1099 Expense Tracker Spreadsheet Template Free are a fun and appealing tool for children and grownups, offering a mix of education and learning and enjoyment. From tinting web pages and puzzles to mathematics obstacles and word games, these worksheets accommodate a wide range of passions and ages. They assist boost important reasoning, analytical, and creativity, making them optimal for homeschooling, classrooms, or family tasks.

Conveniently accessible online, worksheets are a time-saving resource that can transform any day right into an understanding journey. Whether you need rainy-day activities or additional discovering tools, these worksheets supply unlimited possibilities for enjoyable and education. Download and delight in today!

1099 Expense Tracker Spreadsheet Template Free

![]()

1099 Expense Tracker Spreadsheet Template Free

Simplify Note Some radicals cannot be simplified but not many 1 8 4 2 252 2 V180 36 5 615 3 V384 64 6 8 16 5 80 v o v5 So Much More Online! Please visit: www.EffortlessMath.com. Simplifying Radical Expressions. ✍ Simplify. 1) √35𝑥2 = 2) √90𝑥2 =.

7 1R Simplifying Radicals 020316

![]()

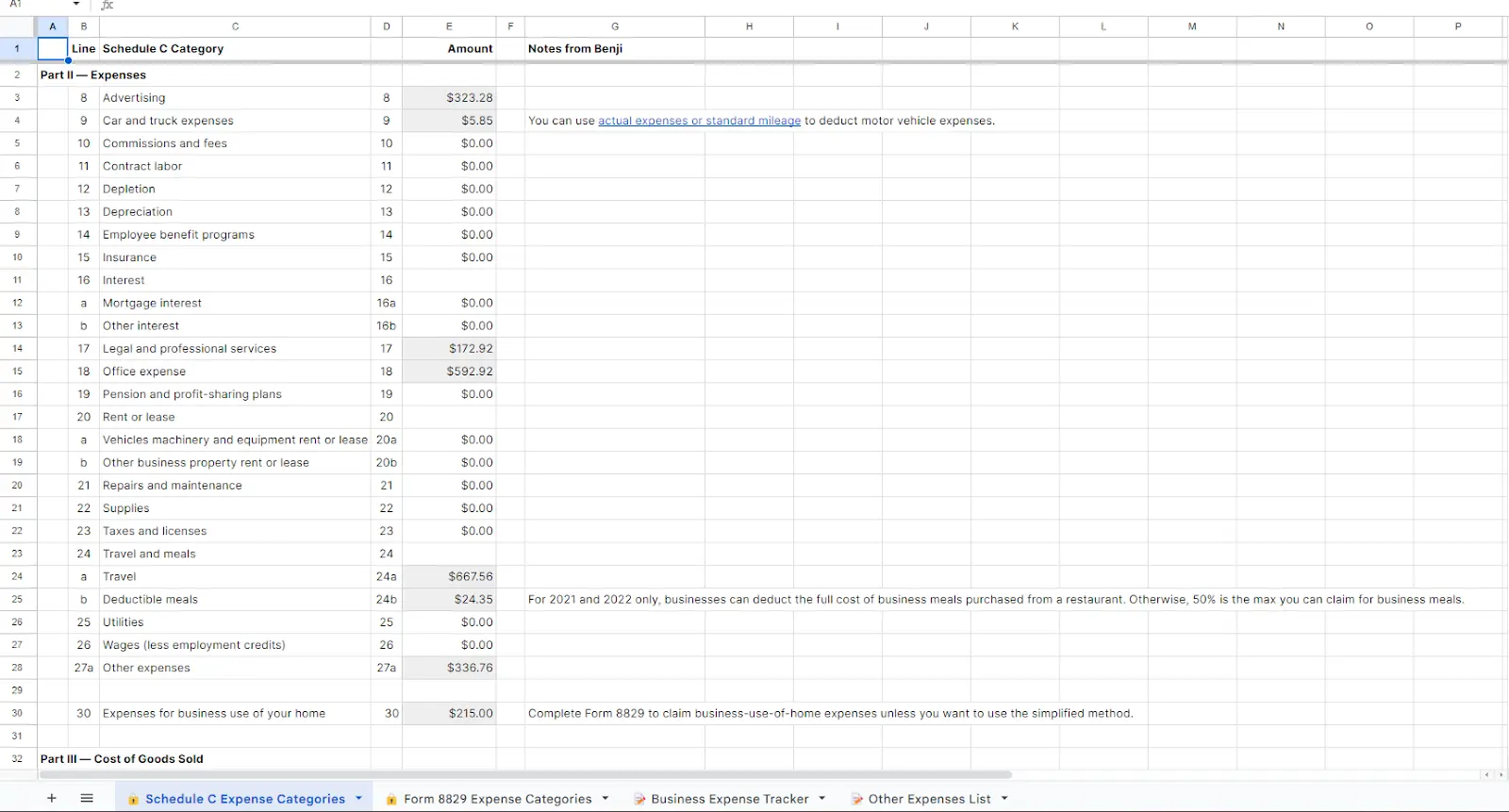

Editable Income Templates In Excel To Download

1099 Expense Tracker Spreadsheet Template FreeSimplify the expression and find your answer in the adjacent answer column. Write the letter of the exercise in the box that contains the number of the answer. Worksheet by Kuta Software LLC Kuta Software Infinite Algebra 1 Simplifying Radical Expressions Simplify 1 125n 2 216v 3 512k 2 4 512m 3 5

