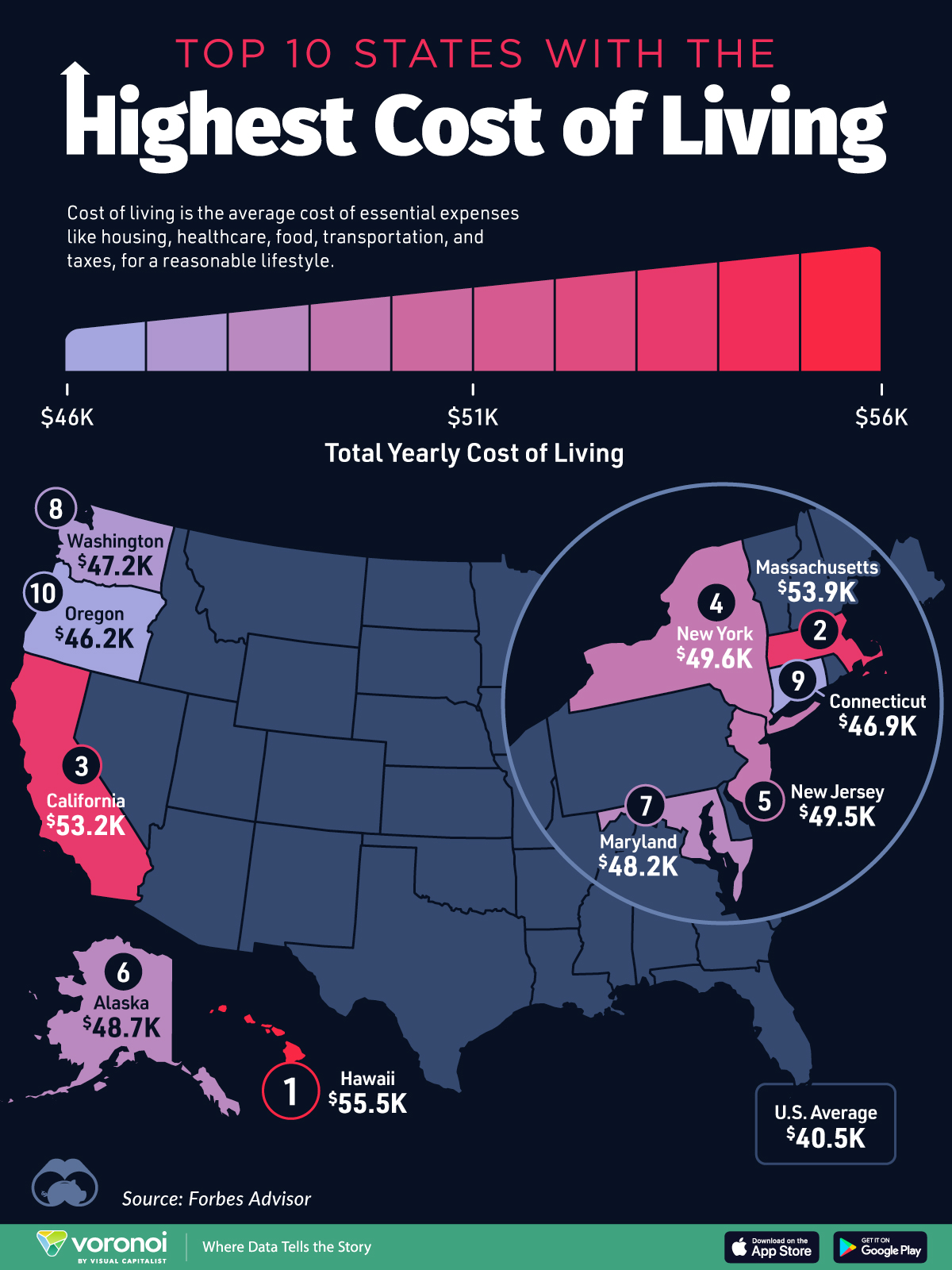

Average Cost Of Living Comparison By State

Average Cost Of Living Comparison By State

Featuring are printable tests in economics geography civics and history These worksheets are highly illustrated activities including multiple choice Social studies and history come alive with our free printable worksheets for Grade 3 students! Discover fascinating facts, explore historical events, and dive ...

Printable 3rd Grade U S History Worksheets Education

Us Map Of Cost Of Living

Average Cost Of Living Comparison By StateThird graders can learn about geography, using maps, U.S. history, basic economics, and more with our social studies worksheets. Free worksheets are available. Free 3rd grade world history worksheetsAfrican historyAncient historyAsian studiesAustralian historyBritish historyCanadian

Browse our printable 3rd Grade Social Studies and History Worksheets resources for your classroom. Download free today! [img_title-17] [img_title-16]

Free Printable History Worksheets for 3rd Grade Quizizz

[img_title-3]

These passages and questions were created to help you integrate 3rd grade social studies into reading [img_title-11]

Explore our engaging 3rd grade history worksheets Boost your child s understanding of historical events and figures with fun printable activities [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]