LO: I can simplify radical expressions including adding, subtracting, multiplying, dividing and rationalizing denominators. ☐ (1) calculator. Simplifying ... Expense Tracker 150 Expense Categories To Help You Track Your Best Bill Budget Planner Fetiwicked

Simplifying Radical Expressions Effortless Math

![]()

Income And Expense Tracker Template Download In Excel Google Sheets

This radical expressions worksheet will produce problems for simplifying radical expressions You may select what type of radicals you want to use 1099 Excel Template

Simplifying Radicals Simplify each radical expression 1 1169 2 1200 3 1125 4 51112 5 168 6 31121 7 263t4 8 248n3 9 260m7 10 x2150x5 11 Travel Expense Report Template Google Sheets Infoupdate 1099 Template Excel

![]()

Unitserg Blog

1099 Worksheet

1099 Worksheet

1099 Worksheet

![]()

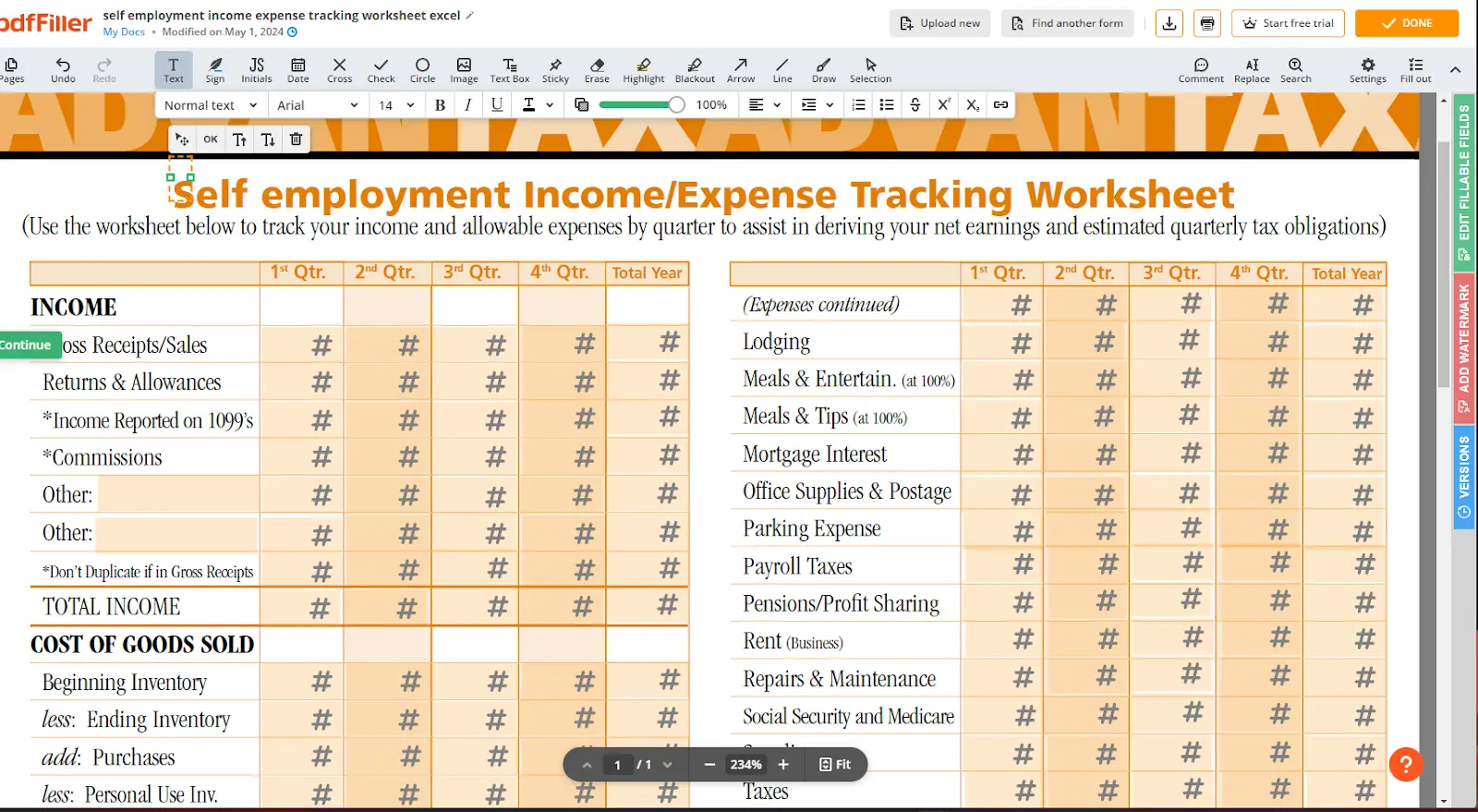

Business Income And Expense Tracker Template Download In Excel

![]()

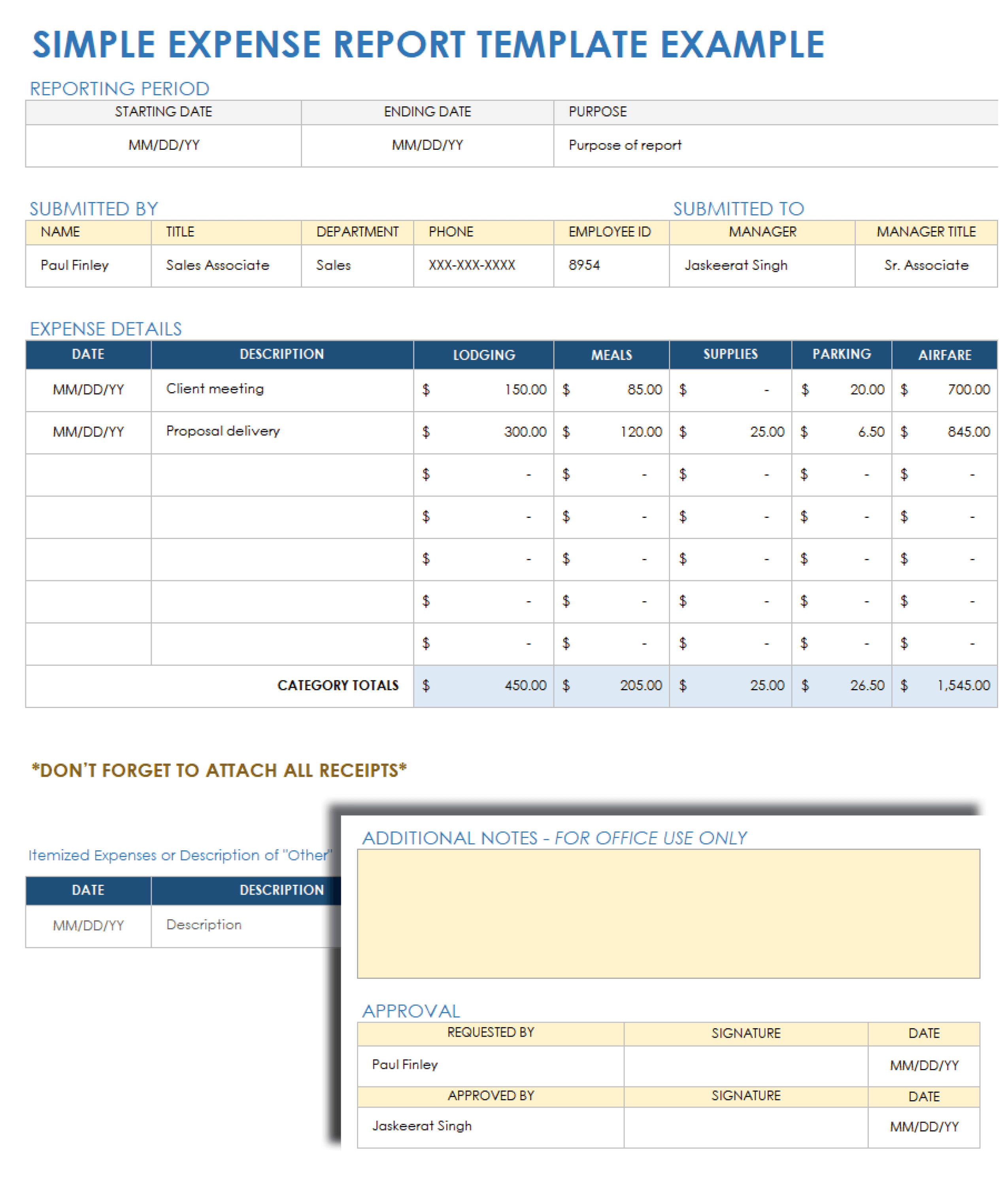

Free Business Expense Tracking Spreadsheet 2024 Worksheets Library

![]()

Medication Tracker Template In Excel Google Sheets Download

1099 Excel Template

![]()

Weekly Expense Tracker Hetyanywhere

Expense Report Spreadsheet Template Colomboalumni